Bed, Bath and Beyond 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

6

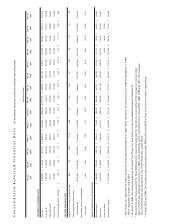

Other significant commitments and contingencies include the following:

•The Company utilizes a combination of insurance and self insurance for a number of risks including workers’ compensation,

general liability and automobile liability.

•Some of the Company’s operating lease agreements have scheduled rent increases. The Company accounts for these scheduled

rent increases on a straight-line basis over the expected lease term, beginning when the Company obtains possession of the

premises, thus creating deferred rent.

Subsequent to fiscal 2005, the Company purchased the Union, New Jersey corporate office location.

SEASONALITY

The Company exhibits less seasonality than many other retail businesses, although sales levels are generally higher in

August, November and December, and generally lower in February and April.

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past year.

There can be no assurance, however, that the Company’s operating results will not be affected by inflation in the future.

RECENT ACCOUNTING PRONOUNCEMENTS

The Financial Accounting Standards Board (“FASB”) issued SFAS No. 123R which requires companies to measure all employee

stock-based compensation awards using a fair value method and record such expense in its consolidated financial statements.

In addition, the adoption of SFAS No. 123R requires additional accounting and disclosure related to income tax and cash flow

effects resulting from stock-based compensation. The Company adopted SFAS No. 123R on August 28, 2005 (the “date of adop-

tion”), the beginning of its thirdquarter of fiscal 2005, the year ended February 25, 2006. While SFAS No. 123R is not required

to be effective until the first annual reporting period that begins after June 15, 2005, early adoption was encouraged and the

Company elected to adopt before the required effective date.

The Company adopted SFAS No.123R under the modified prospective application. Under this application, prior period amounts

are not restated to include the effects of stock-based compensation. As a result, certain components of the Company’s financial

statements will not be comparable until the thirdquarter of fiscal 2006, the anniversary of the adoption of SFAS No. 123R. The

Company will continue to comply with the disclosure requirements of SFAS No. 123R, which include the effect on net earnings

and earnings per share “as reported” and as if compensation expense had been recorded for the comparable periods reported,

respectively. The impact of recording stock-based compensation expense and other changes made to the Company’s overall

compensation plan was approximately $0.06 per diluted share for fiscal 2005. The Company estimates the impact will be approxi-

mately $0.06 per diluted share for the first half of fiscal 2006.

Also under the modified prospective application, the Company records stock-based compensation expense for all awards granted

on or after the date of adoption and for the portion of previously granted awards that remained unvested at the date of adop-

tion. Currently, the Company’s stock-based compensation relates to restricted stock awards and stock options. The Company’s

restricted stock awards are considered nonvested share awards as defined under SFAS No. 123R. Prior to the third quarter of

fiscal 2005, the Company applied the provisions of Accounting Principles Board (“APB”) No. 25, “Accounting for Stock Issued to

Employees,” as permitted under SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure – an

amendment of FASB Statement No. 123.” During the first half of fiscal 2005, which ended on August 27, 2005, the Company

recognized compensation expense for restricted stock awards over the service period, but did not recognize compensation

expense for stock options, since the options were granted at market value on the date of grant.

Stock-based compensation expense for the fiscal year ended February25, 2006, which includes the expense of stock options

beginning in the third quarter of fiscal 2005 and restricted stock awards from the date of grant, was $25.6 million ($16.0 million

after tax or $0.05 per diluted share). The amount of stock-based compensation cost capitalized as of February 25, 2006 was

approximately $0.9 million.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)