Airtran 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

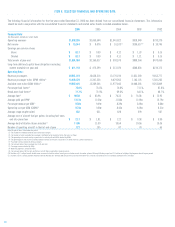

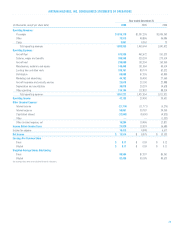

LIQUIDITY AND CAPITAL RESOURCES :

At December 31, 2006 we had total cash, cash equivalents and short-term investments of $310.2 million, which is a decrease of $60.4 million compared to

December 31, 2005. Short-term investments represent auction rate securities with reset periods less than 12 months. As of December 31, 2006 we also had

$24.8 million of restricted cash. Our primary sources of cash are from operating activities and primary uses of cash are for investing and financing activities.

Operating activities

in 2006 provided $75.1 million of cash flow compared to $64.6 million in 2005. Cash flow from operating activities is related to both the level

of our profitability and to changes in working capital and other assets and liabilities. Operating cash inflows are largely attributable to revenues derived from the

transportation of passengers. Operating cash outflows are largely attributable to recurring expenditures for fuel, labor, aircraft rent, aircraft maintenance,

marketing and other activities. For the year ended December 31, 2006, we reported net income of $15.5 million, which was $7.4 million greater than net income for

the year ended December 31, 2005. The increased net income favorably impacted cash provided by operating activities.

Changes in the components of our working capital also impact cash flow from operating activities. Changes in the air traffic liability balance and the related

accounts receivable balance have had a significant impact on our net cash flow from operating activities. We have a liability to provide future air travel because

travelers tend to purchase air transportation in advance of their intended travel date. Advanced ticket sales, which are recorded in air traffic liability, provide cash

as the Company grows and consequently receives additional cash for future travel. During 2006, our air traffic liability balance increased $29 million more than

the related accounts receivable balance increased contributing to net cash provided by operating activities. During 2005, our air traffic liability balance increased

$24 million more than the related accounts receivable balance increased, contributing to net cash flow from operating activities. Changes in accounts payable,

accrued and other current and non-current liabilities also have had a significant impact on our cash flow from operating activities. During 2006, the $30.4 million

increase in accounts payable and accrued and other liabilities contributed favorably to net cash provided by operating activities. Accounts payable and accrued

and other liabilities increased in 2006 due to increases in accrued employee wages and benefits, accrued B737 aircraft rent, accrued interest, liabilities to

governmental authorities for taxes and fees that we collected on their behalf and various other liabilities. During 2005, the $49.7 million increase in accounts

payable and accrued and other liabilities contributed favorably to net cash provided by operating activities.

We used cash to increase other assets. Other assets include aircraft maintenance and other deposits, prepaid insurance and prepaid distribution costs. Our B737

aircraft leases require us to remit aircraft maintenance deposits monthly to the lessor based on actual flight hours and landings. The balances of such aircraft

maintenance deposits are available to reimburse us for certain costs of maintaining airframes, engines and certain other component parts. These payments are

accounted for as deposits and the aggregate amount of such deposits is included in other assets. During 2006 and 2005, the balance of all aircraft maintenance

deposits increased by $21.0 million and $11.1 million, respectively, reducing our cash flow provided by operating activities in each of those years.

Investing activities

in 2006 used $251.5 million in cash compared to the $80.2 million used in 2005. Purchases and sales of available for sale securities are

classified as investing activities. During 2006, purchases of available for sale securities exceeded sales of available for sale securities by $151.0 million. During

2005, sales of available for sale securities exceeded purchases of available for sale securities by $26.9 million. Investing activities also include expenditures for

aircraft deposits and the purchase of aircraft and other property and equipment.

Aircraft purchase contracts typically require that the purchaser make pre-delivery deposits to the manufacturer. These deposits are refunded at the time of aircraft

delivery. We may invest a portion or all of this deposit in the aircraft. During 2006, we received $102.8 million in previously paid aircraft deposits while paying

$89.2 million in new aircraft deposits. During 2005, we received $29.8 million in previously paid aircraft deposits while paying $93.5 million in new aircraft

deposits. During 2006, we purchased 13 B737 aircraft. We expended $68.6 million in cash and incurred $380.6 million of debt related to acquiring aircraft. During

2005, we purchased three B737 aircraft. We expended $11.7 million in cash and incurred $86.5 million of debt related to the acquisition of these aircraft.

During 2006, we expended $50.6 million in cash for the acquisition of other property and equipment. Acquisitions of other property and equipment included

purchases of rotable spare parts, additions to leasehold improvements and the purchase of ground and computer equipment. During 2005, we expended

$23.7 million in cash for the acquisition of other property and equipment.

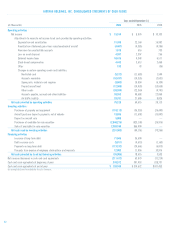

Financing activities

used $35.1 million of cash during 2006 compared to providing cash of $78.6 million in 2005. During 2006, we received cash from the issuance

of debt financing for aircraft pre-delivery deposits of $71.0 million and repaid $87.8 million of pre-delivery deposit debt financing. During 2006, we repaid

$24.5 million of aircraft purchase debt financing. Also, during 2006, we borrowed $380.6 million in non-cash transactions to finance the purchase of 13 B737

aircraft. During 2005, we received cash from the issuance of debt financing for aircraft pre-delivery deposits of $96.7 million and repaid $9.7 million of pre-delivery

deposit debt financing. During 2005, we received $86.5 million aircraft purchase debt financing while repaying $14.1 million of aircraft purchase debt financing.

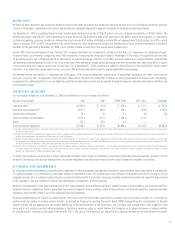

See Note 5 to Consolidated Financial Statements for additional information regarding our outstanding debt.

During 2006 and 2005, we received $7.5 million and $11.1 million, respectively, from the exercise of employee options for the purchase of common stock. On April

6, 2006, 55,468 warrants were exercised for the purchase of our common stock. Each warrant entitled the purchaser to 18.0289 shares of common stock for a total

of 1,000,024 shares at $4.51 per share. Total cash proceeds from aforementioned transaction amounted to approximately $4.5 million.

PROPOSED ACQUISITION OF MIDWEST AIR GROUP :

On January 11, 2007, we commenced an exchange offer for all of the outstanding shares of Midwest Air Group (Midwest), for $13.25 per Midwest share, based on

the closing price of our common stock on January 8, 2007. The offer consists of $6.625 in cash and 0.5884 share of AirTran common stock for each Midwest share.

Accordingly, total equity value of the exchange offer is approximately $345 million. The offer, which is being made through a wholly owned subsidiary of the

Company, has been extended and is scheduled to expire on March 8, 2007. The exchange offer is subject to specified and customary conditions. On January 25,

2007, the board of directors of Midwest announced that it had recommended that Midwest’s shareholders reject our offer to acquire all outstanding shares of

23