Airtran 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

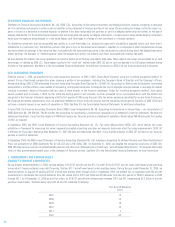

The following table summarizes information at December 31, 2006 concerning outstanding options at such date, all of which were exercisable at such date:

Weighted-

Average

Remaining Weighted- Aggregate

Contractual Average Intrinsic

Range of Number Life Exercise Value

Exercise Prices Outstanding (Years) Price (000’s)

$ 2.78– 4.00 1,123,366 3.0 $ 3.26 $ 9,524

4.22– 5.97 704,971 4.8 4.92 4,810

6.08– 9.12 1,047,333 4.9 8.04 3,871

10.00–13.80 420,255 8.0 12.52 —

$ 2.78–13.80 3,295,925 4.6 $ 6.31 $18,205

The total intrinsic value of options exercised during the years ended December 31, 2006, 2005 and 2004, was $9.8 million, $13.4 million and $17.6 million, respectively.

Cash received from options exercised under all share-based payment arrangements for the years ended December 31, 2006, 2005 and 2004, was $6.0 million,

$9.8 million and $9.7 million, respectively. SFAS 123(R) requires that the benefits associated with the tax deductions in excess of recognized compensation

cost be reported as a financing cash flow rather than as a operating cash flow. For the year ended December 31, 2006, we did not record any excess tax benefit

generated from option exercises.

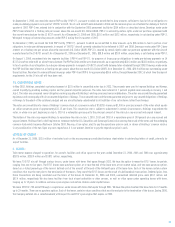

RESTRICTED STOCK AWARDS :

Restricted stock awards have been granted to certain of our officers, directors and key employees pursuant to our 2002 Long-term Incentive Plan. Stock awards are

grants of shares of our common stock which typically vest over time and are valued for financial accounting purposes at the fair market value of our publicly traded

stock on the date of issuance. The value is being charged on a straight-line basis to compensation expense over the respective vesting period (generally three

years). A summary of restricted stock activity under the aforementioned plan is as follows:

Restricted

Stock Awards

Balance at January 1, 2004 —

Vested (160,000)

Issued 657,750

Surrendered —

Balance at December 31, 2004 497,750

Vested (209,603)

Issued 340,500

Surrendered (32,000)

Balance at December 31, 2005 596,647

Vested (306,593)

Issued 472,500

Surrendered (7,633)

Balance at December 31, 2006 754,921

Restricted stock awards are not included in the number of outstanding common shares. As of December 31, 2006 there was $6.7 million of unearned compensation

cost related to non-vested share-based compensation arrangements granted under the Long-term Incentive Plan. The total fair value of shares vested during the

years ended December 31, 2006, 2005 and 2004, was $3.1 million, $2.8 million and $0 million, respectively.

Approximately $4.4 million, $3.5 million and $2.5 million of unearned compensation was amortized as compensation expense during the 12 months ended

December 31, 2006, 2005 and 2004, respectively.

Prior to our adoption of SFAS 123(R), we presented unearned compensation related to restricted stock awards as a separate component of stockholders’ equity.

In accordance with SFAS 123(R), on January 1, 2006, we reclassified unearned compensation as additional paid-in capital on our consolidated balance sheets

and consolidated statements of stockholders’ equity.

45