Air New Zealand 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

53

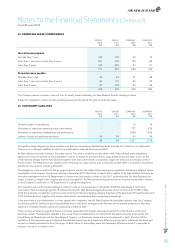

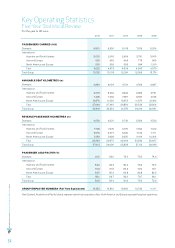

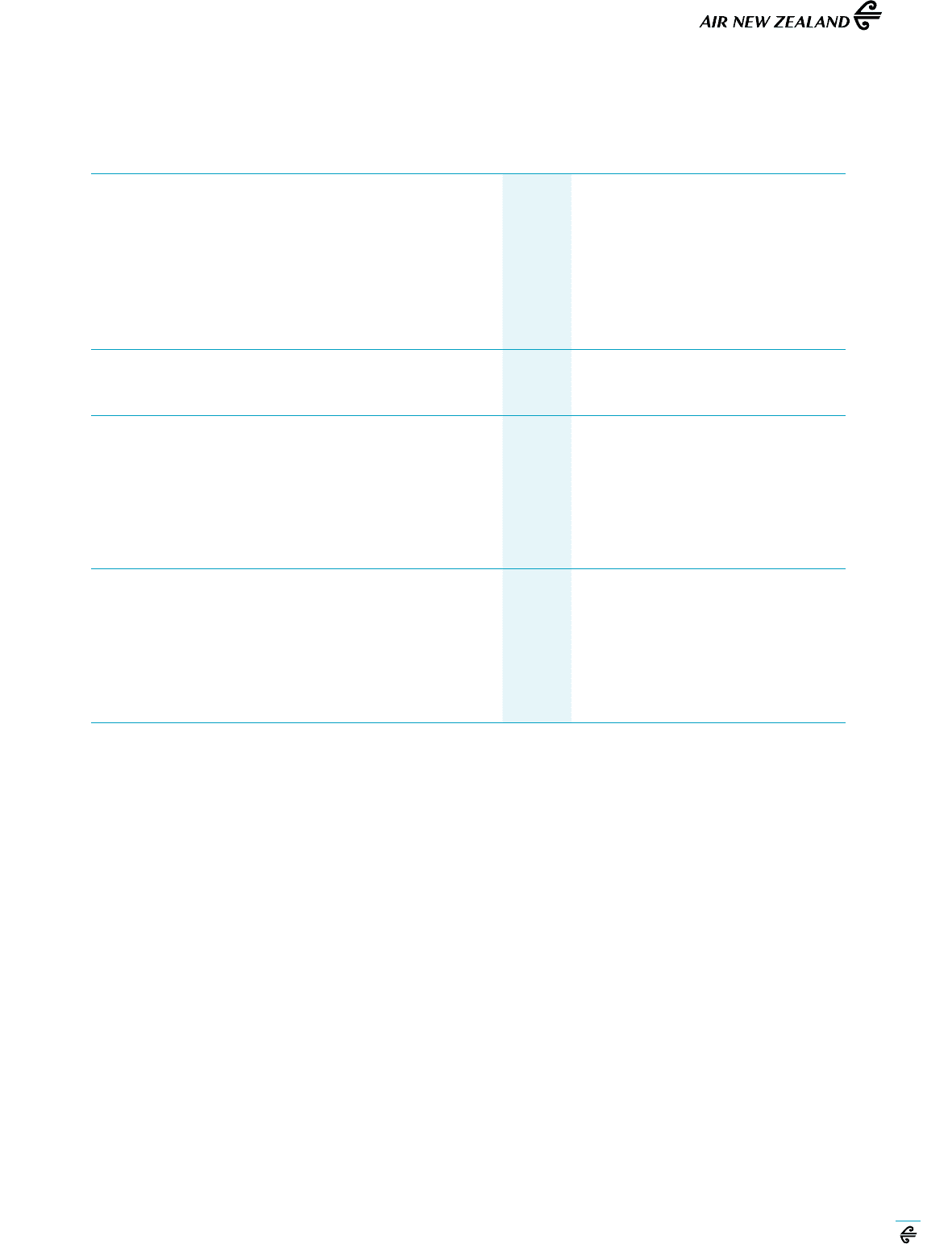

Financial Ratios

Five Year Statistical Review

2012 2 011 2010 2009 2008

PROFITABILITY

EBIT/Revenue % 3.5 2.5 3.7 1.7 7.7

EBITDRA/Revenue % 15.9 15.3 17.5 14.9 20.3

Return on Assets1% 2.9 2.2 3.3 1.5 7.1

Return on Equity2% 4.2 5.4 5.2 1.3 13.8

Basic Earnings Per Ordinary Share cps 6.5 7.5 7.6 2.0 20.7

Fixed Cover3times 2.6 2.4 2.4 1.7 2.9

Passenger Revenue/RPK c 13.5 13.1 12.8 13.8 13.0

LIQUIDITY

Operating Cash Flow Per Share4cps 43.1 43.0 31.1 45.8 70.5

BALANCE SHEET

Gearing (excl. net capitalised aircraft operating leases)5% 21.7 14.4 (9.1) (25.3) (7.2)

Gearing (incl. net capitalised aircraft operating leases)6% 46.1 46.7 47.3 45.0 45.3

Debt to Equity Ratio7% 223.4 225.9 193.6 214.3 218.5

Net Tangible Assets Per Share4$ 1.48 1.33 1.41 1.47 1.45

Working Capital Ratio8% 50.3 44.8 51.2 56.4 55.3

SHAREHOLDER VALUE

Closing Share Price 30 June $ 0.86 1.12 1.07 0.90 1.09

Weighted Average Number of Ordinary Shares m 1,096 1,084 1,073 1,061 1,055

Total Number of Ordinary Shares m 1,100 1,091 1,077 1,065 1,057

Total Market Capitalisation $m 946 1,222 1,152 959 1,152

Total Shareholder Return %(23.2) 4.7 18.9 (17.4) (58.7)

1. EBIT/Total Assets

2. Net Profit After Tax/Total Equity

3. EBITDRA/(Rental and Lease Expenses and Net Finance Costs)

4. Per-share measures based upon Ordinary Shares

5. Net Debt (excluding capitalised operating leases)/Net Debt plus Equity

6. Net Debt (including capitalised operating leases)/Net Debt plus Equity

7. Total Liabilities/Total Equity

8. Current Assets/(Current Assets plus Current Liabilities)