Airtran 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

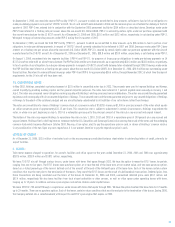

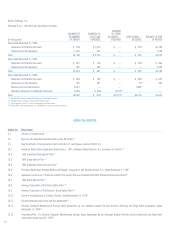

13. SUPPLEMENTAL CASH FLOW INFORMATION :

Supplemental cash flow information is summarized as follows, (in thousands):

Year ended December 31,

2006 2005 2004

Supplemental disclosure of cash flow activities :

Cash paid for interest, net of amounts capitalized $ 17,410 $11,038 $14,832

Cash paid (received) for income taxes, net of amounts refunded —(46) 107

Non-cash financing and investing activities:

Acquisition of equipment under capital leases —— 15,513

Aircraft acquisition debt financing 380,600 86,500 57,500

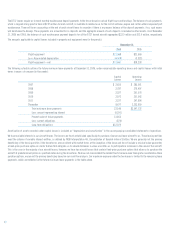

14. QUARTERLY FINANCIAL DATA (UNAUDITED) :

Summarized quarterly financial data for 2006 and 2005 is as follows (in thousands, except per share data):

March 31 June 30 September 30 December 31

2006

Operating revenue $416,042 $528,163 $487,269 $461,881

Operating income (loss) (11,256) 54,501 (3,579) 2,467

Net income (loss) (8,810) 31,958 (4,309) (3,325)

Earnings (loss) per common share:

Basic (0.10) 0.35 (0.05) (0.04)

Diluted (0.10) 0.32 (0.05) (0.04)

2005

Operating revenue $299,707 $366,323 $374,644 $409,870

Operating income (loss) (8,340) 23,604 3,420 4,806

Net income (loss) (7,295) 14,038 964 369

Earnings (loss) per common share:

Basic (0.08) 0.16 0.01 —

Diluted (0.08) 0.15 0.01 —

The results of the fourth quarter of 2005 include expense of $2.7 million, net of tax, related to an advertising barter transaction in which we exchanged flight credits

in our frequent flyer program for promotional consideration.

The results of the third quarter of 2006 include expense of $1.4 million, net of tax, related to a change in estimated volume of travel exchanged in connection with

the 2005 advertising barter transaction.

The results of the fourth quarter of 2006 include expense of $1.0 million, net of tax, related to a change in estimated volume of travel exchanged in connection with

the 2005 advertising barter transaction and a benefit of $1.9 million, net of tax, related to claim settlements.

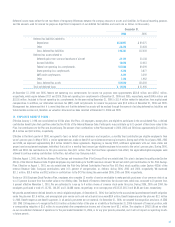

15. SUBSEQUENT EVENT—PROPOSED ACQUISITION OF MIDWEST AIR GROUP :

On January 11, 2007, we commenced an exchange offer for all of the outstanding shares of Midwest Air Group (Midwest), for $13.25 per Midwest share, based on

the closing price of our common stock on January 8, 2007. The offer consists of $6.625 in cash and 0.5884 share of AirTran common stock for each Midwest share.

The total equity value of the exchange offer was approximately $345 million at such date. The offer, which is being made through a wholly-owned subsidiary of the

Company, has been extended and is scheduled to expire on March 8, 2007. The exchange offer is subject to customary conditions. On January 25, 2007, the board of

directors of Midwest announced that it had unanimously recommended that Midwest’s shareholders reject our offer to acquire all outstanding shares of Midwest and

not tender their shares to us. Because we believe a combination of the two airlines would strengthen both airlines we are continuing to pursue the acquisition of

Midwest. We anticipate funding the cash portion of the purchase price with the proceeds from $150 million in senior secured financing under a proposed credit facility.

48