3M 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

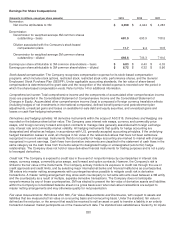

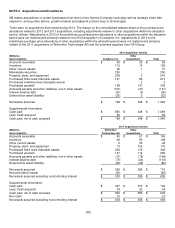

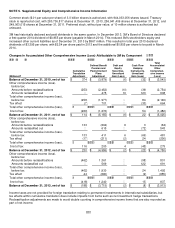

Earnings Per Share Computations

(Amounts in millions, except per share amounts)

2013

2012

2011

Numerator:

Net income attributable to 3M $

4,659 $

4,444 $

4,283

Denominator:

Denominator for weighted average 3M common shares

outstanding – basic

681.9

693.9

708.5

Dilution associated with the Company’s stock-based

compensation plans

11.7

9.4

10.5

Denominator for weighted average 3M common shares

outstanding – diluted

693.6

703.3

719.0

Earnings per share attributable to 3M common shareholders – basic

$

6.83

$

6.40 $

6.05

Earnings per share attributable to 3M common shareholders – diluted

$

6.72

$

6.32 $

5.96

Stock-based compensation: The Company recognizes compensation expense for its stock-based compensation

programs, which include stock options, restricted stock, restricted stock units, performance shares, and the General

Employees’ Stock Purchase Plan (GESPP). Under applicable accounting standards, the fair value of share-based

compensation is determined at the grant date and the recognition of the related expense is recorded over the period in

which the share-based compensation vests. Refer to Note 14 for additional information.

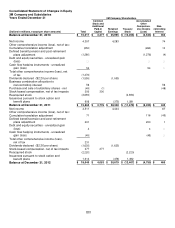

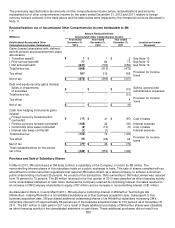

Comprehensive income: Total comprehensive income and the components of accumulated other comprehensive income

(loss) are presented in the Consolidated Statement of Comprehensive Income and the Consolidated Statement of

Changes in Equity. Accumulated other comprehensive income (loss) is composed of foreign currency translation effects

(including hedges of net investments in international companies), defined benefit pension and postretirement plan

adjustments, unrealized gains and losses on available-for-sale debt and equity securities, and unrealized gains and

losses on cash flow hedging instruments.

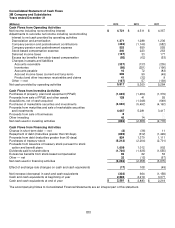

Derivatives and hedging activities: All derivative instruments within the scope of ASC 815, Derivatives and Hedging, are

recorded on the balance sheet at fair value. The Company uses interest rate swaps, currency and commodity price

swaps, and foreign currency forward and option contracts to manage risks generally associated with foreign exchange

rate, interest rate and commodity market volatility. All hedging instruments that qualify for hedge accounting are

designated and effective as hedges, in accordance with U.S. generally accepted accounting principles. If the underlying

hedged transaction ceases to exist, all changes in fair value of the related derivatives that have not been settled are

recognized in current earnings. Instruments that do not qualify for hedge accounting are marked to market with changes

recognized in current earnings. Cash flows from derivative instruments are classified in the statement of cash flows in the

same category as the cash flows from the items subject to designated hedge or undesignated (economic) hedge

relationships. The Company does not hold or issue derivative financial instruments for trading purposes and is not a party

to leveraged derivatives.

Credit risk: The Company is exposed to credit loss in the event of nonperformance by counterparties in interest rate

swaps, currency swaps, commodity price swaps, and forward and option contracts. However, the Company’s risk is

limited to the fair value of the instruments. The Company actively monitors its exposure to credit risk through the use of

credit approvals and credit limits, and by selecting major international banks and financial institutions as counterparties.

3M enters into master netting arrangements with counterparties when possible to mitigate credit risk in derivative

transactions. A master netting arrangement may allow each counterparty to net settle amounts owed between a 3M entity

and the counterparty as a result of multiple, separate derivative transactions. The Company does not anticipate

nonperformance by any of these counterparties. 3M has elected to present the fair value of derivative assets and liabilities

within the Company’s consolidated balance sheet on a gross basis even when derivative transactions are subject to

master netting arrangements and may otherwise qualify for net presentation.

Fair value measurements: 3M follows ASC 820, Fair Value Measurements and Disclosures, with respect to assets and

liabilities that are measured at fair value on a recurring basis and nonrecurring basis. Under the standard, fair value is

defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants as of the measurement date. The standard also establishes a hierarchy for inputs