Air New Zealand 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

22

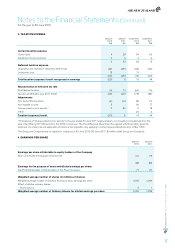

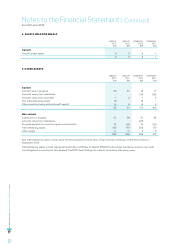

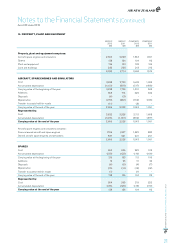

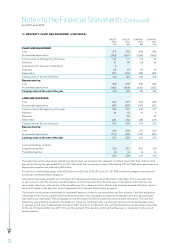

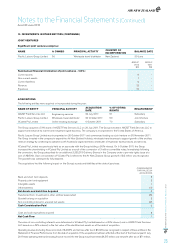

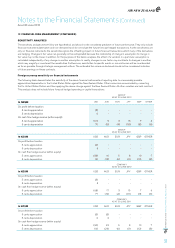

10. PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

GROUP

2012

$M

GROUP

2 011

$M

COMPANY

2012

$M

COMPANY

2 011

$M

PLANT AND EQUIPMENT

Cost 375 378 339 346

Accumulated depreciation (253) (267) (235) (252)

Carrying value at the beginning of the year 122 111 104 94

Additions 31 38 28 33

Acquisitions from business combinations 2 - - -

Disposals (2) (1) (1) (1)

Depreciation (27) (26) (23) (22)

Carrying value at the end of the year 126 122 108 104

Represented by:

Cost 368 375 330 339

Accumulated depreciation (242) (253) (222) (235)

Carrying value at the end of the year 126 122 108 104

LAND AND BUILDINGS

Cost 326 315 302 298

Accumulated depreciation (98) (88) (90) (81)

Carrying value at the beginning of the year 228 227 212 217

Additions 24 18 19 9

Disposals - (2) - (1)

Depreciation (20) (15) (18) (13)

Carrying value at the end of the year 232 228 213 212

Represented by:

Cost 346 326 317 302

Accumulated depreciation (114 ) (98) (104) (90)

Carrying value at the end of the year 232 228 213 212

Land and buildings comprise:

Leasehold properties 219 213 200 198

Freehold properties 13 15 13 14

232 228 213 212

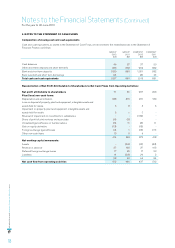

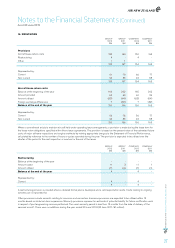

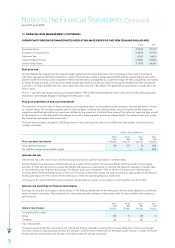

The useful lives and residual values applied to property, plant and equipment are reviewed annually to ensure that they continue to be

appropriate. During the year ended 30 June 2011 the useful lives and residual values of the Boeing 747-400 fleet were reassessed and

depreciation expense was reduced by $13 million.

Aircraft and aircraft related assets of $1,923 million as at 30 June 2012 (30 June 2011: $1,539 million) are pledged as security over

borrowings and finance lease obligations.

New Zealand generally accepted accounting practice requires book values to be written down to the higher of fair value less costs

to sell or value in use. The indicative market valuations of aircraft were less than the book value. In the opinion of the directors, the

recoverable value from continued use of the aircraft as part of a network and their ultimate sale proceeds exceeded the book value of

the aircraft, based on the directors’ current assessment of the Group’s future trading prospects.

The aircraft carrying values were tested for impairment based on a value in use discounted cash flow valuation. Cash flow projections

were prepared for 5 years using Board reviewed business plans. Key assumptions include exchange rates, jet fuel costs, passenger

load factors and route yields. These assumptions have been based on historical data and current market information. The cash flow

projections are particularly sensitive to fluctuations in fuel prices, exchange rates and economic demand and are extrapolated using

an average growth rate of approximately 2.0 percent (30 June 2011: 2.0 percent). The cash flow projections are discounted using rates

of 8.0 and 10.0 percent (30 June 2011: 8.0 and 10.0 percent). The valuation confirmed that there was no impairment to the aircraft

assets required.

Notes to the Financial Statements (Continued)

As at 30 June 2012