Airtran 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

airlines, our own improved operating performance in 2009, and our recent ability to refinance certain B737

aircraft.

Our B737 contract with Boeing requires us to make pre-delivery deposits to Boeing. Although we typically

have financed a significant portion of our pre-delivery deposit requirements with debt from banks or other

financial institutions, we currently have no such financing in place for future deliveries.

If we are unable to generate revenues to cover our costs, we may slow our growth, including by the sale, lease,

or sub-lease of certain of our existing or on-order aircraft.

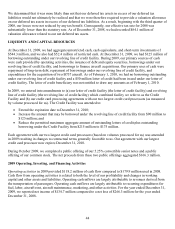

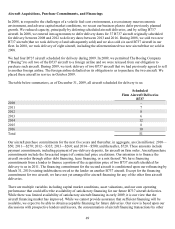

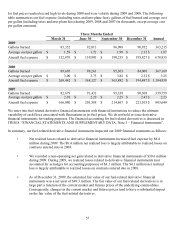

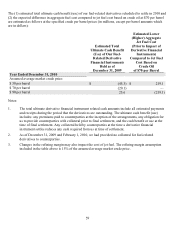

Contractual Obligations

Our contractual obligations as of December 31, 2009 are estimated to be due as follows (in millions):

Nature of commitment

Total 2010 2011-2012 2013-2014 Thereafter

Debt (1) $1,494 $323 $203 $208 $760

Operating lease obligations (2) 2,885 288 545 522 1,530

Capital lease obligations 22 2 4 4 12

Aircraft

p

urchase commitments

(

3

)

2

,

135 50 605 760 720

Total contractual obligations (4) $6,536 $663 $1,357 $1,494 $3,022

(1) Includes principal and interest payments, including interest payments on $665.7 million of floating rate

debt that have been forecasted at current interest rates. Also includes in 2010, repayment of $125 million

outstanding under the Revolving Line of Credit Facility. The holders of the $125 million 7.0% convertible

notes due in 2023 may require us to repurchase such notes in 2010, 2013 or 2018. The maturities of debt

amounts include the $95.8 million assumed impact of the holders exercising their option to require us to

repurchase the notes in 2010. Our debt agreements for aircraft acquisitions generally carry terms of twelve

years and are repaid either quarterly or semiannually.

(2) Amounts include minimum operating lease obligations for aircraft, airport facilities, and other leased

p

roperty. Amounts exclude contingent payments and aircraft maintenance deposit payments based on flight

hours or landings. Aircraft lease agreements are generally for fifteen years for B737 aircraft and for

eighteen to nineteen years for B717 aircraft.

(3) Amounts include payment commitments, including payment of pre-delivery deposits, for aircraft on firm

order. Payment commitments include the forecasted impact of contractual price escalations and directly

related costs.

(4) The table does not include payments to be made to third party aircraft maintenance contractors pursuant to

agreements whereby we pay such contractors based on aircraft flight hours or landings. The table does not

include liabilities to vendors, employees, and others classified as current liabilities on our December 31,

2009 consolidated balance sheet. Additionally, the above table does not include any obligations associated

with derivative financial instruments. As of December 31, 2009, we had recorded the following related to

derivative financial instruments: a $47.0 million current asset; a $14.8 million non-current asset; a $14.9

million current liability; and a $7.8 million non-current liability. Also, as of December 31, 2009, we had

p

rovided counterparties to derivative financial instruments with collateral aggregating $15.0 million.

A variety of assumptions are necessary in order to derive the information with respect to contractual

commitments described in the above table, including, but not limited to, the timing of the aircraft delivery dates.

Our actual obligations may differ from these estimates under different assumptions or conditions.