Airtran 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

Year 2010 Cash Requirements and Potential Sources of Liquidity

Our 2010 cash flows will be impacted by a variety of factors including our operating results, payments of our

debt and capital lease obligations, and capital expenditure requirements. In addition, we may need cash

resources to fund increases in collateral provided to counterparties to our derivative financial instrument

arrangements and our cash flows may be adversely impacted in the event that one or more credit card

processors withholds amounts that would otherwise be remitted to us.

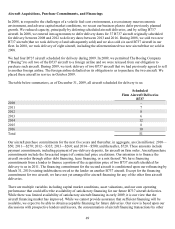

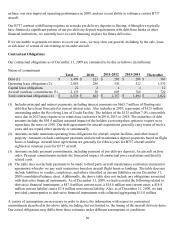

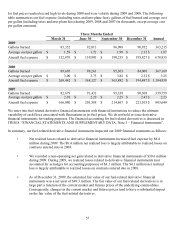

During 2010, we will need cash for capital expenditures and debt and capital lease obligations. Expenditures for

acquisition of property and equipment, other than aircraft and aircraft parts, are anticipated to be approximately

$20 million during 2010. Additionally, during 2010, we currently have scheduled payments of $50 million

related to aircraft purchase commitments. Payments of current maturities of existing debt and capital lease

obligations will aggregate $282.1 million during 2010, including payment of $125 million previously borrowed

under our revolving line of credit facility and which was repaid as of February 1, 2010. The maturities of debt

amount also includes the $95.8 million assumed effect of all holders of our 7.0% convertible notes exercising

their option to require us to repurchase the notes in 2010.

We may need cash resources to fund increases in collateral provided to counterparties to our derivative financial

arrangements and our cash flows may be adversely impacted in the event that one or more credit card

processors withholds amounts that would otherwise be remitted to us. We provide counterparties to our

derivative financial instrument arrangements with collateral when the fair value of our obligation exceeds

specified amounts. As of December 31, 2009, we provided counterparties with collateral aggregating $15.0

million.

Each agreement with our two largest credit card processors (based on volumes processed for us) was amended

in 2009 resulting in changes to contractual terms generally favorable to us. Our agreement with our largest

credit card processor now expires December 31, 2010. Each agreement with our two largest credit card

processors allows, under specified conditions, the processor to retain cash related to future travel that such

processor otherwise would remit to us (a holdback). As of December 31, 2009, we were in compliance with our

processing agreements and our two largest credit card processors were holding back no cash remittances from

us. Our potential cash exposure to holdbacks by our largest two credit card processors, based on advance ticket

sales as of December 31, 2009, was up to a maximum of $149.1 million (after considering the $50 million letter

of credit issued in favor of our largest credit card processor). Even had there been no letter of credit issued for

the benefit of our largest credit card processor, as of December 31, 2009, neither of our two largest credit card

processors would have been entitled to holdback any cash remittances from us. A decrease in our unrestricted

cash and investments could result in cash remittance amounts being held back by our largest credit card

processors. Should the largest processor be entitled in the future to withhold amounts that would otherwise be

remitted to us, we retain the contractual right to eliminate or reduce the amounts withheld by achieving

specified aggregate unrestricted cash and investment levels and / or by providing the processor with letters of

credit. While we may be subject to holdbacks in the future in accordance with the terms of our credit card

processing agreements, based on our current liquidity and current forecast, we do not expect that our two largest

credit card processors would be entitled to holdback cash amounts during 2010.

We believe we have options available to meet our debt repayment, capital expenditure needs, and operating

commitments; such options may include internally generated funds as well as various financing or leasing

options, including the sale, lease, or sublease of our aircraft or other assets. Additionally, we have a $125

million revolving line of credit facility, under which $125 million and zero borrowings were outstanding as of

December 31, 2009 and February 1, 2010, respectively. However, our future financing options may be limited

because our owned aircraft are pledged to the lenders that provided financing to acquire such aircraft, and we

have pledged, directly or indirectly, a significant portion of our owned assets, other than aircraft and engines, to