Air New Zealand 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

33

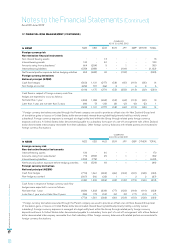

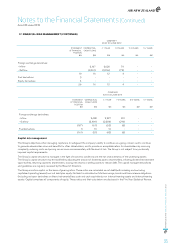

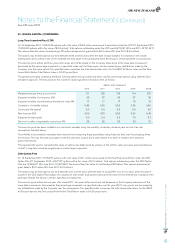

17. FINANCIAL RISK MANAGEMENT (CONTINUED)

Equity price risk

Equity price risk is the risk of loss to Air New Zealand arising from adverse fluctuations in the price of an equity investment or

equity derivative.

Air New Zealand has exposure to equity price risk arising on the equity investment and derivative held in Virgin Australia Holdings

Limited. This investment is held for strategic rather than trading purposes. The Group does not hedge this risk.

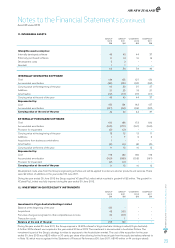

Equity investment price risk sensitivity on financial instruments

The sensitivity to reasonably possible changes in the quoted price of an equity investment or derivative with all other variables held

constant, is set out below.

Equity investment price change:

2012

$M

+ 25%

2012

$M

- 25%

2 011

$M

+ 25%

2 011

$M

- 25%

On profit before taxation

Group 4(4) - -

Company 4(4) - -

On investment revaluation reserve (within equity)

Group 51 (51) 30 (30)

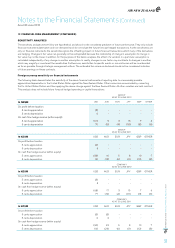

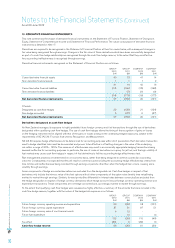

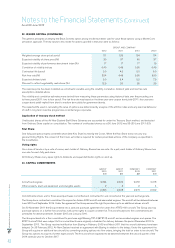

LIQUIDITY RISK

Liquidity risk is the risk that the Group will be unable to meet its obligations as they fall due. Air New Zealand manages the risk by

targeting a minimum liquidity level, ensuring long term commitments are managed with respect to forecast available cash inflow and

managing maturity profiles. Air New Zealand holds significant cash reserves to enable it to meet its liabilities as they fall due and to

sustain operations in the event of unanticipated external factors or event.

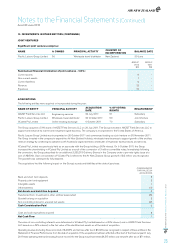

The following table sets out the contractual, undiscounted cash flows for non-derivative financial liabilities:

GROUP

AS AT 30 JUNE 2012

STATEMENT

OF FINANCIAL

POSITION

$M

CONTRACTUAL

CASH FLOWS

$M

< 1 YEAR

$M

1-2 YEARS

$M

2-5 YEARS

$M

5+ YEARS

$M

Bank overdraft and short-term borrowings 2 2 2 - - -

Trade and other payables 373 373 373 - - -

Secured borrowings 97 104 16 16 55 17

Unsecured bonds 150 197 10 10 177 -

Finance lease obligations 1,445 1,634 171 162 563 738

Amounts owing to associates 6 6 6 - - -

Total non-derivative liabilities 2,073 2,316 578 188 795 755

GROUP

AS AT 30 JUNE 2011

STATEMENT

OF FINANCIAL

POSITION

$M

CONTRACTUAL

CASH FLOWS

$M

< 1 YEAR

$M

1-2 YEARS

$M

2-5 YEARS

$M

5+ YEARS

$M

Trade and other payables 369 369 369 - - -

Secured borrowings 154 163 62 16 62 23

Finance lease obligations 1,101 1,246 113 131 408 594

Amounts owing to associates 2 2 2 - - -

Total non-derivative liabilities 1,626 1,780 546 147 470 617

Notes to the Financial Statements (Continued)

As at 30 June 2012