Airtran 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

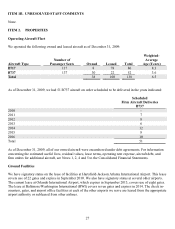

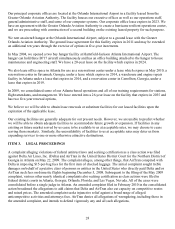

During 2009 we continued to develop our route network by: substantially increasing our presence in Orlando,

Baltimore, and Milwaukee; initiating service to seven domestic locations; and initiating service to three

international destinations. More specifically, during 2009, we:

xDoubled the size of our Milwaukee operations, as measured by available seat miles (ASMs). The new

flights are part of our strategy to expand service from General Mitchell International Airport in Milwaukee

and build our presence in the Midwest. Together with our marketing partner SkyWest Airlines, in February

2010, we will serve 22 non-stop destinations to and from Milwaukee.

xInitiated new service to Allentown/Bethlehem, Pennsylvania; Asheville, North Carolina; Atlantic City, New

Jersey; Branson, Missouri; Charleston, West Virginia; Key West, Florida; and Knoxville, Tennessee. In the

fourth quarter of 2009, we announced that we would resume service to Gulfport, Mississippi in January

2010. We also announced service to Lexington, Kentucky, which commenced in February 2010, and we

announced service to Des Moines, Iowa, which is expected to commence in March 2010. We also

suspended service to three U.S. cities for which the revenue performance was not meeting our expectations.

xExpanded our presence in the Caribbean in 2009 by adding service to Orangestad, Aruba; Cancun, Mexico;

and Nassau, The Bahamas. In the third quarter of 2009, we announced service to Montego Bay, Jamaica,

which commenced in February 2010. We believe that we are enhancing the AirTran Airways travel

experience by offering flights to these popular tourist destinations.

Key Initiatives

After six consecutive years of profitability, during 2008, we were faced with record high jet fuel prices, an

adverse macroeconomic environment, and disrupted capital markets. During 2008, we undertook a variety of

actions to respond to these challenges including: reducing capacity starting in September 2008; deferring new

aircraft deliveries; selling aircraft; reducing other capital expenditures; implementing increases in certain fares

and ancillary fees; entering into a variety of derivative financial arrangements to hedge the cost of fuel; and

managing our costs and employment levels. We also completed capital market transactions in 2008 exceeding

$375 million, including: issuing convertible debt and common stock; entering into a letter of credit facility to

reduce our exposure to holdbacks of cash remittances by a credit card processor; and obtaining a combined

letter of credit facility (the letter of credit facility) and revolving line of credit facility (the revolving line of

credit facility) which combined facility is referred to as the Credit Facility.

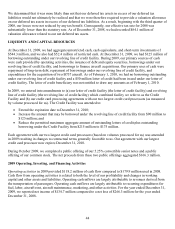

During 2009, we took additional steps to enhance our liquidity and our operating performance substantially

improved. In September 2009, our Credit Facility was amended to, among other things: extend the expiration

date of the facility to December 31, 2010; increase the amount that may be borrowed under the revolving line of

credit facility to $125 million; and reduce the maximum aggregate amount of outstanding letters of credit plus

outstanding borrowing to $175 million. During October 2009, we completed a public offering of $115.0 million

of our 5.25% convertible senior notes due in 2016 and a public offering of 11.3 million shares of our common

stock at a price of $5.08 per share. The net proceeds from the two offerings, which aggregated $166.3 million,

were used for general corporate purposes including improving our overall liquidity. We also continued to utilize

a variety of derivative financial arrangements to hedge the costs of fuel and interest rate volatility.

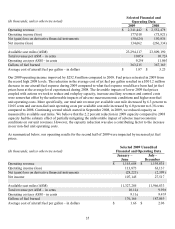

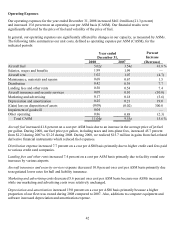

Recent Operating Results

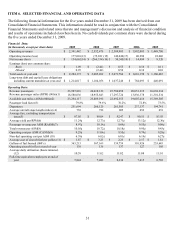

As summarized below, our operating results for 2009 were substantially improved compared to 2008. The

pronounced reduction in jet fuel price levels during 2009 compared to 2008, coupled with the actions that we

undertook to reduce and redeploy capacity, increase ancillary revenues, and control costs produced the

improved operating results.