Airtran 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We entered into the second permanent facility (included in fixed rate aircraft notes above) in September 2004, pursuant to which we financed the acquisition of

three additional B737 aircraft. We took delivery of the aircraft in September 2004, June 2005 and January 2006, respectively. In conjunction with the financing of

these B737 aircraft, we issued equipment notes as aircraft were delivered for an aggregate amount of $85.5 million, which are scheduled to mature between

September 2016 and January 2018. The notes bore interest at a floating rate per annum above the six-month U.S. Dollar LIBOR in effect at the commencement

of each semi-annual period, and payments of principal and interest under the notes are payable semi-annually. During April 2006, we exercised the fixed rate

option on these three floating rate aircraft notes. The notes bear interest at an average fixed rate of 7.02 percent. At December 31, 2006 and 2005, $76 million

and $53 million were outstanding, respectively. Each note is secured by a first mortgage on the aircraft to which it relates. As of December 31, 2005, amounts

outstanding were included in the floating rate aircraft notes payable above as the interest rates were not fixed until 2006.

We entered into the third permanent facility (included in floating rate aircraft notes above) in September 2005, pursuant to which we are entitled to borrow up to

$354 million for purposes of acquiring 12 B737 aircraft currently scheduled to be delivered to us in 2006 and 2007 and satisfying our repayment obligations under

a related pre-delivery payment financing facility, which is described in more detail below. We took delivery of 11 aircraft in May 2006, June 2006, July 2006,

September 2006, October 2006, November 2006, December 2006 and February 2007, respectively. In conjunction with the financing of these aircraft, we issued

equipment notes as aircraft were delivered for an aggregate amount of $324 million, which are scheduled to mature through 2019. The notes bear interest at a

floating rate per annum above the three-month U.S. Dollar LIBOR in effect at the commencement of each quarterly period, and payments of principle and interest

under the notes are payable quarterly. At December 31, 2006, $291 million was outstanding thereunder. Each note is secured by a first mortgage on the aircraft to

which it relates. As of December 31, 2006, we had $59 million available under the facility.

On February 14, 2006, we entered into a fourth permanent facility (included in floating rate aircraft notes above), pursuant to which we financed the acquisition

of two B737 aircraft. We took delivery of the two B737 aircraft in February 2006 and March 2006, respectively. In conjunction with the financing of these B737

aircraft, we issued equipment notes as aircraft were delivered for an aggregate amount of $58.0 million, which are scheduled to mature between February 2018

and March 2018. The equipment notes bear interest at a floating rate per annum above the six-month LIBOR in effect at the commencement of each semi-annual

period, and payments of principal and interest under the notes are payable semi-annually. At December 31, 2006, $57 million was outstanding thereunder. Each

note is secured by a first mortgage on the aircraft to which it relates.

On August 31, 2006, we entered into a fifth permanent facility (included in floating rate aircraft notes above), pursuant to which we intend to finance the acquisition

of five additional B737 aircraft. The five B737 aircraft are scheduled to be delivered in 2007 and 2008. In conjunction with the financing of these B737 aircraft,

we will issue equipment notes as aircraft are delivered. The notes will likely bear interest at a floating rate per annum above the three-month LIBOR; however, we

have the ability to fix the rate on the date such notes are issued. Interest and principle payments will be payable quarterly.

On December 8, 2006, we entered into a sixth permanent facility (included in floating rate aircraft notes above), pursuant to which we intend to finance the

acquisition of two additional B737 aircraft. The two B737 aircraft are scheduled to be delivered in 2007. In conjunction with the financing of these B737 aircraft,

we will issue equipment notes as aircraft are delivered. The notes will likely bear interest at a floating rate per annum above the three-month LIBOR. Interest and

principle payments will be payable quarterly. Additionally, we have an option to enter into financing with the lender for two additional B737 aircraft with delivery

dates in 2008. We have not exercised this option.

On February 12, 2007, we entered into a seventh permanent facility, pursuant to which we intend to finance the acquisition of six additional B737 aircraft. Three

of the B737 aircraft are scheduled to be delivered in 2007 with the remaining three to be delivered in 2008. In conjunction with the financing of the aircraft, we

will issue equipment notes as aircraft are delivered. The notes will likely bear interest at a floating rate per annum above the six-month LIBOR. Interest and principle

will be payable semi-annually. We took delivery of the first B737 aircraft in February 2007. In conjunction with the financing of these aircraft, we issued an

equipment note as the aircraft was delivered for $29 million, which is scheduled to mature in 2019.

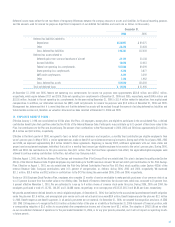

AIRCRAFT NOTES PAYABLE :

We completed a private placement of $178.9 million enhanced equipment trust certificates (EETCs) in 1999. The EETC proceeds were used to replace loans for the

purchase of the first 10 B717 aircraft delivered, and all 10 aircraft were pledged as collateral for the EETCs. In March 2000, we sold and leased back two of the

B717s in a leveraged lease transaction reducing the outstanding principal amount of the EETCs by $35.9 million. Principal and interest payments on the EETCs

are due semi-annually through April 2017.

FLOATING RATE AIRCRAFT PRE-DELIVERY DEPOSIT FINANCING :

Through December 31, 2006, we have entered into five separate facilities (each a “PDP facility”) for purposes of financing our obligations to make pre-delivery

payments in respect of B737 aircraft on order with the aircraft manufacturer.

During May 2005, we closed the first PDP facility (“PDP-1”), pursuant to which we were entitled to draw an amount equal to $19.6 million to fund a portion of our

obligations to make pre-delivery payments in respect of six B737 aircraft delivered through March 2006. Drawings made under PDP-1 bore interest at a floating

rate per annum above the one-month U.S. Dollar LIBOR. PDP-1 was secured by certain rights under our purchase agreement with the aircraft manufacturer for the

six B737 aircraft. As of December 31, 2005, PDP-1 was fully drawn and $9.9 million was outstanding thereunder. All outstanding amounts related to PDP-1 were

repaid in March 2006.

40