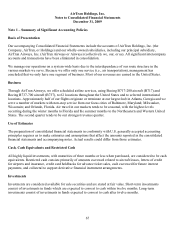

Airtran 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

commitment for two aircraft, we have not yet arranged for aircraft financing for any of the other firm aircraft

deliveries.

There are multiple variables including capital market conditions, asset valuations, and our own operating

performance that could affect the availability of satisfactory financing for our future B737 aircraft deliveries.

While there was limited availability of satisfactory aircraft financing in early 2009, it is our view that the

aircraft financing market has improved. While we cannot provide assurance that sufficient financing will be

available, we expect to be able to obtain acceptable financing for future deliveries. Our view is based upon our

discussions with prospective lenders and lessors, the consummation of aircraft financing transactions by other

airlines, our own improved operating performance in 2009, and our recent ability to refinance certain B737

aircraft.

Our B737 contract with Boeing requires us to make pre-delivery deposits to Boeing. Although we typically

have financed a significant portion of our pre-delivery deposit requirements with debt from banks or other

financial institutions, we currently have no such financing in place for future deliveries.

In October 2008, as part of our agreement to defer certain aircraft deliveries and obtain financing for 2009

aircraft deliveries, we granted an affiliate of Boeing the right to require us to lease, for a period not to exceed

ten years, up to five additional B717 aircraft. If such affiliate of Boeing exercises its right to require us to lease

any B717 aircraft, we have the option to cancel a like number of B737 aircraft we have on firm order for each

such B717 aircraft. In September 2009, we granted Boeing the right to terminate the leases of up to two of our

B717 aircraft before the scheduled lease expiration. To date, Boeing has not yet elected to require us to lease

additional aircraft or terminate any B717 aircraft leases.

Credit Card Processing Arrangements

We have agreements with organizations that process credit card transactions arising from purchases of air travel

by customers of Airways. Each of our agreements with our credit card processors allows, under specified

conditions, the processor to retain cash related to future travel that such processor otherwise would remit to us

(i.e., a “holdback”). Holdbacks are classified as restricted cash on our consolidated balance sheets. Our

exposure to credit card holdbacks consists of advanced ticket sales that customers purchase with credit cards.

Once the customer travels, any related holdback is remitted to us.

Each agreement with our two largest credit card processors (based on volumes processed for us) was amended

in 2009 resulting in changes to contractual terms generally favorable to us. Our agreement with our largest

credit card processor now expires December 31, 2010. Each agreement with our two largest credit card

processors provides that a processor may holdback amounts that would otherwise be remitted to us in the event

that a processor reasonably determines that there has been a material adverse occurrence or certain other events

occur. Our agreement with our largest credit card processor also provides that the processor may holdback

amounts that would otherwise be remitted to us in the event that our aggregate unrestricted cash and

investments (as defined) falls below agreed upon levels. Should the processor be entitled in the future to

withhold amounts that would otherwise be remitted to us, we retain the contractual right to eliminate or reduce

the amounts withheld by achieving specified aggregate unrestricted cash and investment levels and / or by

providing the processor with letters of credit. As of December, 2009, a $50 million letter of credit had been

issued under our letter of credit facility for the benefit of our largest credit card processor.

As of December 31, 2009, we had advance ticket sales of approximately $212.3 million related to all credit card

sales, we were in compliance with our credit card processing agreements, and our two largest processors were

holding back no cash remittances from us. Our maximum potential exposure to cash holdbacks by our two

largest credit card processors, based upon advance ticket sales as of December 31, 2009, was $149.1 million