Air New Zealand 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

29

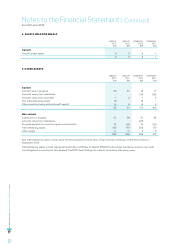

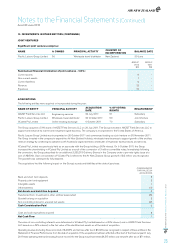

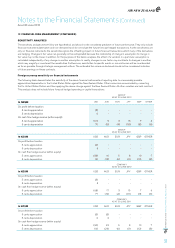

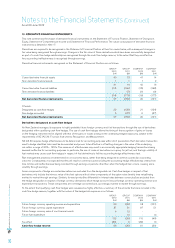

17. FINANCIAL RISK MANAGEMENT (CONTINUED)

With the exception of foreign currency denominated working capital balances, which together are immaterial to foreign currency

fluctuations, Air New Zealand’s exposure to foreign exchange risk arising on financial instruments outstanding at reporting date is

summarised as follows:

GROUP

AS AT 30 JUNE 2012

In NZ$M NZD USD AUD EUR JPY GBP OTHER TOTAL

Foreign currency risk

Non-derivative financial instruments

Non interest-bearing assets - - 13 - - - - 13

Interest-bearing assets 140 - 40 - - - - 180

Investment in quoted equity instruments - - 203 - - - - 203

Interest-bearing liabilities (747) (751) - - (194) - - (1,692)

Net financial position exposure before hedging activities (607) (751) 256 - (194) - - (1,296)

Foreign currency derivatives

Notional principal (NZ$M)

Cash flow hedges (496) 1,125 (277) (58) (65) (119 ) (95) 15

Non-hedge accounted (678) 727 (56) 3 - 6 3 5

(1,781) 1,101 (77) (55) (259) (113) (92) (1,276)

Cash flows in respect of foreign currency cash flow

hedges are expected to occur as follows:

Not later than 1 year (457) 1,057 (265) (55) (63) (113 ) (90) 14

Later than 1 year and not later than 2 years (39) 68 (12) (3) (2) (6) (5) 1

(496) 1,125 (277) (58) (65) (119 ) (95) 15

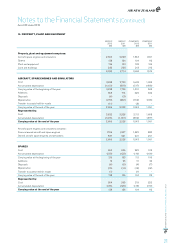

GROUP

AS AT 30 JUNE 2011

In NZ$M NZD USD AUD EUR JPY GBP OTHER TOTAL

Foreign currency risk

Non-derivative financial instruments

Interest-bearing assets 130 - 40 - - - - 170

Investment in quoted equity instruments - - 120 - - - - 120

Interest-bearing liabilities (660) (595) - - - - - (1,255)

Net financial position exposure before hedging activities (530) (595) 160 - - - - (965)

Foreign currency derivatives

Notional principal (NZ$M)

Cash flow hedges (758) 1,551 (393) (86) (133) (181) (128) (128)

Non-hedge accounted (567) 560 (35) 1 - 2 2 (37)

(1,855) 1,516 (268) (85) (133) (179) (126) (1,130)

Cash flows in respect of foreign currency cash flow

hedges are expected to occur as follows:

Not later than 1 year (681) 1,381 (339) (77) (128) (164) (114 ) (122)

Later than 1 year and not later than 2 years (77) 170 (54) (9) (5) (17) (14) (6)

(758) 1, 551 (393) (86) (133) (181) (128) (128)

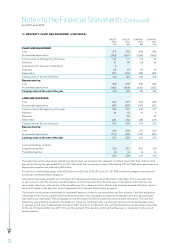

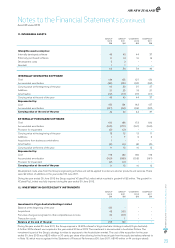

Notes to the Financial Statements (Continued)

As at 30 June 2012