Bed, Bath and Beyond 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

24

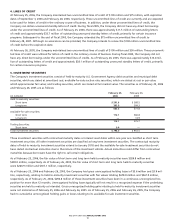

Stock Options

Option grants are issued at market value on the date of grant and generally become exercisable in five equal annual installments

beginning one to three years from the date of grant. Option grants for stock options issued prior to May 10, 2004 expire ten

years after the date of grant. Option grants for stock options issued since May 10, 2004 expire eight years after the date of grant.

All option grants are non-qualified. The fair value of the stock options granted was estimated on the date of the grant using

aBlack-Scholes option-pricing model that uses the assumptions noted in the following table.

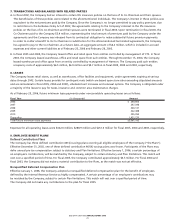

FISCAL YEAR ENDED

February 25, February 26, February 28,

Black-Scholes Valuation Assumptions (1) 2006 2005 2004

Weighted Average Expected Life (in years) (2) 6.1%6.1%5.9%)

Weighted Average Expected Volatility (3) 25.00% 42.00% 45.00%

Weighted Average Risk Free Interest Rates (4) 4.02% 3.89% 2.96%

Expected Dividend Yield —%—%—%

(1) Beginning on the date of adoption, forfeitures are estimated based on historical experience; prior to the date of adoption, forfeitures

wererecorded as they occurred.

(2) The expected life of stock options is estimated based on historical experience.

(3)

The expected volatility is estimated based on historical and current financial data for the Company.

(4) Based on the U.S. Treasury constant maturity interest rate whose term is consistent with the expected life of the stock options.

Changes in the Company’s stock options for the fiscal year ended February 25, 2006 were as follows:

Number of Weighted Average

(Shares in thousands) Stock Options Exercise Price

Options outstanding, beginning of year 24,835)$ 25.73%

Granted 857)37.64%

Exercised (2,300) 15.15%

Forfeited or expired (803) 33.25%

Options outstanding, end of year 22,589)$ 27.01%

Options exercisable, end of year 9,954)$ 20.63%

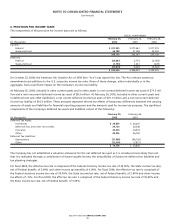

The weighted average fair value for the stock options granted in fiscal 2005, fiscal 2004 and fiscal 2003 was $12.71, $17.16 and

$16.29, respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding

as of February 25, 2006 was 5.5 years and $215.9 million, respectively. The weighted average remaining contractual term and

the aggregate intrinsic value for options exercisable as of February 25, 2006 was 5.4 years and $155.7 million, respectively. The

total intrinsic value for stock options exercised during fiscal 2005, fiscal 2004 and fiscal 2003 was $60.7 million, $71.7 million and

$168.4 million, respectively.

Net cash proceeds from the exercise of stock options for fiscal 2005 was $35.0 million and the associated income tax benefit was

$22.7 million for that same time period.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)