Bed, Bath and Beyond 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2003

15

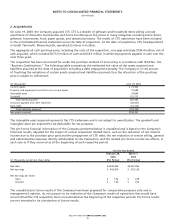

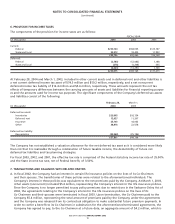

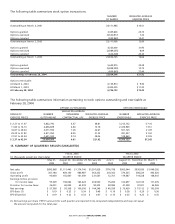

Options for which the exercise price was greater than the average market price of common shares as of the fiscal

years ended 2003, 2002 and 2001 were not included in the computation of diluted earnings per share as the effect

would be anti-dilutive. These consisted of options totaling 543,750, 158,925 and 22,275 shares, respectively.

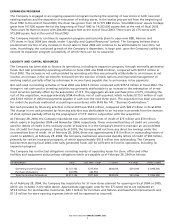

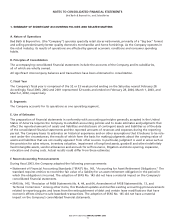

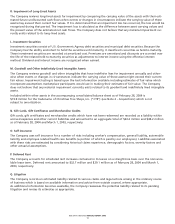

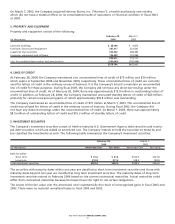

Y. Stock-Based Compensation

As permitted under SFAS No. 123, ”Accounting for Stock Based Compensation” and subsequently amended by SFAS

No. 148, ”Accounting for Stock Based Compensation - Transition and Disclosure - an amendment of FASB Statement

No. 123,” the Company has elected not to adopt the fair value based method of accounting for its stock-based com-

pensation plans, but continues to apply the provisions of Accounting Principles Board No. 25, ”Accounting for Stock

Issued to Employees.” The Company has complied with the disclosure requirements of SFAS No. 123.

Accordingly, no compensation cost has been recognized in connection with the Company’s stock option plans.

Set forth below are the Company’s net earnings and net earnings per share ”as reported,” and as if compensation

cost had been recognized (“pro forma”) in accordance with the fair value provisions of SFAS No. 123:

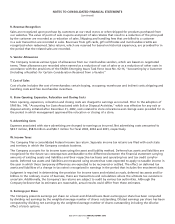

FISCAL YEAR

(in thousands) 2003 2002 2001

NET EARNINGS:

As reported $399,470) $302,179) $219,599)

Deduct: Total stock-based employee compensation

expense determined under fair value based

method, net of related tax effects (29,372) (25,443) (19,590)

Pro forma $370,098) $276,736) $200,009)

NET EARNINGS PER SHARE:

Basic:

As reported $1.35) $1.03) $0.76)

Pro forma $1.25) $0.94) $0.69)

Diluted:

As reported $1.31) $1.00) $0.74)

Pro forma $1.23) $0.92) $0.67)

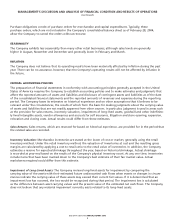

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model

with the following assumptions:

FISCAL YEAR

2003 2002 2001

Dividend yield —%—%—%

Expected volatility 45.00% 45.00% 45.00%

Risk free interest rates 2.96% 4.72% 4.80%

Expected lives (years) 5.9%7.0%7.0%

Weighted average fair value of options

granted during the year $16.29%$17.15%$12.77%

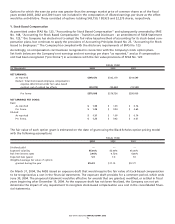

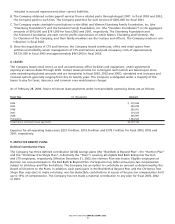

On March 31, 2004, the FASB issued an exposure draft that would require the fair value of stock-based compensation

to be recognized as a cost in the financial statements. The exposure draft provides for a comment period, which ends

June 30, 2004. The proposed statement would be effective for awards that are granted, modified, or settled in fiscal

years beginning after December 15, 2004. As the exposure draft has not been finalized, the Company can not yet

determine the impact of any requirement to recognize stock-based compensation as a cost in the consolidated finan-

cial statements.