3M 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

the Company completed its assessment of any potential goodwill impairment for reporting units impacted by this new

structure and determined that no impairment existed. Long-lived assets with a definite life are reviewed for impairment

whenever events or changes in circumstances indicate that the carrying amount of an asset (asset group) may not be

recoverable. If future non-cash asset impairment charges are taken, 3M would expect that only a portion of the long-lived

assets or goodwill would be impaired. 3M will continue to monitor its reporting units and asset groups in 2014 for any

triggering events or other indicators of impairment.

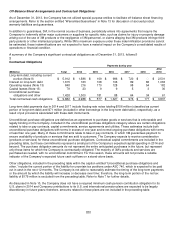

Income Taxes:

The extent of 3M’s operations involves dealing with uncertainties and judgments in the application of complex tax

regulations in a multitude of jurisdictions. The final taxes paid are dependent upon many factors, including negotiations

with taxing authorities in various jurisdictions and resolution of disputes arising from federal, state, and international tax

audits. The Company recognizes potential liabilities and records tax liabilities for anticipated tax audit issues in the United

States and other tax jurisdictions based on its estimate of whether, and the extent to which, additional taxes will be due.

The Company follows guidance provided by ASC 740, Income Taxes, regarding uncertainty in income taxes, to record

these liabilities (refer to Note 7 for additional information). The Company adjusts these reserves in light of changing facts

and circumstances; however, due to the complexity of some of these uncertainties, the ultimate resolution may result in a

payment that is materially different from the Company’s current estimate of the tax liabilities. If the Company’s estimate of

tax liabilities proves to be less than the ultimate assessment, an additional charge to expense would result. If payment of

these amounts ultimately proves to be less than the recorded amounts, the reversal of the liabilities would result in tax

benefits being recognized in the period when the Company determines the liabilities are no longer necessary.

NEW ACCOUNTING PRONOUNCEMENTS

Information regarding new accounting pronouncements is included in Note 1 to the Consolidated Financial Statements.

FINANCIAL CONDITION AND LIQUIDITY

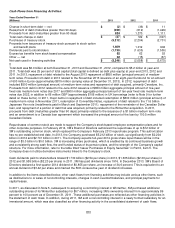

3M’s primary short-term liquidity needs are met through cash on hand, U.S. commercial paper and euro commercial paper

issuances. 3M resumed commercial paper funding in July 2013 for the first time since late 2008. 3M expects to maintain a

consistent presence in the market and believes it will have continuous access to the commercial paper market. 3M’s

commercial paper program permits the Company to have a maximum of $3 billion outstanding with a maximum maturity of

397 days from date of issuance. At both of December 31, 2013 and 2012, 3M’s outstanding commercial paper balance

was zero.

The Company has sufficient liquidity and generates significant ongoing cash flow, which have been used, in part, to

repurchase shares and to pay dividends on 3M common stock. In addition, 3M’s liquidity and cash flow enable it to meet

currently anticipated growth plans, including funds for capital expenditures, working capital investments and acquisitions.

As discussed in Note 2, in 2012 3M acquired Ceradyne, Inc. and other acquisitions for approximately $1.0 billion. In 2011,

3M acquired Winterthur Technologie AG and other acquisitions for approximately $700 million (including purchases of

noncontrolling interest). 3M was able to complete these acquisitions while maintaining a strong net debt position, as

shown in the table below.

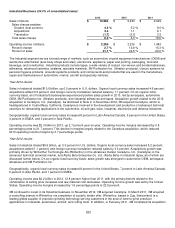

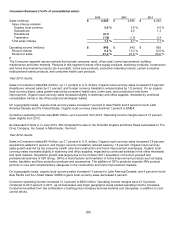

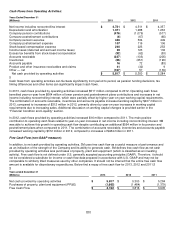

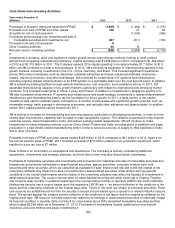

At December 31

(Millions)

2013

2012

Total Debt

$

6,009

$

6,001

Less: Cash and cash equivalents and marketable securities

4,790

5,693

Net Debt

$

1,219

$

308

The Company defines net debt as total debt less cash, cash equivalents and current and long-term marketable securities.

3M considers net debt to be an important measure of liquidity and its ability to meet ongoing obligations. This measure is

not defined under U.S. generally accepted accounting principles and may not be computed the same as similarly titled

measures used by other companies.

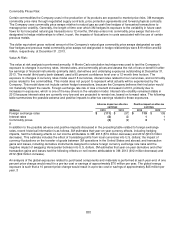

At December 31, 2013, cash, cash equivalents and marketable securities held by the Company’s foreign subsidiaries and

in the United States totaled approximately $4.3 billion and $0.5 billion, respectively. The United States balance and 62

percent of cash and securities held by the Company’s foreign subsidiaries were invested in U.S. denominated cash or

cash equivalents or U.S. denominated investments in money market funds, asset-backed securities, agency securities,