Bed, Bath and Beyond 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2003

17

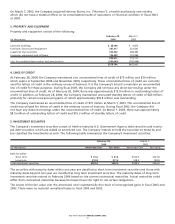

On March 5, 2002, the Company acquired Harmon Stores, Inc. (“Harmon”), a health and beauty care retailer,

which did not have a material effect on its consolidated results of operations or financial condition in fiscal 2003

or 2002.

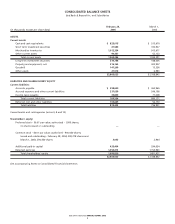

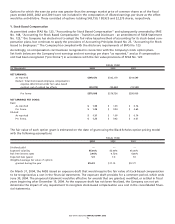

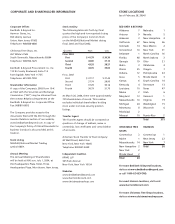

3. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

February 28, March 1,

(in thousands) 2004 2003

Land and buildings $28,189)$6,875)

Furniture, fixtures and equipment 387,517)321,507)

Leasehold improvements 333,502)268,493)

Computer equipment and software 146,999)122,896)

896,207)719,771)

Less: Accumulated depreciation and amortization (380,043) (295,864)

$516,164)$423,907)

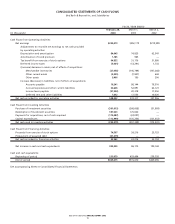

4. LINES OF CREDIT

At February 28, 2004, the Company maintained two uncommitted lines of credit of $75 million and $50 million,

which expire in September 2004 and November 2004, respectively. These uncommitted lines of credit are currently

used for letters of credit in the ordinary course of business. It is the Company’s intent to maintain an uncommitted

line of credit for these purposes. During fiscal 2003, the Company did not have any direct borrowings under the

uncommitted lines of credit. As of February 28, 2004, there was approximately $15.0 million in outstanding letters of

credit. In addition, at February 28, 2004, the Company maintained unsecured standby letters of credit of $40 million,

primarily for certain insurance programs, of which approximately $35.8 million was outstanding.

The Company maintained an uncommitted line of credit of $75 million at March 1, 2003. This uncommitted line of

credit was utilized for letters of credit in the ordinary course of business. During fiscal 2002, the Company did

not have any direct borrowings under the uncommitted line of credit. At March 1, 2003, there was approximately

$8.5 million of outstanding letters of credit and $16.2 million of standby letters of credit.

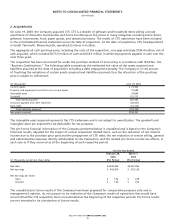

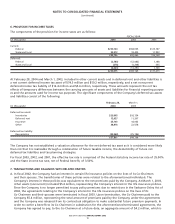

5. INVESTMENT SECURITIES

The Company’s investment securities consist of held-to-maturity U.S. Government Agency debt securities and munici-

pal debt securities, which are stated at amortized cost. The Company intends to hold the securities to maturity and

has classified the investments as such. The following table summarizes the Company’s investment securities:

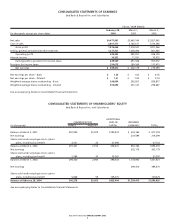

February 28,March 1,

2004 2003

(in thousands) Amortized Cost Fair Value Amortized Cost Fair Value

Debt Securities:

Short term $41.6 $ 41.6 $100.9 $101.8

Long term 210.8 211.4 148.0 148.4

Total investment securities $252.4 $253.0 $248.9 $250.2

The securities with maturity dates within one year are classified as short term investment securities and those with

maturity dates beyond one year are classified as long term investment securities. The maturity dates of long term

investment securities extend to February 2006 based on the current contractual maturities. Actual maturities could

differ from contractual maturities because borrowers have the right to call certain obligations.

The excess of the fair value over the amortized cost is substantially the result of unrecognized gains in fiscal 2003 and

2002. There were no material unrealized losses in fiscal 2003 and 2002.