Bed, Bath and Beyond 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

21

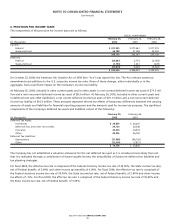

7. TRANSACTIONS AND BALANCES WITH RELATED PARTIES

A. In fiscal 2002, the Company had an interest in certain life insurance policies on the lives of its Co-Chairmen and their spouses.

The beneficiaries of these policies were related to the aforementioned individuals. The Company’s interest in these policies was

equivalent to the net premiums paid by the Company. Since the Company is no longer permitted to pay policy premiums due

to restrictions in the Sarbanes-Oxley Act of 2002, the agreements relating to the Company’s interest in the life insurance

policies on the lives of its Co-Chairmen and their spouses were terminated in fiscal 2003. Upon termination in fiscal 2003, the

Co-Chairmen paid to the Company $5.4 million, representing the total amount of premiums paid by the Company under the

agreements and the Company was released from its contractual obligation to make substantial future premium payments.

In order to confer a benefit to its Co-Chairmen in substitution for the aforementioned terminated agreements, the Company

has agreed to pay to the Co-Chairmen, at a future date, an aggregate amount of $4.2 million, which is included in accrued

expenses and other current liabilities as of February 25, 2006 and February 26, 2005.

B. In fiscal 2005 and 2004, the Company leased office and retail space from entities controlled by management of CTS. In fiscal

2003, the Company leased warehouse, office and retail space from such entities. Through November 15, 2004, the Company

leased warehouse and office space from an entity controlled by management of Harmon. The Company paid such entities

occupancy costs of approximately $6.5 million, $6.9 million and $4.7 million in fiscal 2005, 2004 and 2003, respectively.

8. LEASES

The Company leases retail stores, as well as warehouses, office facilities and equipment, under agreements expiring at various

dates through 2042. Certain leases provide for contingent rents (which are based upon store sales exceeding stipulated amounts

and areimmaterial in fiscal 2005, 2004 and 2003), scheduled rent increases and renewal options. The Company is obligated under

amajority of the leases to pay for taxes, insurance and common area maintenance charges.

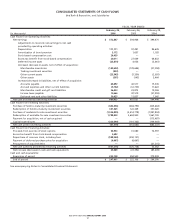

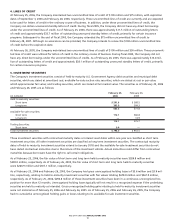

As of February25, 2006, futureminimum lease payments under noncancelable operating leases areas follows:

Fiscal Year (in thousands) Amount

2006 $ 340,806

2007 347,398

2008 340,131

2009 322,488

2010 295,050

Thereafter 1,421,270

Total future minimum lease payments $3,067,143

Expenses for all operating leases were $322.0 million, $288.9 million and $251.0 million for fiscal 2005, 2004 and 2003, respectively.

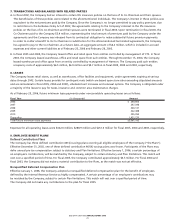

9. EMPLOYEE BENEFIT PLANS

Defined Contribution Plans

The Company has three defined contribution 401(k) savings plans covering all eligible employees of the Company (“the Plans”).

Effective December 31, 2003, one of these defined contribution 401(k) savings plans was frozen. Participants of the Plans may

defer annual pre-tax compensation subject to statutory and Plan limitations. Effective January 1, 2006, a certain percentage of

an employee’s contributions, will be matched by the Company, subject to certain statutory and Plan limitations. This match will

vest over a specified period of time. For fiscal 2005, the Company contributed approximately $0.5 million. For fiscal 2004 and

fiscal 2003, the Company did not make a material contribution to the Plans, as the match was not yet effective.

Nonqualified Deferred Compensation Plan

Effective January 1, 2006, the Company adopted a nonqualified deferred compensation plan for the benefit of employees

defined by the Internal Revenue Service as highly compensated. A certain percentage of an employee’s contributions may

be matched by the Company,subject to certain Plan limitations. This match will vest over a specified period of time.

The Company did not make any contributions to the plan for fiscal 2005.