Bed, Bath and Beyond 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

17

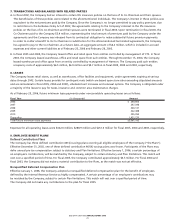

Under SFAS No. 123R, the Company uses a Black-Scholes option-pricing model to determine the fair value of its stock options.

The Black-Scholes model includes various assumptions, including the expected life of stock options, the expected volatility and the

expected risk free interest rate. These assumptions reflect the Company’s best estimates, but they involve inherent uncertainties

based on market conditions generally outside the control of the Company. As a result, if other assumptions had been used,

total stock-based compensation cost, as determined in accordance with SFAS No. 123R could have been materially impacted.

Furthermore, if the Company uses different assumptions for future grants, stock-based compensation cost could be materially

impacted in future periods.

Also, under SFAS No. 123R, the Company is required to record stock-based compensation expense net of estimated forfeitures.

The Company’s forfeiture rate assumption used in determining its stock-based compensation expense is estimated based on

historical data. The actual forfeiture rate could differ from these estimates.

Prior to the third quarter of fiscal 2005, the Company applied the provisions of APB No. 25, “Accounting for Stock Issued to

Employees,” as permitted under SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure – an

amendment of FASB Statement No. 123” and complied with the disclosure requirements of SFAS 123. During the first half of

fiscal 2005, which ended on August 27, 2005, the Company recognized compensation expense for restricted stock awards over

the service period, but did not recognize compensation expense for stock options, since the options were granted at market

value on the date of grant. No compensation expense for stock-based awards was recognized in fiscal 2004 and 2003.

X. Income Taxes

The Company files a consolidated Federal income tax return. Income tax returns are filed with each state and territory in which

the Company conducts business.

The Company accounts for its income taxes using the asset and liability method. Deferred tax assets and liabilities are recognized

for the future tax consequences attributable to the differences between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabili-

ties aremeasured using enacted tax rates expected to apply to taxable income in the year in which those temporarydifferences

are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in

earnings in the period that includes the enactment date.

Judgment is required in determining the provision for income taxes and related accruals, deferred tax assets and liabilities. In

the ordinary course of business, there are transactions and calculations where the ultimate tax outcome is uncertain. Additionally,

the Company’stax returns aresubject to audit by various tax authorities. Although the Company believes that its estimates are

reasonable, actual results could differ from these estimates.

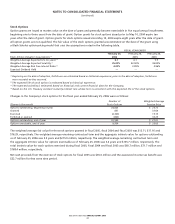

Y. Earnings per Share

The Company presents earnings per share on a basic and diluted basis. Basic earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding. Diluted earnings per share has been computed by dividing

net earnings by the weighted average number of shares outstanding including the dilutive effect of stock-based awards as

calculated under the treasury stock method.

Stock-based awards of approximately 4,879,700, 2,766,400 and 543,800 shares were excluded from the computation of diluted

earnings per share as the effect would be anti-dilutive for fiscal 2005, 2004 and 2003, respectively.

Z. Reclassifications

Certain reclassifications have been made to the fiscal 2004 and 2003 consolidated financial statements to conform to the fiscal

2005 consolidated financial statement presentation.