Bed, Bath and Beyond 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2003

18

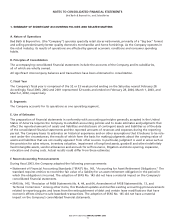

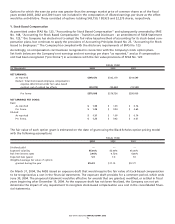

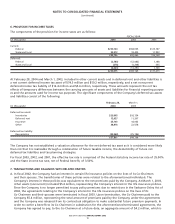

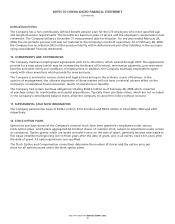

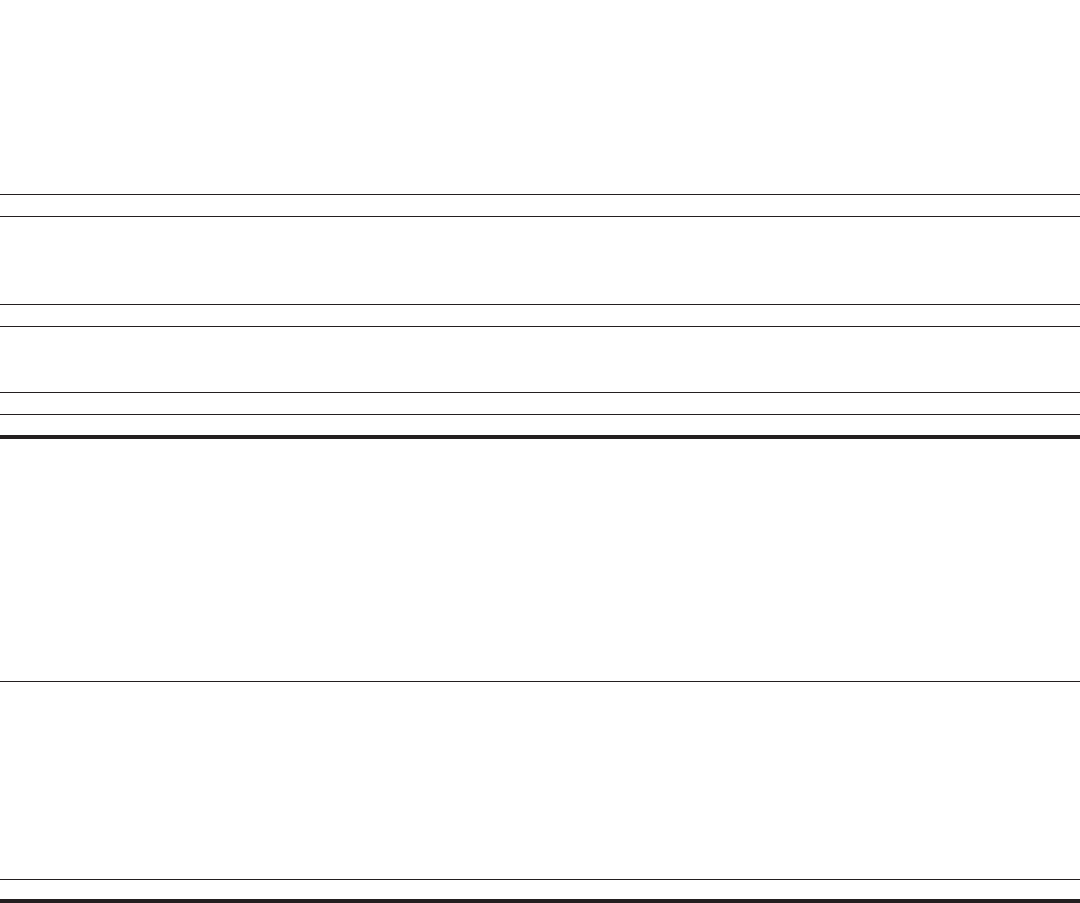

6. PROVISION FOR INCOME TAXES

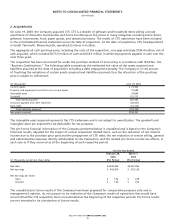

The components of the provision for income taxes are as follows:

FISCAL YEAR

(in thousands) 2003 2002 2001

Current:

Federal $230,124)$184,055)$123,787

State and local 23,012)18,405)11,953

253,136)202,460)135,740

Deferred:

Federal (2,783) (12,083) 1,188

State and local (278) (1,208) 545

(3,061) (13,291) 1,733

$250,075)$189,169)$137,473

At February 28, 2004 and March 1, 2003, included in other current assets and in deferred rent and other liabilities is

a net current deferred income tax asset of $74.3 million and $50.2 million, respectively, and a net noncurrent

deferred income tax liability of $16.4 million and $5.4 million, respectively. These amounts represent the net tax

effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purpos-

es and the amounts used for income tax purposes. The significant components of the Company’s deferred tax assets

and liabilities consist of the following:

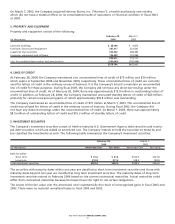

February 28, March 1,

(in thousands) 2004 2003

Deferred tax assets:

Inventories $25,003)$18,134)

Deferred rent 12,627)11,207)

Insurance 25,103)18,063)

Other 38,418)22,578)

Deferred tax liability:

Depreciation (43,260) (25,186)

$57,891)$44,796)

The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely

than not that it is realizable through a combination of future taxable income, the deductibility of future net

deferred tax liabilities and tax planning strategies.

For fiscal 2003, 2002, and 2001, the effective tax rate is comprised of the Federal statutory income tax rate of 35.00%

and the State income tax rate, net of Federal benefit, of 3.50%.

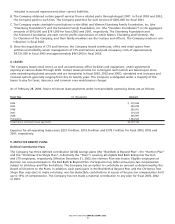

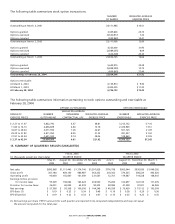

7. TRANSACTIONS AND BALANCES WITH RELATED PARTIES

A. In fiscal 2002, the Company had an interest in certain life insurance policies on the lives of its Co-Chairmen

and their spouses. The beneficiaries of these policies were related to the aforementioned individuals. The

Company’s interest in these policies was equivalent to the net premiums paid by the Company. At March 1, 2003,

other assets (noncurrent) included $5.4 million, representing the Company’s interest in the life insurance policies.

Since the Company is no longer permitted to pay policy premiums due to restrictions in the Sarbanes-Oxley Act of

2002, the agreements relating to the Company’s interest in the life insurance policies on the lives of its

Co-Chairmen and their spouses were terminated in fiscal 2003. Upon termination, the Co-Chairmen paid to the

Company $5.4 million, representing the total amount of premiums paid by the Company under the agreements

and the Company was released from its contractual obligation to make substantial future premium payments. In

order to confer a benefit to its Co-Chairmen in substitution for the aforementioned terminated agreements, the

Company has agreed to pay, to the Co-Chairmen at a future date, an aggregate amount of $4.2 million, which is

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)