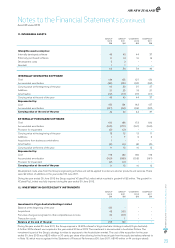

Air New Zealand 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2012

25

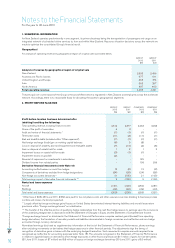

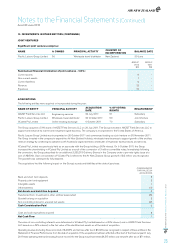

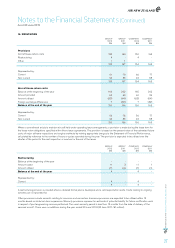

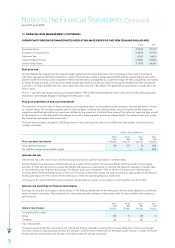

13. INVESTMENTS IN OTHER ENTITIES (CONTINUED)

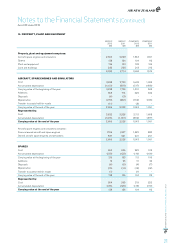

JOINT VENTURES

Significant joint ventures comprise:

NAME % OWNED PRINCIPAL ACTIVITY COUNTRY OF

INCORPORATION BALANCE DATE

Pacific Leisure Group Limited 50 Wholesale travel distributor New Zealand 30 June

GROUP

2012

$M

GROUP

2 011

$M

Summarised financial information of joint ventures - 100%:

Current assets 9 -

Non-current assets 1 -

Current liabilities 9 -

Revenue 12 -

Expenses 12 -

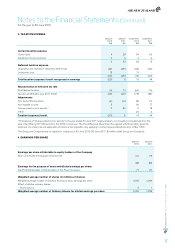

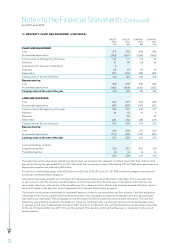

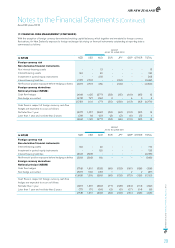

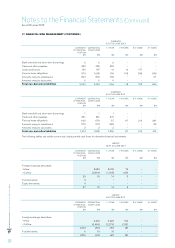

ACQUISITIONS

The following entities were acquired or incorporated during the year:

NAME OF ENTITY PRINCIPAL ACTIVITY ACQUISITION

DATE

% OF VOTING

RIGHTS RELATIONSHIP

ANZGT Field Services LLC Engineering services 29 July 2011 51 Subsidiary

Pacific Leisure Group Limited Wholesale travel distributor 20 October 2011 50 Joint Venture

VCubed Pty Limited Online booking exchange 6 October 2011 70 Subsidiary

The Group acquired a 51% share of ANZGT Field Services LLC on 29 July 2011. The Group invested in ANZGT Field Services LLC to

support and enhance its marine and industrial engine business. The company is incorporated in the United States of America.

Pacific Leisure Group Limited was incorporated on 20 October 2011 and commenced trading as a joint venture on 25 November 2011.

The Group invested in the company to expand the Air New Zealand Holiday’s wholesale travel business to support growth of the ancillary

revenue strategy by combining its operations with Australia’s largest domestic wholesaler of Australian travel products and services.

VCubed Pty Limited was previously held as an associate with the Group holding a 26% interest. On 6 October 2011, the Group

increased the shareholding in VCubed Pty Limited as a result of the conversion of 3 million convertible notes. Immediately following

the conversion, the Group subscribed for an additional 2,225,313 Ordinary Shares in the Company under a pro-rata rights issue at a

cost of A$800k. Upon consolidation of VCubed Pty Limited into the Air New Zealand Group goodwill of $2 million was recognised.

The goodwill was subsequently fully impaired.

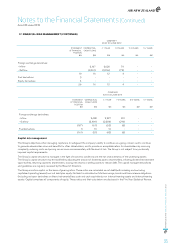

The acquisitions had the following impact on the Group’s assets and liabilities at the date of purchase:

CONSOLIDATED

FAIR VALUE ON

ACQUISITION

Bank and short term deposits 3

Property, plant and equipment 2

Intangible assets 1

Other liabilities (1)

Net Assets and Liabilities Acquired 5

Transferred from: Investment in other entities (associates) (3)

Goodwill arising on acquisition 2

Non-controlling interest in acquired net assets (2)

Cash Consideration Paid 2

Cash and cash equivalents acquired 3

Net Cash Flow 1

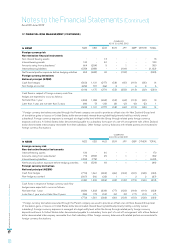

The value of non-controlling interests was determined in VCubed Pty Limited based on a 30% interest, and in ANZGT Field Services

LLC based on a 49% interest, in the fair value of the identified net assets as at the date of acquisition.

Operating revenue (including finance income) of $4,847k and net loss after tax of $1,020k was recognised in respect of these entities in the

Statement of Financial Performance from the date of acquisition. If the acquisitions had been effected at the start of the financial year (1 July

2011) total operating revenue (including finance income) for the Group would have been $4,515 million and net profit after tax of $71 million.

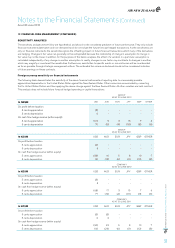

Notes to the Financial Statements (Continued)

As at 30 June 2012