Airtran 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

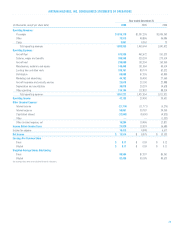

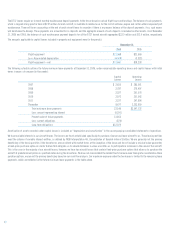

The components of accrued and other liabilities were (in thousands):

December 31,

2006 2005

Deferred gains from sale/leaseback of aircraft $ 59,682 $ 62,366

Accrued salaries, wages and benefits 53,903 32,383

Accrued interest 25,386 17,309

Deferred credits 21,671 15,503

Accrued federal excise taxes 11,304 9,120

Unremitted fees and taxes collected from passengers 7,608 7,624

Accrued maintenance 1,650 2,461

Accrued insurance 1,192 1,381

Other 41,260 29,910

223,656 178,057

Less non-current deferred gains from sale/leaseback of aircraft (55,172) (57,968)

Less non-current other (34,945) (18,745)

Less non-current accrued rent (11,830) (6,437)

Accrued and other liabilities $121,709 $ 94,907

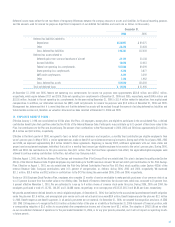

5. DEBT :

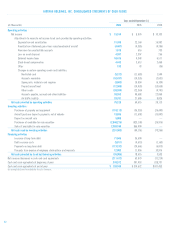

The components of long-term debt were (in thousands):

December 31,

2006 2005

B737 Aircraft Purchase Financing Facilities:

Floating rate aircraft notes payable due through 2018,

6.83% weighted-average interest rate $428,681 $138,906

Fixed rate aircraft notes payable due through 2017,

7. 02% weighted-average interest rate 76,069 —

Aircraft notes payable through 2017, 10.64% weighted-average interest rate 97,322 107,036

Floating rate aircraft pre-delivery deposit financings payable through 2008,

6.07% weighted-average interest rate 70,183 86,969

7.00% Convertible notes due 2023 125,000 125,000

Total long-term debt 797,255 457,911

Less current maturities (85,969) (70,515)

$711,286 $387,396

Maturities of long-term debt for the next five years and thereafter, in aggregate, are (in thousands): 2007–$85,969; 2008–$69,096; 2009–$35,039;

2010–$38,495; 2011–$43,348; thereafter–$525,308.

As of December 31, 2006, the aggregate net book value of assets (primarily flight equipment) which serves as collateral for outstanding debt was $730 million.

Additionally, we have pledged our pre-delivery deposits as collateral for outstanding debt.

B737 AIRCRAFT PURCHASE FINANCING FACILITIES :

Through December 31, 2006, we have entered into six separate aircraft purchase financing facilities for purposes of financing the acquisition of B737 aircraft on

order with the aircraft manufacturer.

We entered into the first permanent facility (included in floating rate aircraft notes above) in August 2004, pursuant to which we financed the acquisition of three

B737 aircraft. We took delivery of the three B737 aircraft in August 2004, July 2005 and August 2005, respectively. In conjunction with the financing of these B737

aircraft, we issued equipment notes as aircraft were delivered for an aggregate amount of $87.0 million, which are scheduled to mature between August 2016 and

August 2017. The equipment notes bear interest at a floating rate per annum above the six-month U.S. Dollar London Interbank Offering rate (LIBOR) in effect at

the commencement of each semi-annual period, and payments of principal and interest under the notes are payable semi-annually. At December 31, 2006 and

2005, $81 million and $85 million were outstanding, respectively. Each note is secured by a first mortgage on the aircraft to which it relates.

39