Bed, Bath and Beyond 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

14

In March 2005, the FASB issued FASB Interpretation (“FIN”) No. 47, “Accounting for Conditional Asset Retirement Obligations.”

FIN No. 47 clarifies the term “conditional asset retirement obligation” as used in FASB Statement No. 143, “Accounting for Asset

Retirement Obligations.” This interpretation requires companies to recognize a liability for the fair value of a legal obligation

to perform asset-retirement activities that are conditional on a future event if the amount can be reasonably estimated. FIN

No. 47 also clarifies when an entity would have sufficient information to reasonably estimate the fair value of an asset retirement

obligation. FIN No. 47 is effective no later than the end of fiscal years ending after December 15, 2005. The adoption of FIN

No. 47 did not have a material impact on the Company’s consolidated financial statements.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs, an Amendment of ARB No. 43, Chapter 4.” SFAS No. 151

amends the guidance to clarify that abnormal amounts of idle facility expense, freight, handling costs and wasted materials

should be recognized as current period charges. In addition, SFAS No. 151 requires that allocation of fixed production overhead

to the costs of conversions be based on the normal capacity of the production facilities. The statement is effective for inventory

costs incurred during fiscal years beginning after June 15, 2005. The Company does not believe that the adoption of SFAS No. 151

will have a material impact on the Company’sconsolidated financial statements.

G. Fair Value of Financial Instruments

The Company’s financial instruments include cash and cash equivalents, investment securities, accounts payable and certain other

liabilities. The Company’s investment securities consist primarily of held-to-maturity debt securities which are stated at amortized

cost and available-for-sale debt securities which are stated at their approximate fair value. The book value of all financial instru-

ments is representative of their fair values with the exception of investment securities (see Note 5 – Investment Securities).

H. Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with original maturities of three months or less to be cash

equivalents. Included in cash and cash equivalents arecredit and debit card receivables from banks, which typically settle within

5business days, of $34.9 million and $31.4 million as of February 25, 2006 and February 26, 2005, respectively.

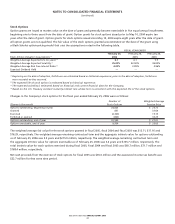

I. Investment Securities

Investment securities primarily consist of auction rate securities, U.S. Government Agency debt securities and municipal debt

securities.

Auction rate securities are securities with interest rates that reset periodically through an auction process. Auction rate securities

areclassified as available-for-sale and are stated at cost or par value which approximates fair value due to interest rates which

reset periodically, typically within 28 days. As a result, there are no cumulative gross unrealized holding gains or losses relating

to these auction rate securities. All income from these investments is recorded as interest income.

Primarily all other investment securities are classified as held-to-maturity because the Company has the ability and intent to hold

these investments until maturity and are stated at amortized cost.

Premiums areamortized and discounts are accreted over the life of the security as adjustments to interest income using the

effective interest method. Dividend and interest income are recognized when earned.

J. Inventory Valuation

Merchandise inventories are stated at the lower of cost or market. Inventory costs for BBB and Harmon are calculated using the

retail inventorymethod and inventorycost for CTS is calculated using the first-in, first-out cost method. Under the retail inventory

method, the valuation of inventories at cost and the resulting gross margins are calculated by applying a cost-to-retail ratio to the

retail value of inventories.

At any one time, inventories include items that have been written down to the Company’sbest estimate of their realizable value.

Judgment is required in estimating realizable value and factors considered are the age of merchandise and anticipated demand.

Actual realizable value could differ materially from this estimate based upon futurecustomer demand or economic conditions.

The Company estimates its reserve for shrinkage throughout the year, based on historical shrinkage. Actual shrinkage is recorded

at year-end based upon the results of the Company’sphysical inventorycount. Historically, the Company’s shrinkage has not been

volatile.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)