Airtran 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

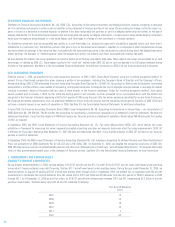

DERIVATIVE FINANCIAL INSTRUMENTS :

Statement of Financial Accounting Standards No. 133 (SFAS 133),

Accounting for Derivative Instruments and Hedging Activities

, requires companies to recognize

all of its derivative instruments as either assets or liabilities in the statement of financial position at fair value. The accounting for changes in the fair value (i.e.,

gains or losses) of a derivative instrument depends on whether it has been designated and qualifies as part of a hedging relationship and further, on the type of

hedging relationship. For those derivative instruments that are designated and qualify as hedging instruments, a company must designate the hedging instrument,

based upon the exposure being hedged, as a fair value hedge, cash flow hedge or a hedge of a net investment in a foreign operation.

For derivative instruments that are designated and qualify as a cash flow hedge (i.e., hedging the exposure to variability in expected future cash flows that is

attributable to a particular risk), the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive income

and reclassified into earnings in the same line item associated with the forecasted transaction in the same period or periods during which the hedged transaction

affects earnings (for example, in “interest expense” when the hedged transactions are interest cash flows associated with floating-rate debt).

We have entered into interest rate swap agreements to convert a portion of our floating-rate debt to fixed-rates. These interest rate swaps are accounted for as cash

flow hedges, as defined by SFAS 133. These hedges qualify for the “short-cut” method under SFAS 133 and as such are deemed to be 100 percent effective during

the term of the agreements. See Note 3 to the Consolidated Financial Statements for additional information on SFAS 133 and financial derivative instruments.

NEW ACCOUNTING STANDARDS :

Effective January 1, 2006, we adopted the fair value recognition provisions of SFAS 123(R),

Share-Based Payment

, using the “modified prospective method” to

account for our stock-based compensation plans covering a portion of our employees, including the Company’s Board of Directors and the Company’s officers.

Among other things SFAS 123(R) eliminated the use of Accounting Principles Board Opinion No. 25 (APB 25),

Accounting for Stock Issued to Employees

, and related

interpretations, and the intrinsic value method of accounting, and required companies to recognize the cost of employee services received in exchange for awards

of equity instruments, based on the grant date fair value of those awards, in the financial statements. Under the “modified prospective method,” stock option

awards granted prior to January 1, 2006, but for which the vesting period is not complete, must be accounted for on a prospective basis with the related cost

recognized in the financial statements beginning with the first quarter of 2006 using the grant date fair values previously calculated for our pro forma disclosures.

We recognize the related compensation costs not previously reflected in the pro forma disclosures over the remaining vesting period. Adoption of SFAS 123(R) did

not have a material impact on our results of operations in 2006. See Note 9 to the Consolidated Financial Statements for additional information.

In June 2006, the Financial Accounting Standards Board (FASB) issued Interpretation No. 48,

Accounting for Uncertainty in Income Taxes—An interpretation of

FASB Statement No. 109

(FIN 48). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements. We have not

determined the effects, if any, that the adoption of FIN 48 will have on our financial position or statement of operations. We will adopt FIN 48 during the first quarter

of 2007, as required.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157,

Fair Value Measurements

(SFAS 157), which defines fair value,

establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. SFAS 157

is effective for fiscal years beginning after November 15, 2007. We have not determined the effect, if any, that the adoption of SFAS 157 will have on our financial

position or results of operations.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158,

Employers Accounting for Defined Pensions and Other Postretirement

Plans (an amendment of FASB Statements No. 87, 88, 106 and 123R,

(SFAS 158). On December 31, 2006, we adopted the recognition provisions of SFAS 158.

SFAS 158 requires plan sponsors of defined benefit pensions and other post-retirement plans (collectively, “post-retirement benefit plans”) to recognize the funded

status of their postretirement benefit plans in the statement of financial position. See Note 12 to the Consolidated Financial Statements for more information.

2. COMMITMENTS AND CONTINGENCIES :

AIRCRAFT PURCHASE COMMITMENTS :

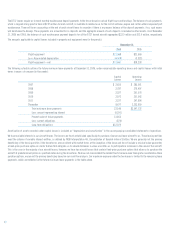

During the year ended December 31, 2006, we took delivery of 20 B737 aircraft and two B717 aircraft. Of the 20 B737 aircraft, seven were leased under operating

leases while 13 were purchased using debt financing. The two B717 aircraft were leased under operating leases. During the year ended December 31, 2006, we

exercised options to acquire 24 additional B737 aircraft with delivery dates through 2010. In September 2006, we entered into an agreement with the aircraft

manufacturer to reschedule five aircraft deliveries from the second half of 2007 and three aircraft deliveries from the first quarter of 2008 to deliveries in 2009

through 2011. As of December 31, 2006 we had firm orders for 60 B737 aircraft with delivery dates between 2007 and 2011 representing $2.2 billion in aircraft

purchase commitments. The table below sets forth all aircraft scheduled for delivery:

Firm Aircraft Deliveries

B737

2007 12

2008 15

2009 18

2010 14

2011 1

Total 60

36