Bed, Bath and Beyond 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

15

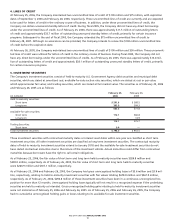

K. Property and Equipment

Property and equipment are stated at cost. Depreciation is computed primarily using the straight-line method over the estimated

useful lives of the assets (forty years for buildings; five to fifteen years for furniture, fixtures and equipment; and three to five

years for computer equipment and software). Leasehold improvements are amortized using the straight-line method over the

lesser of their estimated useful life or the life of the lease.

The cost of maintenance and repairs is charged to earnings as incurred; significant renewals and betterments are capitalized.

Maintenance and repairs amounted to $54.2 million, $51.4 million and $44.5 million for fiscal 2005, 2004 and 2003, respectively.

L. Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment annually or when events or changes in circumstances indicate the carrying

value of these assets may exceed their current fair values. If it is determined that an impairment loss has occurred, the loss would

be recognized during that period. The impairment loss is calculated as the difference between asset carrying values and the fair

value. The Company has not historically had any material impairment of long-lived assets. In the future, if events or market

conditions affect the fair value of the Company’s long-lived assets to the extent that an asset is impaired, the Company will adjust

the carrying value of these assets in the period in which the impairment occurs.

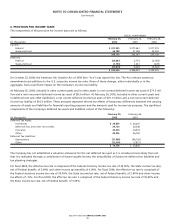

M. Goodwill and Other Indefinitely Lived Intangible Assets

The Company reviews goodwill and other intangibles that have indefinite lives for impairment annually or when events or

changes in circumstances indicate the carrying value of these assets might exceed their current fair values.

Impairment testing is based upon the best information available including estimates of fair value which incorporate assumptions

marketplace participants would use in making their estimates of fair value. The Company has not historically recorded an

impairment to its goodwill and other indefinitely lived intangible assets. In the future, if events or market conditions affect the

estimated fair value to the extent that an asset is impaired, the Company will adjust the carrying value of these assets in the

period in which the impairment occurs.

Included within other assets in the accompanying consolidated balance sheets as of February 25, 2006 and February 26, 2005

is $147.6 million for goodwill and $19.9 million for the tradename of CTS, which arenot subject to amortization.

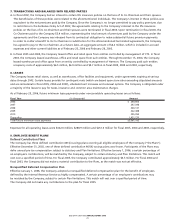

N. Self Insurance

The Company utilizes a combination of insurance and self insurance for a number of risks including workers’ compensation,

general liability,automobile liability and employee related health care benefits (a portion of which is paid by its employees).

Liabilities associated with the risks that the Company retains are estimated by considering historical claims experience, demo-

graphic factors, severity factors and other actuarial assumptions. Although the Company’s claims experience has not displayed

substantial volatility in the past, actual experience could materially varyfrom its historical experience in the future. Factors that

affect these estimates include but are not limited to: inflation, the number and severity of claims and regulatory changes. In the

future, if the Company concludes an adjustment to self insurance accruals is required, the liability will be adjusted accordingly.

O. Litigation

The Company records an estimated liability related to various claims and legal actions arising in the ordinary course of business

which is based on available information and advice from outside counsel, whereappropriate. As additional information becomes

available, the Company reassesses the potential liability related to its pending litigation and revises its estimates, as appropriate.

The ultimate resolution of these ongoing matters as a result of futuredevelopments could have a material impact on the

Company’s earnings. The Company cannot predict the nature and validity of claims which could be asserted in the future, and

future claims could have a material impact on its earnings.

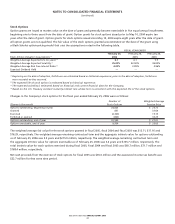

P. Deferred Rent

The Company accounts for scheduled rent increases contained in its leases on a straight-line basis over the term of the lease.

Historically,the Company’smethod of accounting defined the beginning of the lease termas the date the Company commenced

lease payments. In fiscal 2004, due to clarification by the Office of the Chief Accountant of the Securities and Exchange

Commission, the Company changed its method of accounting to define the beginning of the lease term as the date the Company

obtained possession of the leased premises. This change in the Company’s method of accounting did not have a material impact

on the Company’sfiscal 2003 and prior consolidated financial statements. Deferred rent amounted to $53.4 million and $42.6 mil-

lion as of February 25, 2006 and February 26, 2005, respectively.