Airtran 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Midwest and not tender their shares to us. Because we believe a combination of the two airlines would strengthen both airlines we are continuing to pursue the

acquisition of Midwest. We have filed a registration statement (Form S-4 No. 333-139917) with the Securities and Exchange Commission which contains additional

information regarding the exchange offer and the benefits and risks related to the proposed acquisition.

We anticipate funding the cash portion of the purchase price with the proceeds from $150 million in senior secured financing under a proposed credit facility. It is

expected that this floating rate term loan facility would be payable in equal quarterly installments, aggregating 1% of the original principal balance in each of years

one through four and the remainder of the principal balance paid at the end of year five. Certain of the terms of the proposed credit facility have not been finalized.

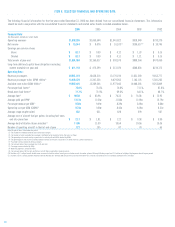

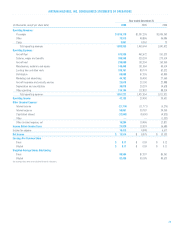

AIRCRAFT ACQUISITIONS AND AIRCRAFT PURCHASE COMMITMENTS :

During 2006, we took delivery of two B717 and 20 B737 aircraft of which the two B717 and seven B737 were held under operating leases. The additional 13 B737

aircraft deliveries in 2006 were purchased and financed with debt. During 2005, we took delivery of six B717 and 12 B737 aircraft of which six B717 and nine B737

aircraft were held under operating leases. The additional three B737 aircraft deliveries in 2005 were financed with debt.

As of December 31, 2006, we had 60 Boeing 737 aircraft on order scheduled to be delivered in the year indicated below:

Firm Aircraft Deliveries

B737

2007 12

2008 15

2009 18

2010 14

2011 1

Total 60

The above table includes two B737 aircraft scheduled for delivery in the second quarter 2007 which we have agreed to sell to an airline which operates outside of

the United States.

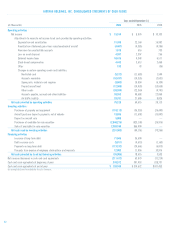

Aircraft purchase contracts typically require the purchaser to make pre-delivery deposits to the manufacturer. We have arranged pre-delivery deposit financing

for all of our pre-delivery deposit requirements for aircraft scheduled to be delivered in 2007 and 2008. The pre-delivery deposit financing typically funds between

75 percent and 100 percent of our pre-delivery deposit obligation for any given aircraft. We expect to arrange pre-delivery deposit financing for the remainder of

our scheduled aircraft deliveries.

Of the 60 B737 aircraft we have on order, we have secured debt financing for 10 B737 aircraft scheduled for delivery in 2007 and for five of the aircraft which are

scheduled to be delivered in 2008. Such debt financing funds approximately 85 percent of the total cost of the aircraft. While our intention is to finance the

remainder of the aircraft on order via a combination of debt and lease financings, we have not yet arranged for such financing. Additionally, we have sale/leaseback

commitments from an aircraft leasing company with respect to six spare engines to be delivered through 2010. During 2006, we entered into a sales/leaseback

agreement related to one of these spare engines.

LETTERS OF CREDIT :

As of December 31, 2006, $13.5 million of restricted cash on the accompanying consolidated balance sheet relates to outstanding letters of credit, primarily for

airport facilities.

OTHER YEAR 2007 CASH REQUIREMENTS :

During 2007, in addition to funding the committed aircraft acquisitions discussed above, we will need cash for non-aircraft capital expenditures and debt

maturities. Non-aircraft capital expenditures are projected to be approximately $35 million. Scheduled 2007 debt and capital lease maturities aggregate

$86.8 million. It is anticipated that non-aircraft capital expenditures and 2007 debt and capital lease maturities will be funded with cash flow from operations,

other financings and the use of existing cash resources.

OTHER SOURCES OF LIQUIDITY :

We have various options available to meet our debt repayments, capital expenditures and operating commitments including internally generated funds and various

borrowing or leasing options. Additionally, we have an outstanding shelf registration which it may utilize to raise funds for aircraft financings or other purposes in

the future. However, we have no unused lines of credit available and our owned aircraft and our pre-delivery deposits are pledged as collateral for outstanding debt.

There can be no assurance that financing will be available for all B737 aircraft deliveries or for other capital expenditures not covered by firm financing

commitments. Should fuel prices remain high and if we are unable to generate revenues to cover our costs, we may slow our growth, including through the

rescheduling of aircraft deliveries or through the sale, lease or sublease of some of our aircraft.

24