Bed, Bath and Beyond 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2003

5

EXPANSION PROGRAM

The Company is engaged in an ongoing expansion program involving the opening of new stores in both new and

existing markets and the expansion or relocation of existing stores. In the twelve year period from the beginning of

fiscal 1992 to the end of fiscal 2003, the chain has grown from 34 to 575 BBB stores. Total BBB stores’ square footage

grew from 917,000 square feet at the beginning of fiscal 1992 to 19,353,000 square feet at the end of fiscal 2003.

There were 30 Harmon stores with 204,000 square feet at the end of fiscal 2003. There were 24 CTS stores with

915,000 square feet at the end of fiscal 2003.

The Company intends to continue its expansion program and currently plans to open new BBB, Harmon and

CTS stores in fiscal 2004 (see details under “Liquidity and Capital Resources” below). The Company believes that a

predominant portion of any increase in its net sales in fiscal 2004 will continue to be attributable to new store net

sales. Accordingly, the continued growth of the Company is dependent, in large part, upon the Company’s ability to

execute its expansion program successfully, of which there can be no assurance.

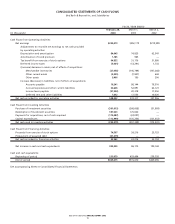

LIQUIDITY AND CAPITAL RESOURCES

The Company has been able to finance its operations, including its expansion program, through internally generated

funds. Net cash provided by operating activities in fiscal 2003 was $548.4 million, compared with $419.3 million in

fiscal 2002. The increase in net cash provided by operating activities was primarily attributable to an increase in net

income, an increase in the tax benefit received from the exercise of stock options and improved management of

working capital, partially offset by a decrease in income taxes payable due to an increase in tax payments.

Net cash used in investing activities in fiscal 2003 was $292.5 million compared with $357.4 million in fiscal 2002. The

change in net cash used in investing activities was primarily attributable to an increase in the redemption of invest-

ment securities partially offset by the acquisition of CTS. The aggregate all cash purchase price of CTS, including the

cost of the acquisition, was approximately $194.4 million, net of cash acquired, which includes $175.5 million of cash

and $18.9 million in deferred payments payable in cash over the next three years. The acquisition has been accounted

for under the purchase method of accounting in accordance with SFAS No. 141, “Business Combinations.”

Net cash provided by financing activities in fiscal 2003 was $53.4 million, compared with $24.2 million in fiscal 2002.

The change in net cash provided by financing activities was attributable to an increase in proceeds from the exercise

of stock options partially offset by the prepayment of CTS’ debt in conjunction with the acquisition.

At February 28, 2004, the Company maintained two uncommitted lines of credit of $75 million and $50 million,

which expire in September 2004 and November 2004, respectively. These uncommitted lines of credit are currently

used for letters of credit in the ordinary course of business. It is the Company’s intent to maintain an uncommitted

line of credit for these purposes. During fiscal 2003, the Company did not have any direct borrowings under the

uncommitted lines of credit. As of February 28, 2004, there was approximately $15.0 million in outstanding letters of

credit. In addition, at February 28, 2004, the Company maintained unsecured standby letters of credit of $40 million,

primarily for certain insurance programs, of which approximately $35.8 million was outstanding. The Company

believes that during fiscal 2004, internally generated funds will be sufficient to fund its operations, including its

expansion program.

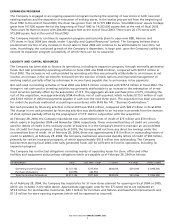

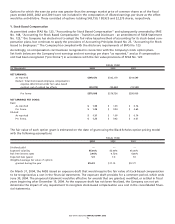

The Company has contractual obligations consisting mainly of operating leases for store, office and other

facilities and equipment and purchase obligations which are payable as of February 28, 2004 as follows:

(in thousands) Total Less than 1 year 1-3 years 4-5 years After 5 years

Operating Lease Obligations $2,727,162 $273,934 $842,674 $514,046 $1,096,508

Purchase Obligations 643,994 643,994———

Total Contractual Obligations $3,371,156 $917,928 $842,674 $514,046 $1,096,508

As of February 28, 2004, the Company has leased sites for 57 new stores planned for opening in fiscal 2004 or 2005,

which are included in the table above. Approximate aggregate costs for the 57 leased stores are estimated at

$79.9 million for merchandise inventories, $43.1 million for furniture and fixtures and leasehold improvements and

$11.8 million for store opening expenses (which will be expensed as incurred).