Bed, Bath and Beyond 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2003

16

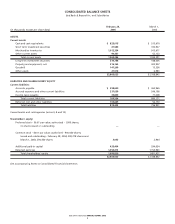

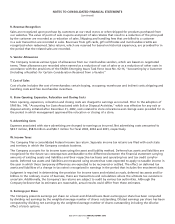

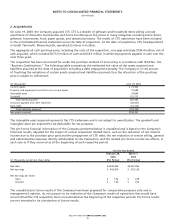

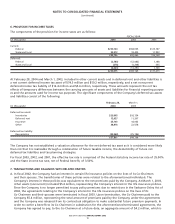

2. ACQUISITIONS

On June 19, 2003, the Company acquired CTS. CTS is a retailer of giftware and household items selling a broad

assortment of domestics merchandise and home furnishings at low prices in many categories including home décor,

giftware, housewares, food, paper goods, and seasonal products. The results of CTS’ operations have been included

in the consolidated financial statements since the date of acquisition. At the date of acquisition, CTS, headquartered

in South Yarmouth, Massachusetts, operated 23 stores in 6 states.

The aggregate all cash purchase price, including the costs of the acquisition, was approximately $194.4 million, net of

cash acquired, which included $175.5 million of cash and $18.9 million in deferred payments payable in cash over the

next three years.

The acquisition has been accounted for under the purchase method of accounting in accordance with SFAS No. 141,

”Business Combinations.” The following table summarizes the estimated fair value of the assets acquired and

liabilities assumed at the date of acquisition including a debt prepayment penalty. The Company is in the process

of finalizing the valuations of certain assets acquired and liabilities assumed; thus the allocation of the purchase

price is subject to refinement.

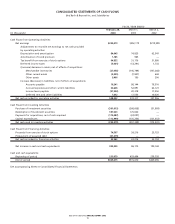

(in thousands) June 19, 2003

Current assets $ 73,302)

Property and equipment and other non-current assets 72,680)

Intangible asset 19,898)

Goodwill 131,713)

Total assets acquired 297,593)

Accounts payable and other liabilities (82,027)

Bank debt (21,215)

Total liabilities assumed (103,242)

Net assets acquired $194,351)

The intangible asset acquired represents the CTS tradename and is not subject to amortization. The goodwill and

intangible asset are expected to be deductible for tax purposes.

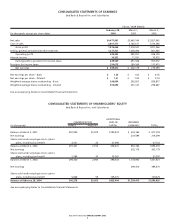

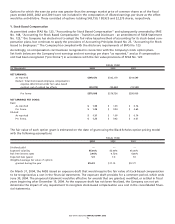

The pro forma financial information of the Company presented below is unaudited and is based on the Company’s

historical results, adjusted for the impact of certain acquisition related items, such as: the reduction of net interest

income due to the purchase price paid and the prepayment of CTS’ debt, the net reduction of certain selling, general

and administrative expenses directly attributable to the transaction, and the related pro forma income tax effects, in

each case as if they occurred as of the beginning of each respective period.

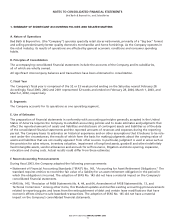

For the Year Ended

February 28, March 1,

2004 2003

(in thousands, except per share data) (Pro Forma) (Pro Forma)

Net sales $4,582,309 $4,037,956

Net earnings $402,479 $ 318,139

Net earnings per share:

Basic $1.36 $ 1.09

Diluted $1.32 $ 1.06

The unaudited pro forma results of the Company have been prepared for comparative purposes only and in

management’s opinion, do not purport to be indicative of the Company’s results of operations that would have

occurred had the CTS acquisition been consummated at the beginning of the respective periods. Pro forma results

are not intended to be a projection of future results.

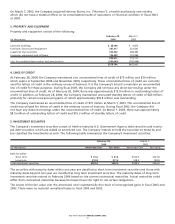

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)