Bed, Bath and Beyond 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2003

12

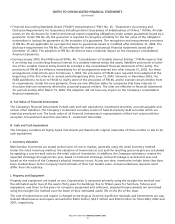

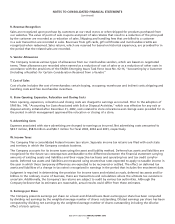

• Financial Accounting Standards Board (“FASB”) Interpretation (“FIN”) No. 45, “Guarantor’s Accounting and

Disclosure Requirements for Guarantees Including Indirect Guarantees of Indebtedness of Others.” FIN No. 45 elab-

orates on the disclosures for interim and annual reports regarding obligations under certain guarantees issued by a

guarantor. Under FIN No. 45, the guarantor is required to recognize a liability for the fair value of the obligation

undertaken in issuing the guarantee at the inception of a guarantee. The recognition and measurement provisions

of FIN No. 45 are applicable on a prospective basis to guarantees issued or modified after December 31, 2002. The

disclosure requirements for FIN No. 45 are effective for interim and annual financial statements issued after

December 15, 2002. The adoption of FIN No. 45 did not have a material impact on the Company’s consolidated

financial statements.

• During January 2003, the FASB issued FIN No. 46, ”Consolidation of Variable Interest Entities.” FIN 46 requires that

if an entity has a controlling financial interest in a variable interest entity, the assets, liabilities and results of activi-

ties of the variable interest entity should be included in the consolidated financial statements of the entity. The

provisions of FIN 46 are effective immediately for all arrangements entered into after January 31, 2003. For those

arrangements entered into prior to February 1, 2003, the provisions of FIN 46 were required to be adopted at the

beginning of the first interim or annual period beginning after June 15, 2003. However, in December 2003, the

FASB published a revision to FIN 46 to clarify some of the provisions of FIN 46, and to exempt certain entities from

its requirements. Under the new guidance, there are new effective dates for companies that have interests in

structures that are commonly referred to as special-purpose entities. The rules are effective in financial statements

for periods ending after March 15, 2004. The adoption did not have any impact on the Company’s consolidated

financial statements.

G. Fair Value of Financial Instruments

The Company’s financial instruments include cash and cash equivalents, investment securities, accounts payable and

certain other liabilities. The Company’s investment securities consist of held-to-maturity debt securities which are

stated at amortized cost. The book value of all financial instruments is representative of their fair values with the

exception of investment securities (see Note 5 - Investment Securities).

H. Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with original maturities of three months or less to be

cash equivalents.

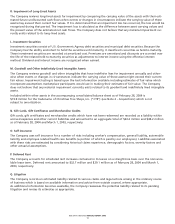

I. Inventory Valuation

Merchandise inventories are stated at the lower of cost or market, generally using the retail inventory method.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are calculated

by applying a cost-to-retail ratio to the retail value of inventories. In addition, the Company estimates a reserve for

expected shrinkage throughout the year, based on historical shrinkage. Actual shrinkage is recorded at year-end

based on the results of the Company’s physical inventory count. At any one time, inventories include items that have

been marked down to the Company’s best estimate of their fair market value. Actual markdowns required could

differ from this estimate.

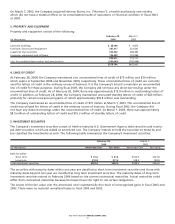

J. Property and Equipment

Property and equipment are stated at cost. Depreciation is computed primarily using the straight-line method over

the estimated useful lives of the assets (forty years for buildings; five to fifteen years for furniture, fixtures and

equipment; and three to five years for computer equipment and software). Leasehold improvements are amortized

using the straight-line method over the lesser of their estimated useful life or the life of the lease.

The cost of maintenance and repairs is charged to earnings as incurred; significant renewals and betterments are cap-

italized. Maintenance and repairs amounted to $44.5 million, $34.7 million and $34.3 million for fiscal 2003, 2002 and

2001, respectively.

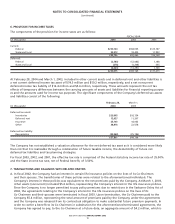

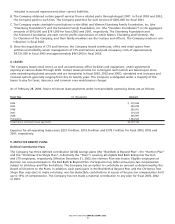

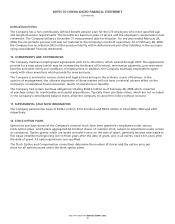

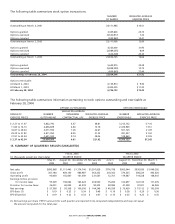

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)