Airtran 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

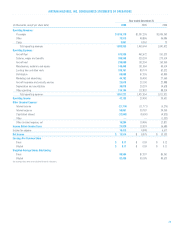

INCOME TAXES :

We have not been required to pay significant federal or state income taxes during the prior three years because we have had a loss for federal income tax purposes

in each of those years, largely because tax basis depreciation has exceeded depreciation expense calculated for financial accounting purposes.

Our December 31, 2006 consolidated balance sheet includes gross deferred tax assets of $163.8 million and gross deferred tax liabilities of $149.2 million. The

deferred tax assets include $107.1 million pertaining to the tax effect of $318.8 million of federal net operating losses (NOLs) previously recognized as a tax benefit

for financial reporting purposes. In addition, deferred tax assets include $5.3 million attributable to state NOLs of approximately $134.6 million. Such NOLs, which

expire in the years 2017 to 2026, are available to be carried forward to offset future taxable income and thereby reduce future income tax payments. Included in

the NOLs for the year ending December 31, 2006 is $11.4 million related to deductions from equity based compensation.

Section 382 of the Internal Revenue Code (“Section 382”) imposes limitations on a corporation’s ability to utilize NOLs if it experiences an “ownership change.”

In general terms, an ownership change may result from transactions increasing the ownership of certain stockholders in the stock of a corporation by more than

50 percentage points over a three-year period. In the event of an ownership change, utilization of our NOLs would be subject to an annual limitation under Section

382 determined by multiplying the value of our stock at the time of the ownership change by the applicable long-term tax exempt rate. Any unused NOLs in excess

of the annual limitation may be carried over to later years. As of December 31, 2006, we were not subject to the limitations under Section 382. Under current

conditions, if an ownership change were to occur, our annual NOL utilization would be limited to approximately $48 million per year.

Our deferred income tax liability is in large part due to the excess of the financial statement carrying value of owned flight equipment and other assets over the

tax bases of such assets. Consequently, future tax basis depreciation will tend to be lower than financial accounting depreciation for these assets. Accordingly,

management has determined that it is more likely than not that the deferred tax assets will be realized through the reversal of existing deferred tax liabilities and

future taxable income.

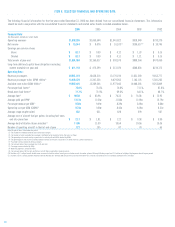

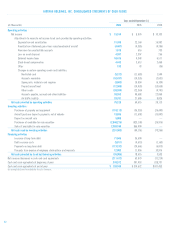

CONTRACTUAL OBLIGATIONS :

Our contractual obligations as of December 31, 2006 are estimated to be due as follows (in millions):

Nature of commitment Total 2007 2008–2009 2010–2011 Thereafter

Long-term debt(1) $1,269.3 $ 143.8 $ 203.4 $ 167.7 $ 754.4

Operating lease obligations(2) 3,547.1 285.6 538.1 499.4 2,224.0

Capital lease obligations 23.1 2.7 5.7 6.3 8.4

Aircraft purchase commitments(3) 2,072.9 457.7 1,143.9 471.3 —

Other(4) 131.7 128.7 3.0 — —

Total contractual obligations $7,044.1 $1,018.5 $1,894.1 $1,144.7 $2,986.8

(1) Includes related interest payments, forecasted at the current interest rates, on the aforementioned debt of approximately $472.0 million. Debt agreements generally carry terms of twelve years and are repaid either

quarterly or semiannually.

(2) Amounts include minimum operating leases obligations for aircraft, airport facilities and other leased property. Amounts exclude contingent rentals and aircraft maintenance deposit payments based on flight hours or

landings. Lease agreements are generally for fifteen years on aircraft obligations.

(3) Amounts include payment commitments, including payment of pre-delivery deposits, for aircraft on firm order. Payment commitments include the forecasted impact of contractual price escalations. As noted under

Aircraft Acquisitions and Aircraft Purchase Commitments, we have arranged pre-delivery deposit financing for 2007 and 2008 deliveries and have also arranged debt financing for 10 aircraft to be delivered in 2007

and for five aircraft to be delivered in 2008. The above table does not reflect the effects of such financings.

(4) Amounts include fuel purchase commitments, our sponsorship of the Georgia Aquarium and other contractual commitments. The table does not include payments to be made to third-party aircraft maintenance

contractors pursuant to agreements whereby we pay such contractors based on aircraft flight hours or landings. The table does not include liabilities to vendors, employees and others classified as current

liabilities on our December 31, 2006 consolidated balance sheet.

A variety of assumptions are necessary in order to derive the information with respect to contractual commitments described in the above table, including, but not

limited to, the timing of the aircraft delivery dates. Our actual obligations may differ from these estimates under different assumptions or conditions.

OFF-BALANCE SHEET ARRANGEMENTS :

An off-balance sheet arrangement is any transaction, agreement or other contractual arrangement involving an unconsolidated entity under which a company has

(1) made guarantees, (2) a retained or a contingent interest in transferred assets, (3) an obligation under derivative instruments classified as equity or (4) any

obligation arising out of a material variable interest in an unconsolidated entity that provides financing, liquidity, market risk or credit risk support to the company,

or that engages in leasing, hedging or research and development arrangements with the company.

We have no arrangements of the types described in the first three categories that we believe may have a material current or future affect on our financial condition,

liquidity or results of operations. Certain guarantees that we do not expect to have a material current or future effect on our financial condition, liquidity or resulted

operations are disclosed in Note 2 to our Consolidated Financial Statements.

We have variable interests in many of our aircraft leases. The lessors are trusts established specifically to purchase, finance and lease aircraft to us. These leasing

entities meet the criteria of variable interest entities, as defined by Financial Accounting Standards Board (FASB) Interpretation 46,

Consolidation of Variable

Interest Entities

. We are generally not the primary beneficiary of the leasing entities if the lease terms are consistent with market terms at the inception of the

lease and do not include a residual value guarantee, a fixed-price purchase option or similar feature that obligates us to absorb decreases in value or entitles

us to participate in increases in the value of the aircraft. This is the case in the majority of our aircraft leases; however, we have two aircraft leases that contain

25