Airtran 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

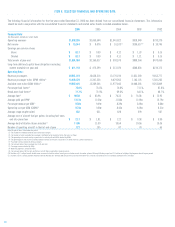

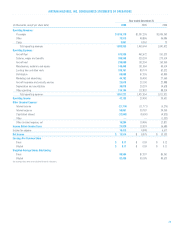

OPERATING EXPENSES :

Our operating expenses for the year ended December 31, 2005 increased $415.1 million (41.0 percent), or 9.8 percent on a cost per ASM basis. Our financial results

were significantly affected by changes in the price of fuel. During 2005, we experienced high aircraft fuel prices driven by sharp increases in the cost of crude oil

and disruptions to the Gulf Coast refineries as a result of hurricanes.

In general, our operating expenses are significantly affected by changes in our capacity, as measured by ASMs. The following table presents our unit costs, defined

as operating expenses per ASM, for the indicated periods:

Year ended Percent

December 31, Increase

2005 2004 (Decrease)

Aircraft fuel 3.01¢ 2.10¢ 43.3%

Salaries, wages and benefits 2.14 2.28 (6.1)

Aircraft rent 1.25 1.26 (0.8)

Maintenance, materials and repairs 0.66 0.58 13.8

Landing fees and other rents 0.53 0.52 1.9

Distribution 0.44 0.42 4.8

Marketing and advertising 0.24 0.23 4.3

Aircraft insurance and security services 0.15 0.19 (21.1)

Depreciation 0.13 0.12 8.3

Other operating 0.73 0.75 (2.7)

Total CASM 9.28¢ 8.45¢ 9.8%

Aircraft fuel

increased 43.3 percent on a cost per ASM basis, primarily due to escalating fuel prices. Our fuel price per gallon, including all fees and taxes, increased

48.3 percent from $1.22 for the year ended December 31, 2004 to $1.81 for the year ended December 31, 2005. The level of our flight operations, as measured by

block hours flown, increased 23.3 percent while our fuel consumption per block hour increased slightly 0.6 percent to 667 gallons.

Salaries, wages and benefits

decreased 6.1 percent on a cost per ASM basis, primarily due to gains in productivity driven by the increased number of aircraft and

higher daily utilization. We employed approximately 6,700 full-time equivalent employees, as of December 31, 2005, representing a 13.5 percent increase over the

comparative period in 2004.

Maintenance, materials and repairs

increased 13.8 percent on a cost per ASM basis. On a cost per block hour basis, maintenance materials and repairs expense

increased 18.8 percent to $266 per block hour due to the expiration of warranties on the B717 aircraft and an increase in airframe checks. As the original

manufacturer warranties expire on our B717 and B737 aircraft, the maintenance, repair and overhaul of aircraft engines and a significant number of aircraft

systems become covered by maintenance agreements with FAA-approved contractors.

Aircraft insurance and security services

decreased 21.1 percent on a cost per ASM basis. While the addition of 18 new Boeing aircraft to our fleet during the year

ended December 31, 2005 increased our total insured hull value and related insurance premiums, the decrease on a cost per ASM basis is primarily due to a

reduction in hull and liability insurance rates and security costs for our 2005 fleet coverage.

Depreciation

increased 8.3 percent on a cost per ASM basis, primarily due to the addition of three owned B737 for the year ended December 31, 2005, as well as

the purchase of spare aircraft parts for the new B737 fleet. With the exception of these three B737s, all aircraft additions during the year were lease financed rather

than purchased.

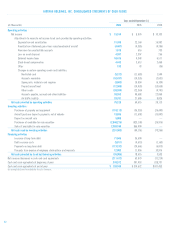

NONOPERATING (INCOME) EXPENSE :

Other (income) expense, net

decreased by $2.4 million (18.4 percent). Increases in rates earned on cash and higher investment balances increased interest income

by $6.5 million. Interest expense, including amortization of debt issuance costs, increased by $6.4 million primarily due to the issuance of new debt relating to new

aircraft financing during the year ended December 31, 2005. Capitalized interest represents the interest cost associated with financing deposits for future aircraft

deliveries. Capitalized interest increased $3.6 million due to an increase in outstanding deposits for future aircraft deliveries in 2005 compared to 2004.

Additionally, $1.3 million of other income is included in our 2004 results relating a break-up fee paid to us in connection with our unsuccessful bid for certain

leased gates and other assets of another airline at Chicago’s Midway airport.

INCOME TAX EXPENSE :

Our effective income tax rate was 38.0 percent and 39.4 percent for the years ended December 31, 2005 and 2004, respectively. Our tax expense for the year ended

December 31, 2005 includes a one-time benefit of $1.7 million resulting from an adjustment to our deferred tax liabilities for a decrease in our state effective rate.

22