Airtran 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

We have variable interests in many of our aircraft leases. The lessors are trusts established specifically to

purchase, finance, and lease aircraft to us. These leasing entities meet the criteria of variable interest entities, as

defined by Accounting Standards Codification (ASC) 810 “Consolidation” (Consolidation Topic). We are

generally not the primary beneficiary of the leasing entities if the lease terms are consistent with market terms at

the inception of the lease and do not include a residual value guarantee, a fixed-price purchase option, or similar

feature that obligates us to absorb decreases in value or entitles us to participate in increases in the value of the

aircraft. This is the case in the majority of our aircraft leases; however, we have two aircraft leases that contain

fixed-price purchase options that allow us to purchase the aircraft at predetermined prices on specified dates

during the lease term. We have not consolidated the related trusts because even taking into consideration these

purchase options, we are not the primary beneficiary based on our cash flow analysis.

Critical Accounting Policies and Estimates

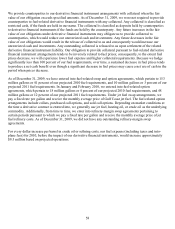

General. The discussion and analysis of our financial condition and results of operations is based upon our

Consolidated Financial Statements, which have been prepared in accordance with accounting principles

generally accepted in the United States. The preparation of these financial statements requires us to make

estimates and judgments that affect the reported amount of assets and liabilities, revenues and expenses, and

related disclosure of contingent assets and liabilities at the date of our financial statements.

Our actual results may differ from these estimates under different assumptions or conditions. Critical

accounting policies are defined as those that are reflective of significant judgments and uncertainties and are

sufficiently sensitive to result in materially different results under different assumptions and conditions. The

following is a description of what we believe to be our most critical accounting policies and estimates. See

Notes to the Consolidated Financial Statements for a description of our financial accounting policies.

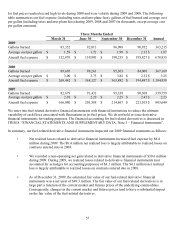

Revenue Recognition. Passenger revenue is recognized when transportation is provided. Ticket sales for

transportation which has not yet been provided are recorded as air traffic liability. Air traffic liability represents

tickets sold for future travel dates. The balance of the air traffic liability fluctuates throughout the year based on

seasonal travel patterns and fare sale activity. Passenger revenue accounting is inherently complex and the

measurement of the air traffic liability is subject to some uncertainty.

A nonrefundable ticket expires at the date of scheduled travel unless the customer exchanges the ticket in

advance of such date for a credit to be used by the customer as a form of payment for another ticket. We

recognize as revenue the value of a non-refundable ticket at the date of scheduled travel unless the customer

exchanges his or her ticket for credit. A percent of credits expire unused. We recognize as revenue over time, in

proportion to the credits that are used, the value of credits that we expect to go unused based on historical

experience. Estimating the amount of credits that will go unused involves some level of subjectivity and

judgment. Changes in our estimate of the amount of unused credits could have an effect on our revenues.

Frequent Flyer Program. We accrue a liability for the estimated incremental cost of providing free travel for

awards earned under our A+ Rewards Program based on credits we expect to be redeemed on us or the

contractual rate of expected redemption on other carriers. Incremental cost includes the cost of fuel, catering,

and miscellaneous direct costs, but does not include any costs for aircraft ownership, maintenance, labor, or

overhead allocation. We adjust this liability based on credits earned and redeemed, changes in the estimated

incremental costs, and changes in the A+ Rewards Program.

We also sell credits in our A+ Rewards Program to third parties, such as credit card companies, financial

institutions, and car rental agencies. Revenue from the sale of credits is deferred and recognized as passenger

revenue when transportation is expected to be provided, based on estimates of its fair value. The remaining

portion, which is the excess of the total sales proceeds over the estimated fair value of the transportation to be