3M 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

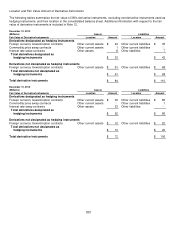

96

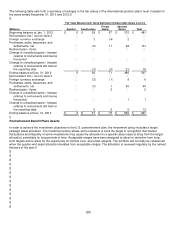

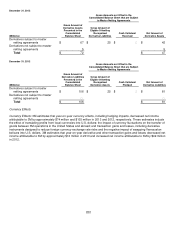

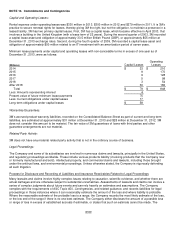

December 31, 2012

Gross Amounts not Offset in the

Consolidated Balance Sheet that are Subject

to Master Netting Agreements

(Millions)

Gross Amount of

Derivative Assets

Presented in the

Consolidated

Balance Sheet

Gross Amount of

Eligible Offsetting

Recognized

Derivative Liabilities

Cash Collateral

Received

Net Amount of

Derivative Assets

Derivatives subject to master

netting agreements

$

67

$

25

$

―

$

42

Derivatives not subject to master

netting agreements

5

5

Total

$

72

$

47

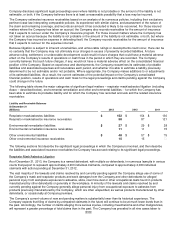

December 31, 2012

Gross Amounts not Offset in the

Consolidated Balance Sheet that are Subject

to Master Netting Agreements

(Millions)

Gross Amount of

Derivative Liabilities

Presented in the

Consolidated

Balance Sheet

Gross Amount of

Eligible Offsetting

Recognized

Derivative Assets

Cash Collateral

Pledged

Net Amount of

Derivative Liabilities

Derivatives subject to master

netting agreements

$

106

$

25

$

―

$

81

Derivatives not subject to master

netting agreements

―

―

Total

$

106

$

81

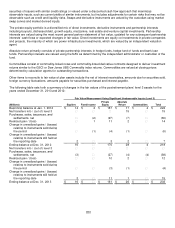

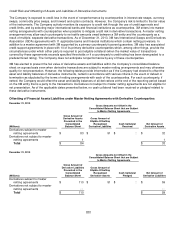

Currency Effects

Currency Effects: 3M estimates that year-on-year currency effects, including hedging impacts, decreased net income

attributable to 3M by approximately $74 million and $103 million in 2013 and 2012, respectively. These estimates include

the effect of translating profits from local currencies into U.S. dollars; the impact of currency fluctuations on the transfer of

goods between 3M operations in the United States and abroad; and transaction gains and losses, including derivative

instruments designed to reduce foreign currency exchange rate risks and the negative impact of swapping Venezuelan

bolivars into U.S. dollars. 3M estimates that year-on-year derivative and other transaction gains and losses decreased net

income attributable to 3M by approximately $12 million in 2013 and increased net income attributable to 3M by $49 million

in 2012.