Airtran 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

The B737 leases require us to remit monthly maintenance deposit payments to the lessor based on actual flight

hours and landings. The balance of such payments, which is capped at any point in time at $2.25 million for

each aircraft, is available to reimburse us for the cost of airframe, engine, and certain other component-part

maintenance. There will be an accounting at the end of each aircraft lease to ascertain if there is any excess

balance of the deposit payments; if so, such excess will be returned to us. These payments are accounted for as

deposits and the aggregate amount of such deposits is included in other assets. As of December 31, 2009 and

2008, the balance of all maintenance deposits for all the B737 leased aircraft and related leased engines

aggregated $55.8 million and $54.2 million, respectively.

We also lease facilities from local airport authorities or other carriers, as well as office space under operating

leases with terms ranging up to 12 years. In addition, we lease spare engines and certain rotable parts under

capital leases.

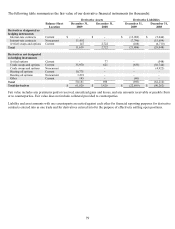

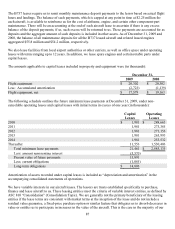

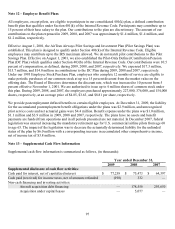

The amounts applicable to capital leases included in property and equipment were (in thousands):

December 31,

2009 2008

Flight equipment $ 20,302 $ 20,302

Less: Accumulated amortization (2,723)(1,139)

Flight equipment, net $ 17,579 $ 19,163

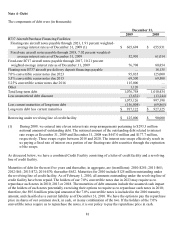

The following schedule outlines the future minimum lease payments at December 31, 2009, under non-

cancelable operating leases and capital leases with initial terms in excess of one year (in thousands):

Capital

Leases

Operating

Leases

2010 $ 1,981 $ 288,663

2011 1,981 273,385

2012 1,981 271,156

2013 1,981 265,993

2014 1,981 255,532

Thereafter 11,556 1,530,406

Total minimum lease payments 21,461 $ 2,885,135

Less: amount re

p

resentin

g

interest

(

5

,

570

)

Present value of future payments 15,891

Less: current obligations (1,085)

Long-term obligations $ 14,806

Amortization of assets recorded under capital leases is included as “depreciation and amortization” in the

accompanying consolidated statements of operations.

We have variable interests in our aircraft leases. The lessors are trusts established specifically to purchase,

finance and lease aircraft to us. These leasing entities meet the criteria of variable interest entities, as defined by

ASC 810 “Consolidation” (Consolidation Topic). We are generally not the primary beneficiary of the leasing

entities if the lease terms are consistent with market terms at the inception of the lease and do not include a

residual value guarantee, a fixed-price purchase option or similar feature that obligates us to absorb decreases in

value or entitles us to participate in increases in the value of the aircraft. This is the case in the majority of our