Airtran 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

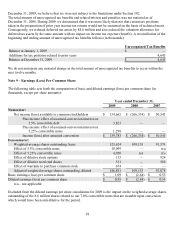

December 31, 2009, we believe that we were not subject to the limitations under Section 382.

The total amount of unrecognized tax benefits and related interest and penalties was not material as of

December 31, 2008. During 2009, we determined that it was more likely than not that certain tax positions

taken in the preparation of prior year income tax returns would not be sustained on the basis of technical merit.

Consequently, we reduced deferred tax assets by $4.6 million and also reduced the valuation allowance for

deferred tax assets by the same amount with no impact on income tax expense (benefit). A reconciliation of the

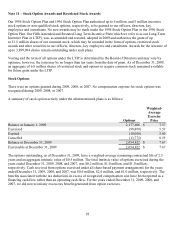

beginning and ending amount of unrecognized tax benefits follows (in thousands):

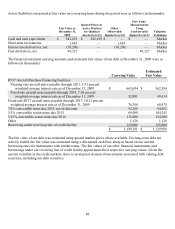

Unrecognized Tax Benefits

Balance at January 1, 2009 $

—

Additions for tax positions related to prior years 4,645

Balance at December 31, 2009 $ 4,645

We do not anticipate any material change in the total amount of unrecognized tax benefits to occur within the

next twelve months.

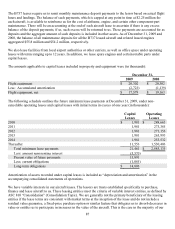

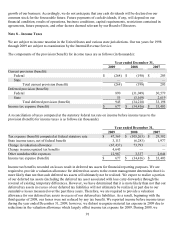

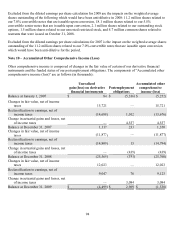

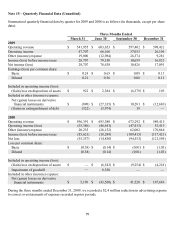

Note 9 – Earnings (Loss) Per Common Share

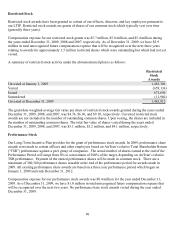

The following table sets forth the computation of basic and diluted earnings (loss) per common share (in

thousands, except per share amounts):

Year ended December 31,

2009 2008 2007

Numerator:

Net income (loss) available to common stockholders $ 134,662 $ (266,334) $ 50,545

Plus income effect of assumed-conversion interest on

5.5% convertible debt 3,823

—

—

Plus income effect of assumed-conversion interest on

5.25% convertible notes 1,298

—

—

Income (loss) after assumed conversion $ 139,783 $ (266,334) $ 50,545

Denominator:

Weighted-average shares outstanding, basic 123,624 109,153 91,574

Effect of 5.5% convertible notes 18,099

—

n/a

Effect of 5.25% convertible notes 4,050 n/

a

n/a

Effect of dilutive stock options 113

—

924

Effect of dilutive restricted shares 331

—

580

Effect of warrants to purchase common stock 674

—

—

Adjusted weighted-average shares outstanding, diluted 146,891 109,153 93,078

Basic earnings (loss) per common share $ 1.09 $ (2.44) $ 0.55

Diluted earnings (loss) per common share $ 0.95 $ (2.44) $ 0.54

n/a – not a

pp

licable

Excluded from the diluted earnings per share calculations for 2009 is the impact on the weighted average shares

outstanding of the 8.6 million shares related to our 7.0% convertible notes that are issuable upon conversion

which would have been anti-dilutive for the period.