3M 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

amortized over the five-year life of the note. 3M expects to reclassify a majority of the remaining balance to earnings over

the next 12 months (with the impact offset by cash flows from underlying hedged items).

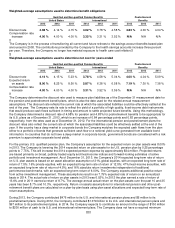

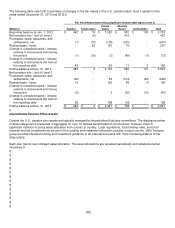

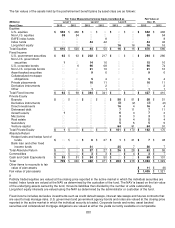

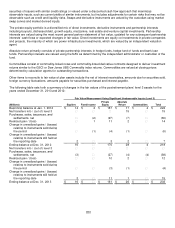

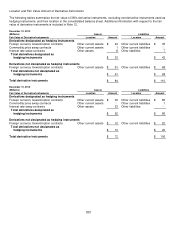

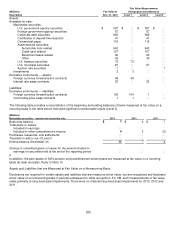

The location in the consolidated statements of income and comprehensive income and amounts of gains and losses

related to derivative instruments designated as cash flow hedges are provided in the following table. Reclassifications of

amounts from accumulated other comprehensive income into income include accumulated gains (losses) on

dedesignated hedges at the time earnings are impacted by the forecasted transaction.

The Company revised amounts previously presented in the tables below for the pretax gain (loss) recognized in other

comprehensive income on effective portion of derivative (“Gain Recognized in OCI”) and the pretax gain (loss) recognized

in income on effective portion of derivative as a result of reclassification from accumulated other comprehensive income

(“Gain Reclassified into Income”) for the years ended December 31, 2012 and 2011 relative to foreign currency forward

contracts. These immaterial corrections increased both the previously presented amounts of the Gain Recognized in OCI

and the Gain Reclassified into Income in the disclosure tables below by $13 million and $11 million in 2012 and 2011,

respectively. The revisions had no impact on the Company’s consolidated results of operations or financial condition.

Year Ended December 31, 2013

(Millions)

Pretax Gain (Loss)

Recognized in Other

Comprehensive

Income on Effective

Portion of Derivative

Pretax Gain (Loss) Recognized in

Income on Effective Portion of

Derivative as a Result of

Reclassification from

Accumulated Other

Comprehensive Income

Ineffective Portion of Gain

(Loss) on Derivative and

Amount Excluded from

Effectiveness Testing

Recognized in Income

Derivatives in Cash Flow Hedging Relationships

Amount

Location

Amount

Location

Amount

Foreign currency forward/option

contracts

$

9

Cost of sales

$

(11)

Cost of sales

$

―

Foreign currency forward contracts

(108)

Interest expense

(108)

Interest expense

―

Commodity price swap contracts

1

Cost of sales

(2)

Cost of sales

―

Interest rate swap contracts

―

Interest expense

(1)

Interest expense

―

Total

$

(98)

$

(122)

$

―

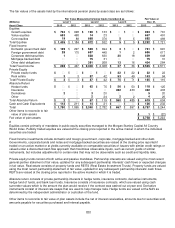

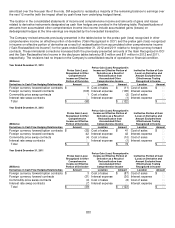

Year Ended December 31, 2012

(Millions)

Pretax Gain (Loss)

Recognized in Other

Comprehensive

Income on Effective

Portion of Derivative

Pretax Gain (Loss) Recognized in

Income on Effective Portion of

Derivative as a Result of

Reclassification from

Accumulated Other

Comprehensive Income

Ineffective Portion of Gain

(Loss) on Derivative and

Amount Excluded from

Effectiveness Testing

Recognized in Income

Derivatives in Cash Flow Hedging Relationships

Amount

Location

Amount

Location

Amount

Foreign currency forward/option

contracts

$

(35)

Cost of sales

$

41

Cost of sales

$

―

Foreign currency forward contracts

42

Interest expense

42

Interest expense

―

Commodity price swap contracts

(4)

Cost of sales

(10)

Cost of sales

―

Interest rate swap contracts

―

Interest expense

(1)

Interest expense

―

Total

$

3

$

72

$

―

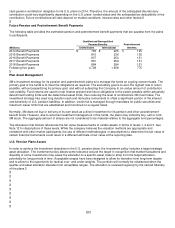

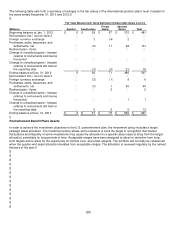

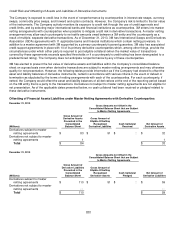

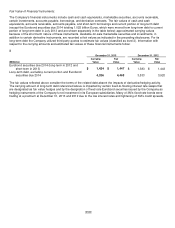

Year Ended December 31, 2011

(Millions)

Pretax Gain (Loss)

Recognized in Other

Comprehensive

Income on Effective

Portion of Derivative

Pretax Gain (Loss) Recognized in

Income on Effective Portion of

Derivative as a Result of

Reclassification from

Accumulated Other

Comprehensive Income

Ineffective Portion of Gain

(Loss) on Derivative and

Amount Excluded from

Effectiveness Testing

Recognized in Income

Derivatives in Cash Flow Hedging Relationships

Amount

Location

Amount

Location

Amount

Foreign currency forward/option

contracts

$

3

Cost of sales

$

(87)

Cost of sales

$

―

Foreign currency forward contracts

(31)

Interest expense

(30)

Interest expense

―

Commodity price swap contracts

(4)

Cost of sales

(6)

Cost of sales

―

Interest rate swap contracts

(7)

Interest expense

―

Interest expense

―

Total

$

(39)

$

(123)

$

―