Air New Zealand 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

43

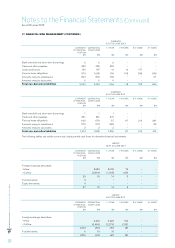

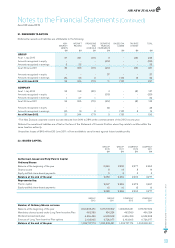

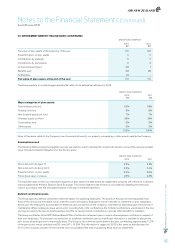

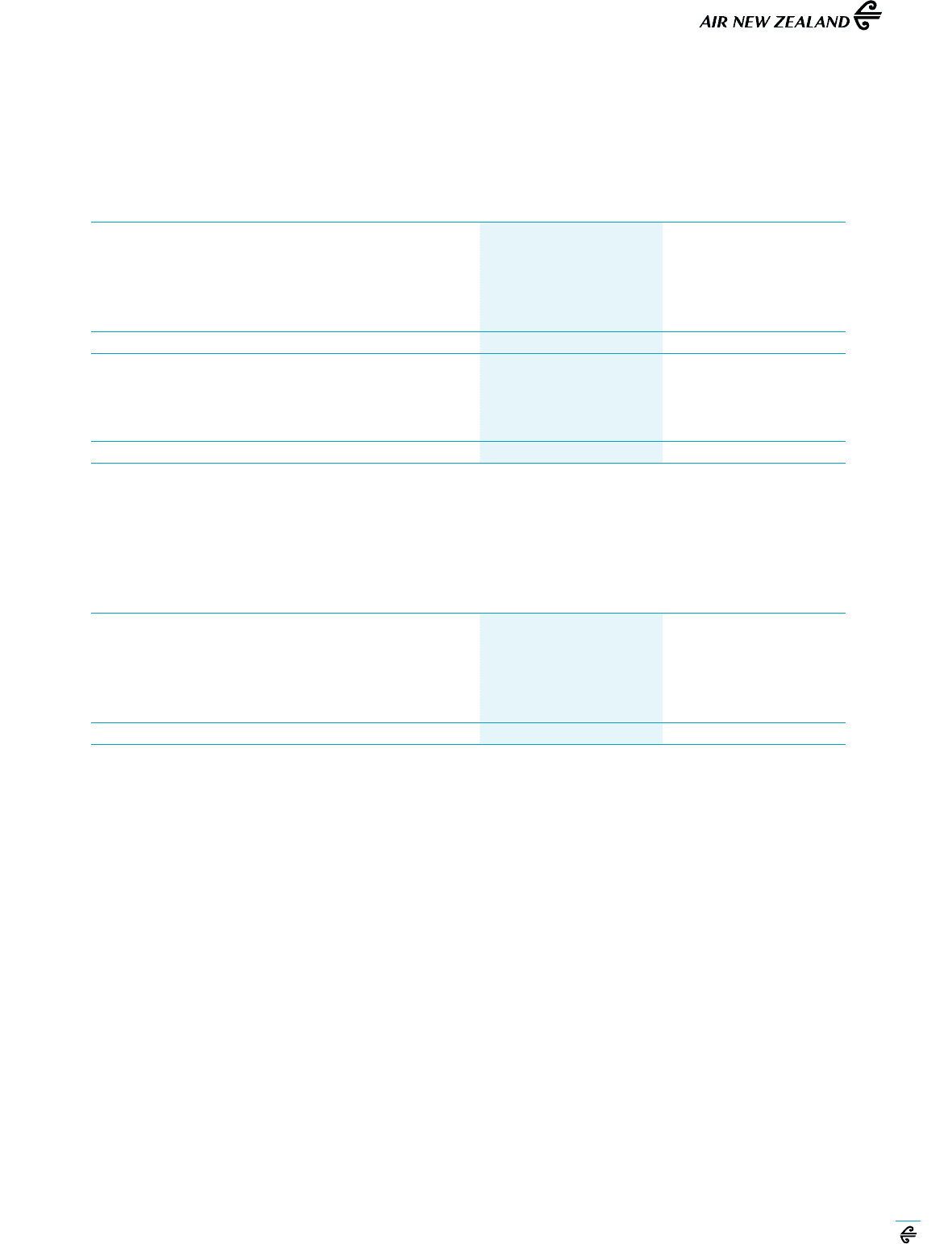

24. OPERATING LEASE COMMITMENTS

GROUP

2012

$M

GROUP

2 011

$M

COMPANY

2012

$M

COMPANY

2 011

$M

Aircraft leases payable

Not later than 1 year 139 152 42 73

Later than 1 year and not later than 5 years 467 476 142 149

Later than 5 years 164 253 54 91

770 881 238 313

Property leases payable

Not later than 1 year 35 43 31 38

Later than 1 year and not later than 5 years 96 101 90 93

Later than 5 years 87 103 84 98

218 247 205 229

The Company leases a number of aircraft from its wholly owned subsidiary, Air New Zealand Aircraft Holdings Limited.

Subject to negotiation, certain aircraft operating leases give the Group the right to renew the lease.

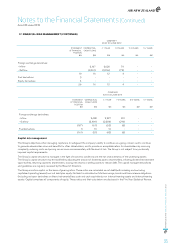

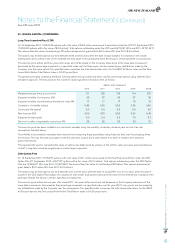

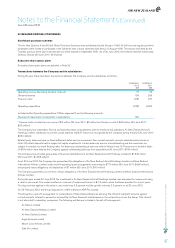

25. CONTINGENT LIABILITIES

GROUP

2012

$M

GROUP

2 011

$M

COMPANY

2012

$M

COMPANY

2 011

$M

Uncalled capital of subsidiaries - - 12 12

Guarantee of subsidiary operating lease commitments - - 777 876

Guarantee of subsidiary indebtedness and performance - - 1,548 1,262

Letters of credit and performance bonds 26 34 20 28

26 34 2,357 2,178

All significant legal disputes involving probable loss that can be reliably estimated have been provided for in the financial statements.

There are no contingent liabilities for which it is practicable to estimate the financial effect.

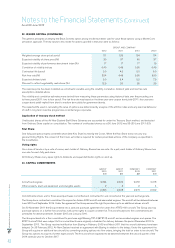

Air New Zealand has been named in five class actions. Two (one in Australia and the other in the United States) make allegations

against more than 30 airlines, of anti competitive conduct in relation to pricing in the air cargo business and one class action (in the

United States) alleges that Air New Zealand together with many other airlines conspired in respect of fares and surcharges on trans-

Pacific routes. The likelihood of any liability on the remaining two class actions (one in Australia and the other in Canada) is considered

remote. All class actions are being defended.

The allegations made in relation to the air cargo business are also the subject of proceedings by regulators. Following a detailed, formal

investigation, the European Commission advised in November 2010 that it had closed its file in relation to Air New Zealand. Similarly, an

intensive investigation by the US Department of Justice was concluded by a letter in July 2011 confirming that “Air New Zealand is no

longer a subject or target of the ongoing grand jury investigation”. Air New Zealand has paid no fine nor incurred any penalty in relation

to the European Commission or US Department of Justice investigations.

Two regulators are continuing proceedings in relation to the air cargo business. In December 2008 the New Zealand Commerce

Commission filed proceedings against 13 airlines including Air New Zealand alleging breaches of the Commerce Act 1986. In May

2010 the Australian Competition and Consumer Commission filed proceedings alleging breaches of the (Australian) Trade Practices Act

1974. Air New Zealand, together with certain other airlines, are defending these remaining proceedings.

In the event that a court determined, or it was agreed with a regulator, that Air New Zealand had breached relevant laws, the Company

would have potential liability for pecuniary penalties and to third party damages under the laws of the relevant jurisdictions. No other

significant contingent liability claims are outstanding at balance date.

There is some uncertainty regarding the tax outcomes associated with foreign exchange movements on the Group’s contracts to

purchase aircraft. The treatment adopted in the annual financial statements is consistent with the approach jointly proposed by the

Inland Revenue Department and the New Zealand Treasury in a discussion document recently released to clarify the intent of the

legislation. If this approach was not adopted, the potential impact may be a temporary difference giving rise to a deferred tax asset and

current tax liability estimated to be in the region of $65 million. In the unlikely event this temporary difference arose it is expected to

reverse in the short to medium term.

Notes to the Financial Statements (Continued)

As at 30 June 2012