Air New Zealand 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

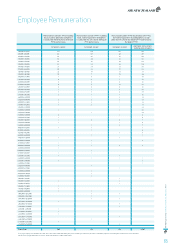

Employee Remuneration (Continued)

The exercise price of the options is set three years from issue date, and is calculated by multiplying the share price of the Company’s

shares at the date of issue by the movement in an index over the three years to exercise date, decreased by any distributions made by

Air New Zealand over the same period.

The index comprises the Total Shareholder Return (TSR) for the NZSX All Gross Index and the TSR for the Dow Jones World Airline

Total Return Index in equal proportions.

The share price at the date of issue is measured as the average daily closing price of ordinary shares over the ten business days starting

on the third business day following the announcement of the Company’s annual results.

Options may be exercised at any time after the third anniversary and before the fifth anniversary of the date of issue assuming any

conditions outlined and any additional conditions set by the PRDC have been met.

Unless Air New Zealand’s share price outperforms the index as outlined above, no value will accrue to the participating executive.

CEOREMUNERATION

FixedBaseSalary

Over the course of the 2012 financial year, the CEO, Rob Fyfe, earned a base salary of $1,431,000 (2011 financial year: $1,350,000)

paid in cash.

AnnualPerformanceIncentive

The annual value of the STI scheme for the CEO is set at 55% of base salary if all performance targets are achieved. If a performance

rating below 90 is achieved, no STI is payable. Up to 110% of base salary is payable for outstanding performance.

For the 2012 financial year, Rob Fyfe earned a total STI payment to the value of $338,809 (2011 financial year: $349,718).

This payment will be made in the 2013 financial year.

LongTermIncentive

Rob Fyfe has access to two long term incentives schemes:

• theAirNewZealandLongTermIncentivePlan(LTIP);and

• theCEOLongTermIncentivePlan(CLTIP).

LTIP

The mandatory shareholding commitment for the CEO is 66% of his fixed cash amount. For the 2012 financial year the value is

$944,460. This holding must be maintained to enable the CEO to exercise any options. Rob Fyfe owns or has a beneficial interest in

1,192,321 shares of which 892,061 are held as part of the mandatory shareholding.

Rob Fyfe earned 4,553,613 options under the LTIP for the 2011 financial year valued independently at $0.192 each, for a total value of

$874,294 (which were issued in September 2011).

CLTIP

The CEO Long Term Incentive Plan is solely an option based scheme and has a five year time horizon. It was established as a further

incentive to retain the services of the current CEO for an extended period.

The CEO option scheme commenced in the 2008 financial year and the issue of options will cease in the 2012 financial year. Each year,

at the absolute discretion of the Board, options can be issued to the CEO based on 80% of the CEO’s fixed cash remuneration.

Options issued under this scheme are not earned nor do they vest unless the CEO remains employed by Air New Zealand through to

September 2012. If this condition is met the options may be exercised within two years after this date.

The exercise price and valuation methodology of the options under the CLTIP mirror the LTIP scheme. So unless Air New Zealand’s

share price outperforms the index, no value will accrue to the CEO.

Under the CLTIP, Rob Fyfe received a grant of 6,708,075 options for the 2011 financial year valued at $0.161 each, for a total value of

$1,080,000 (which were issued in September 2011).

SUPERANNUATION

The CEO is a member of Air New Zealand’s group superannuation scheme, KoruSaver. As a member of the scheme Rob Fyfe is eligible

to contribute and receive a matching Company contribution up to 4% of gross taxable earnings (including STI). For the 2012 financial

year the Company contribution was $71,229 (2011 financial year $71,536).

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

67