Airtran 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

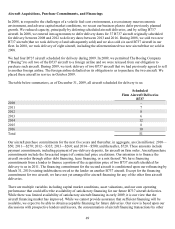

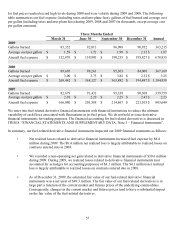

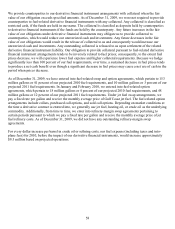

The (1) estimated total ultimate cash benefit (use) of our fuel-related derivatives scheduled to settle in 2010 and

(2) the expected difference in aggregate fuel cost compared to jet fuel cost based on crude oil at $70 per barrel

are estimated as follows at the specified crude per barrel prices (in millions, except per barrel amounts which

are in dollars):

Estimated Total

Ultimate Cash Benefit

(Use) of Our Fuel-

Related Derivative

Financial Instruments

Held as of

December 31

,

2009

Estimated Lower

(Higher) Aggregate

Jet Fuel Cost

(Prior to Impact of

Derivative Financial

Instruments)

Compared to Jet Fuel

Cost Based on

Crude Oil

of $70

p

er Barrel

Year Ended December 31, 2010

Assumed average market crude price:

$ 50 per barrel $(45.3) $ 219.1

$ 70 per barrel (20.1)

—

$ 90 per barrel 25.6 (219.1)

Notes:

1. The total ultimate derivative financial instrument related cash amounts include all estimated payments

and receipts during the period that the derivatives are outstanding. The ultimate cash benefit (use)

includes: any premiums paid to counterparties at the inception of the arrangements, any obligation for

us to provide counterparties with collateral prior to final settlement, and the cash benefit or use at the

time of final settlement. Any collateral held by counterparties at the time a derivative financial

instrument settles reduces any cash required from us at time of settlement.

2. As of December 31, 2009 and February 1, 2010, we had provided no collateral for fuel-related

derivatives to counterparties.

3. Changes in the refining margin may also impact the cost of jet fuel. The refining margin assumption

included in the table above is 15% of the assumed average market crude price.