Airtran 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

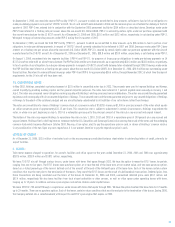

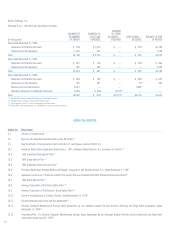

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes

and the amounts used for income tax purposes. Significant components of our deferred tax liabilities and assets are as follows (in thousands):

December 31,

2006 2005

Deferred tax liabilities related to:

Depreciation $120,957 $ 89,375

Other 28,244 23,028

Gross deferred tax liabilities 149,201 112,403

Deferred tax assets related to:

Deferred gains from sale and leaseback of aircraft 22,142 23,138

Accrued liabilities 18,838 12,681

Federal net operating loss carryforwards 107,083 89,399

State operating loss carryforwards 5,336 3,877

AMT credit carryforwards 3,292 3,292

Other 7,138 1,962

Gross deferred tax assets 163,829 134,349

Total net deferred taxes $ 14,628 $ 21,946

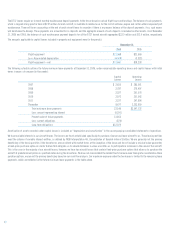

At December 31, 2006 and 2005, federal net operating loss carryforwards for income tax purposes were approximately $318.8 million and $256.7 million,

respectively, which expire between 2017 and 2026. State net operating loss carryforwards at December 31, 2006 and 2005, respectively, were $134.6 million and

$153.6 million. Included in the net operating loss carryforwards for the year ending December 31, 2006 is $11.4 million related to deductions from equity based

compensation. In addition, our alternative minimum tax (AMT) credit carryforwards for income tax purposes were $3.3 million at December 31, 2006 and 2005.

Management has determined that it is more likely than not that the deferred tax assets will be realized through the reversal of existing deferred tax liabilities and

future taxable income and, therefore, no valuation allowance has been recorded at December 31, 2006 and 2005.

12. EMPLOYEE BENEFIT PLANS :

Effective January 1, 1998, we consolidated our 401(k) plans (the Plan). All employees, except pilots, are eligible to participate in the consolidated Plan, a defined

contribution benefit plan that qualifies under Section 401(k) of the Internal Revenue Code. Participants may contribute up to 15 percent of their base salary to the

Plan. Our contributions to the Plan are discretionary. The amount of our contributions to the Plan expensed in 2006, 2005 and 2004 was approximately $1.0 million,

$0.6 million and $0.3 million, respectively.

Effective in the third quarter of 2000, we agreed to fund, on behalf of our mechanics and inspectors, a monthly fixed contribution per eligible employee to their

union’s pension plan. In May of 2001, a similar agreement was made on behalf of our maintenance training instructors. During each of the fiscal years 2006, 2005

and 2004, we expensed approximately $0.4 million related to these agreements. Beginning in January 2002, additional agreements with our stores clerks and

ground service equipment employees took effect that call for a monthly fixed amount per eligible employee to be made to the union’s pension plan. During 2006,

2005 and 2004, the contributions to this plan were less than $0.1 million. From the time these agreements took effect, the applicable eligible employees were

allowed to continue making contributions to the Plan, but without any Company match.

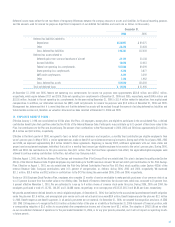

Effective August 1, 2001, the AirTran Airways Pilot Savings and Investment Plan (Pilot Savings Plan) was established. This plan is designed to qualify under Section

401(k) of the Internal Revenue Code. Eligible employees may contribute up to the IRS maximum allowed. We will not match pilot contributions to this Pilot Savings

Plan. Effective on August 1, 2001, we also established the Pilot-Only Defined Contribution Pension Plan (DC Plan) which qualifies under Section 403(b) of the

Internal Revenue Code. Company contributions were 10.5 percent of compensation, as defined, during 2006, 2005 and 2006, respectively. We expensed

$11.1 million, $10.0 million and $8.2 million in contributions to the DC Plan during the years ended 2006, 2005 and 2004, respectively.

Under our 1995 Employee Stock Purchase Plan, employees who complete 12 months of service are eligible to make periodic purchases of our common stock at up

to a 15 percent discount from the market value on the offering date. The Board of Directors determines the discount rate, which was increased to 10 percent from

5 percent effective November 1, 2001. We are authorized to issue up to 4 million shares of common stock under this plan. During 2006, 2005 and 2004, the

employees purchased a total of 113,765, 144,597 and 116,488 shares, respectively, at an average price of $12.32, $9.13 and $9.84 per share, respectively.

We provide postretirement defined benefits to certain eligible employees. At December 31, 2006, the liability for the accumulated postretirement benefit obligation

under the plan was $11.6 million, and unrecognized prior service costs and net actuarial losses were $8.4 million. Benefit expense under the plan was $2.1 million

in 2006. Benefit expense and benefit payments in all periods presented are not material. On December 31, 2006, we adopted the recognition provisions of SFAS

158. SFAS 158 requires us to recognize the $11.6 million unfunded status of the plan as a liability in the December 31, 2006 statement of financial position, with

a corresponding reduction of $5.3 million to accumulated other comprehensive income, net of income tax of $3.1 million. The adoption of SFAS 158 had no effect

on our consolidated statement of operations for the year ended December 31, 2006, or for any prior periods presented, and it will not impact our operating results

in future periods.

47