Bed, Bath and Beyond 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

9

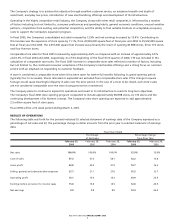

Litigation: The Company records an estimated liability related to various claims and legal actions arising in the ordinary course of

business which is based on available information and advice from outside counsel, where appropriate. As additional information

becomes available, the Company reassesses the potential liability related to its pending litigation and revises its estimates, as

appropriate. The ultimate resolution of these ongoing matters as a result of future developments could have a material impact

on the Company’s earnings. The Company cannot predict the nature and validity of claims which could be asserted in the future,

and future claims could have a material impact on its earnings.

Store Opening, Expansion, Relocation and Closing Costs: Store opening, expansion, relocation and closing costs, including

markdowns, asset residual values and projected occupancy costs, are charged to earnings as incurred.

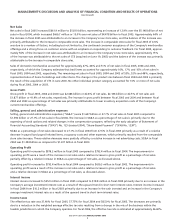

Stock-Based Compensation: Prior to August 28, 2005, the Company accounted for its stock-based compensation plans under the

provisions of APB No. 25, “Accounting for Stock Issued to Employees,” as permitted under SFAS No. 148, “Accounting for Stock-

Based Compensation - Transition and Disclosure - an amendment of FASB Statement No. 123.” During the first half of fiscal 2005,

which ended on August 27, 2005, the Company recognized compensation expense for restricted stock awards over the service

period, but did not recognize compensation expense for stock options, since the options were granted at market value on the

date of grant.

Effective August 28, 2005, the Company adopted SFAS No. 123R under the modified prospective method. Accordingly, prior period

amounts have not been restated. Under this application, the Company records stock-based compensation expense for all awards

granted on or after the date of adoption and for the portion of previously granted awards that remain unvested at the date of

adoption. Currently, the Company’s stock-based compensation relates to restricted stock awards and stock options. The Company’s

restricted stock awards are considered nonvested share awards as defined under SFAS No. 123R.

Under SFAS No. 123R, the Company uses a Black-Scholes option-pricing model to determine the fair value of its stock options.

The Black-Scholes model includes various assumptions, including the expected life of stock options, the expected volatility and the

expected risk free interest rate. These assumptions reflect the Company’s best estimates, but they involve inherent uncertainties

based on market conditions generally outside the control of the Company.As a result, if other assumptions had been used, total

stock-based compensation cost, as determined in accordance with SFAS No. 123R could have been materially impacted.

Furthermore, if the Company uses different assumptions for future grants, stock-based compensation cost could be materially

impacted in future periods.

Also, under SFAS No. 123R, the Company is required to record stock-based compensation expense net of estimated forfeitures.

The Company’sforfeiturerate assumption used in determining its stock-based compensation expense is estimated based on

historical data. The actual forfeiture rate could differ from these estimates.

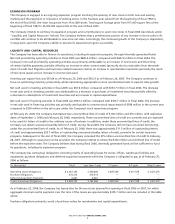

Income Taxes: The Company accounts for its income taxes using the asset and liability method. Deferred tax assets and liabilities

are recognized for the future tax consequences attributable to the differences between the financial statement carrying amounts

of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the year in which those temporary

differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is

recognized in earnings in the period that includes the enactment date.

Judgment is required in determining the provision for income taxes and related accruals, deferred tax assets and liabilities. In

the ordinary course of business, there are transactions and calculations where the ultimate tax outcome is uncertain. Additionally,

the Company’s tax returns are subject to audit by various tax authorities. Although the Company believes that its estimates are

reasonable, actual results could differ from these estimates.

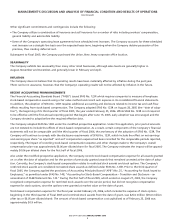

FORWARD LOOKING STATEMENTS

This Annual Report and, in particular, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and

the Shareholder Letter, contain forward looking statements within the meaning of Section 21E of the Securities Exchange Act of

1934, as amended. The Company’sactual results and future financial condition may differ materially from those expressed in

any such forward looking statements as a result of many factors that may be outside the Company’s control. Such factors include,

without limitation: changes in the retailing environment and consumer preferences and spending habits; demographics and

other macroeconomic factors that may impact the level of spending for the types of merchandise sold by the Company; general

economic conditions; unusual weather patterns; competition from existing and potential competitors; competition from other

channels of distribution; pricing pressures; the cost of labor,merchandise and other costs and expenses; and the ability to find

suitable locations at acceptable occupancy costs to support the Company’s expansion program.