Bed, Bath and Beyond 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2003

6

Purchase obligations consist of purchase orders for merchandise and capital expenditures. Typically, these

purchase orders, which are not included in the Company’s consolidated balance sheet as of February 28, 2004,

allow the Company to cancel the orders without recourse.

SEASONALITY

The Company exhibits less seasonality than many other retail businesses, although sales levels are generally

higher in August, November and December and generally lower in February and March.

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past

year. There can be no assurance, however, that the Company’s operating results will not be affected by inflation in

the future.

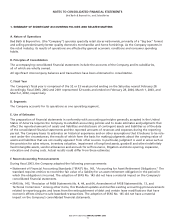

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires the Company to establish accounting policies and to make estimates and judgments that

affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date

of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting

period. The Company bases its estimates on historical experience and on other assumptions that it believes to be

relevant under the circumstances, the results of which form the basis for making judgments about the carrying value

of assets and liabilities that are not readily apparent from other sources. In particular, judgment is used in areas such

as the provision for sales returns, inventory valuation, impairment of long-lived assets, goodwill and other indefinite-

ly lived intangible assets, vendor allowances and accruals for self insurance, litigation and store opening, expansion,

relocation and closing costs. Actual results could differ from these estimates.

Sales Returns: Sales returns, which are reserved for based on historical experience, are provided for in the period that

the related sales are recorded.

Inventory Valuation: Merchandise inventories are stated at the lower of cost or market, generally using the retail

inventory method. Under the retail inventory method, the valuation of inventories at cost and the resulting gross

margins are calculated by applying a cost-to-retail ratio to the retail value of inventories. In addition, the Company

estimates a reserve for expected shrinkage throughout the year, based on historical shrinkage. Actual shrinkage

is recorded at year-end based on the results of the Company’s physical inventory count. At any one time, inventories

include items that have been marked down to the Company’s best estimate of their fair market value. Actual

markdowns required could differ from this estimate.

Impairment of Long-Lived Assets: The Company reviews long-lived assets for impairment by comparing the

carrying value of the assets with their estimated future undiscounted cash flows when events or changes in circum-

stances indicate the carrying value of these assets may exceed their current fair values. If it is determined that an

impairment loss has occurred, the loss would be recognized during that period. The impairment loss is calculated

as the difference between asset carrying values and the present value of the estimated net cash flows. The Company

does not believe that any material impairment currently exists related to its long-lived assets.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)