Bed, Bath and Beyond 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

13

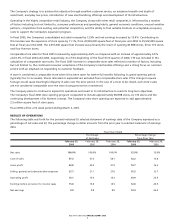

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RELATED MATTERS

A. Nature of Operations

Bed Bath & Beyond Inc. and subsidiaries (the “Company”) is a nationwide chain of retail stores, operating under the names

Bed Bath & Beyond (“BBB”), Christmas Tree Shops (“CTS”) and Harmon. The Company sells a wide assortment of merchandise

principally including domestics merchandise and home furnishings as well as food, giftware and health and beauty care items.

As the Company operates in the retail industry, its results of operations are affected by general economic conditions and

consumer spending habits.

B. Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries, all of which are

wholly owned.

All significant intercompany balances and transactions have been eliminated in consolidation.

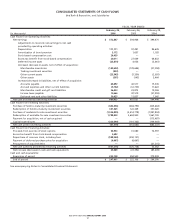

C. Fiscal Year

The Company’s fiscal year is comprised of the 52 or 53 week period ending on the Saturday nearest February 28. Accordingly,

fiscal 2005, 2004 and 2003 represented 52 weeks and ended on February 25, 2006, February 26, 2005 and February 28, 2004,

respectively.

D. Segments

The Company accounts for its operations as one operating segment.

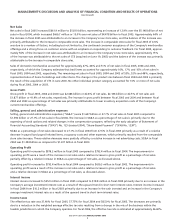

E. Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires

the Company to establish accounting policies and to make estimates and judgments that affect the reported amounts of assets

and liabilities and disclosureof contingent assets and liabilities as of the date of the consolidated financial statements and the

reported amounts of revenues and expenses during the reporting period. The Company bases its estimates on historical experi-

ence and on other assumptions that it believes to be relevant under the circumstances, the results of which form the basis for

making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. In particular,

judgment is used in areas such as inventory valuation, impairment of long-lived assets, goodwill and other indefinitely lived

intangible assets, accruals for self insurance, litigation, store opening, expansion, relocation and closing costs, the provision for

sales returns, vendor allowances, stock-based compensation and income taxes. Actual results could differ from these estimates.

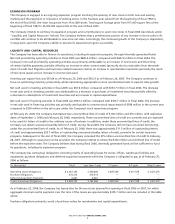

F.Recent Accounting Pronouncements

In October 2005, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position (“FSP”) 13-1, “Accounting for

Rental Costs Incurred during a Construction Period.” FSP 13-1 requires rental costs associated with ground or building operating

leases that are incurred during a construction period be recognized as rental expense. FSP 13-1 becomes effective for the first

reporting period beginning after December 15, 2005. The Company does not believe that the adoption of FSP 13-1 will have

amaterial impact on the Company’s consolidated financial statements.

In June 2005, the FASB’sEmerging Issues Task Force (“EITF”) reached a consensus on Issue No. 05-6, “Determining the

Amortization Period for Leasehold Improvements Purchased after Lease Inception or Acquired in a Business Combination.”

EITF 05-6 requires leasehold improvements purchased after the beginning of the initial lease term to be amortized over the short-

er of the assets’ useful life or a term that includes the original lease term plus any renewals that are reasonably assured at the

date the leasehold improvements are purchased. This guidance was effective for reporting periods beginning after June 29, 2005.

The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements.

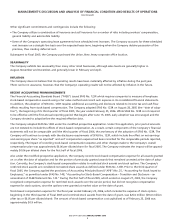

In May 2005, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 154, “Accounting Changes and Error

Corrections - a replacement of Accounting Principles Board Opinion (“APB”) No. 20 and SFAS No. 3,” which changes the require-

ments for the accounting for, and reporting of, a change in accounting principle. SFAS No. 154 is effective for accounting changes

and correction of errors made in fiscal years beginning after December 15, 2005; however, the statement does not change the

transition provisions of any existing accounting pronouncements. The Company does not believe that the adoption of SFAS

No.154 will have a material impact on the Company’sconsolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Bed Bath & Beyond Inc. and Subsidiaries