Airtran 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

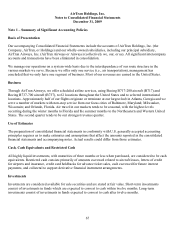

Note 2 – Commitments and Contingencies

Aircraft Related Commitments, Financing Arrangements and Transactions

In 2008, to respond to the challenges of a volatile fuel-cost environment, a recessionary macroeconomic

environment, and adverse capital market conditions, we recast our business plan to defer previously planned

growth. We reduced capacity, principally by deferring scheduled aircraft deliveries, and by selling B737

aircraft. In 2008, we entered into agreements to defer delivery dates for 37 B737 aircraft originally scheduled

for delivery between 2008 and 2012 to delivery dates between 2013 and 2016. During 2008, we sold two new

B737 aircraft (that we took delivery of and subsequently sold) and we also sold six used B737 aircraft in our

fleet. In 2008, we took delivery of eight aircraft, including the aforementioned two new aircraft that we sold in

2008.

We had four B737 aircraft scheduled for delivery during 2009. In 2009, we permitted The Boeing Company

(“Boeing”) to sell two of the B737 aircraft to a foreign airline and we were released from our obligation to

purchase such aircraft. During 2009, we took delivery of two B737 aircraft that we had previously agreed to sell

to another foreign airline. The foreign airline defaulted on its obligation to us to purchase the two aircraft. We

placed these aircraft in service in October 2009.

During 2009, we recognized net gains on the disposition of assets of $3.0 million, including: $2.4 million loss

for the write-off of capitalized interest related to our release of our obligation to purchase two B737 aircraft

which Boeing sold to a foreign airline, and, $6.6 million gain related to the deposits we previously received

from the counterparty who defaulted on its obligation to purchase two B737 aircraft. Gain on disposition of

assets for the year ended December 31, 2008, consisting primarily of gains on the sale of eight aircraft, was

$20.0 million.

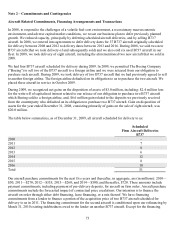

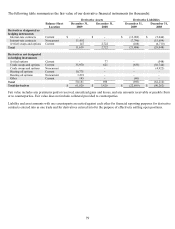

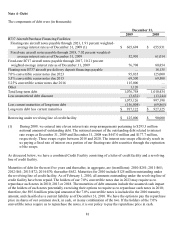

The table below summarizes, as of December 31, 2009, all aircraft scheduled for delivery to us:

Scheduled

Firm Aircraft Deliveries

B737

2010 -

2011 7

2012 8

2013 6

2014 12

2015 8

2016 10

Total 51

Our aircraft purchase commitments for the next five years and thereafter, in aggregate, are (in millions): 2010—

$50; 2011—$270; 2012—$335; 2013—$260; and 2014—$500; and thereafter, $720. These amounts include

payment commitments, including payment of pre-delivery deposits, for aircraft on firm order. Aircraft purchase

commitments include the forecasted impact of contractual price escalations. Our intention is to finance the

aircraft on order through either debt financing, lease financing, or a mix thereof. We have financing

commitments from a lender to finance a portion of the acquisition price of two B737 aircraft scheduled for

delivery to us in 2011. The financing commitment for the second aircraft is conditioned upon our refinancing by

March 31, 2010 existing indebtedness owed to the lender on another B737 aircraft. Except for the financing