Bed, Bath and Beyond 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

20

6. PROVISION FOR INCOME TAXES

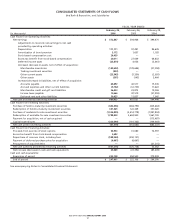

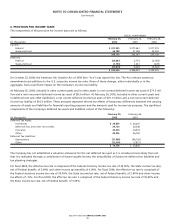

The components of the provision for income taxes are as follows:

FISCAL YEAR ENDED

February 25, February 26, February 28,

(in thousands) 2006 2005 2004

Current:

Federal $ 331,930)$ 271,061 $ 217,912)

State and local 36,188)31,106 35,224)

368,118)302,167 253,136)

Deferred:

Federal (24,681) 2,715 (2,783)

State and local (1,193) 1,341 (278)

(25,874) 4,056 (3,061)

$ 342,244)$ 306,223 $ 250,075)

On October 22, 2004, the American Job Creation Act of 2004 (the “Act”) was signed into law. The Act contains numerous

amendments and additions to the U.S. corporate income tax rules. None of these changes, either individually or in the

aggregate, had a significant impact on the Company’s income tax liability.

At February25, 2006, included in other current assets and in other assets is a net current deferred income tax asset of $71.5 mil-

lion and a net noncurrent deferred income tax asset of $8.2 million. At February 26, 2005, included in other current assets and

in deferred rent and other liabilities is a net current deferred income tax asset of $70.1 million and a net noncurrent deferred

income tax liability of $16.3 million. These amounts represent the net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The significant

components of the Company’s deferred tax assets and liabilities consist of the following:

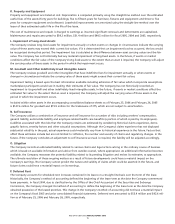

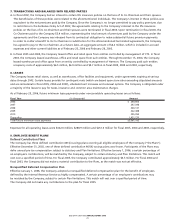

February 25, February 26,

(in thousands) 2006 2005

Deferred Tax Assets:

Inventories $ 29,859)$ 26,207)

Deferred rent and other rent credits 29,130)20,348)

Insurance 26,404)24,518)

Other 44,306)36,705)

Deferred Tax Liabilities:

Depreciation (37,986) (46,126)

Other (12,004) (7,817)

$ 79,709)$ 53,835)

The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely than not

that it is realizable through a combination of future taxable income, the deductibility of future net deferred tax liabilities and

tax planning strategies.

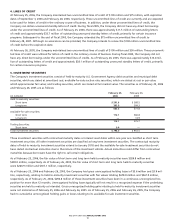

For fiscal 2005, the effective tax rate is comprised of the Federal statutory income tax rate of 35.00%, the State income tax rate,

net of Federal benefit, of 2.49% and other income tax benefits of 0.09%. For fiscal 2004, the effective tax rate is comprised of

the Federal statutory income tax rate of 35.00%, the State income tax rate, net of Federal benefit, of 2.60% and other income

tax effects of .15%. For fiscal 2003, the effective tax rate is comprised of the Federal statutory income tax rate of 35.00% and

the State income tax rate, net of Federal benefit, of 3.50%.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)