3M 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

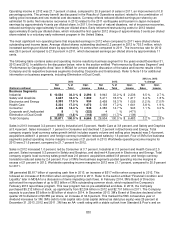

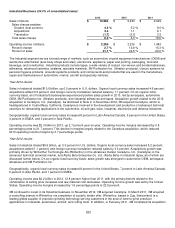

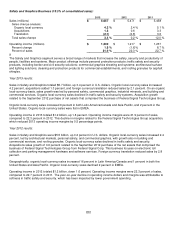

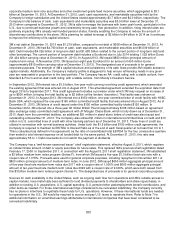

Electronics and Energy Business (17.5% of consolidated sales):

2013 2012 2011

Sales (millions)

$

5,393

$

5,458

$

5,732

Sales change analysis:

Organic local currency

―

%

(3.7)

%

(0.5)

%

Translation

(1.2)

(1.1)

2.3

Total sales change

(1.2)

%

(4.8)

%

1.8

%

Operating income (millions)

$

954

$

1,026

$

1,140

Percent change

(7.0)

%

(10.0)

%

(5.5)

%

Percent of sales

17.7

%

18.8

%

19.9

%

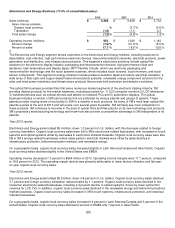

The Electronics and Energy segment serves customers in the electronics and energy markets, including solutions for

dependable, cost-effective, high-performance electronic devices, telecommunications networks, electrical products, power

generation and distribution, and infrastructure protection. This segment’s electronics solutions include optical film

solutions for the electronic display industry; packaging and interconnection devices; high performance fluids and

abrasives; high-temperature and display tapes; 3M™ Flexible Circuits, which use electronic packaging and

interconnection technology; and the touch systems business, which includes touch screens, touch monitors, and touch

sensor components. This segment’s energy solutions include pressure sensitive tapes and resins; electrical insulation; a

wide array of fiber-optic and copper-based telecommunications systems; renewable energy component solutions for the

solar and wind power industries; and infrastructure products that provide both protection and detection solutions.

The optical film business provides films that serve numerous market segments of the electronic display industry. 3M

provides distinct products for five market segments, including products for: 1) LCD computer monitors 2) LCD televisions

3) handheld devices such as cellular phones and tablets 4) notebook PCs and 5) automotive displays. The optical

business includes a number of different products that are protected by various patents and groups of patents. These

patents provide varying levels of exclusivity to 3M for a number of such products. As some of 3M’s multi-layer optical film

patents expired at the end of 2013 and will expire over several years thereafter, 3M will likely see more competition in

these products. 3M continues to innovate in the area of optical films and files patents on its new technology and products.

3M’s proprietary manufacturing technology and know-how also provide a competitive advantage to 3M independent of its

patents.

Year 2013 results:

Electronics and Energy sales totaled $5.4 billion, down 1.2 percent in U.S. dollars, with this decrease related to foreign

currency translation. Organic local-currency sales were flat in 3M’s electronics-related businesses, with increases in touch

systems and optical systems offset by decreases in electronics markets materials. Organic local-currency sales were also

flat in 3M’s energy-related businesses, where sales gains in electrical markets were offset by sales declines in

infrastructure protection, telecommunication markets, and renewable energy.

On a geographic basis, organic local-currency sales increased slightly in Latin America/Canada and Asia Pacific. Organic

local-currency sales declined slightly in the United States and EMEA.

Operating income decreased 7.0 percent to $954 million in 2013. Operating income margins were 17.7 percent, compared

to 18.8 percent in 2012. The operating margin decline was primarily attributable to lower factory utilization and flat year-

on-year organic local-currency sales.

Year 2012 results:

Electronics and Energy sales totaled $5.5 billion, down 4.8 percent in U.S. dollars. Organic local-currency sales declined

3.7 percent and foreign currency translation reduced sales by 1.1 percent. Organic local-currency sales declined in the

consumer electronics-related businesses, including a 9 percent decline in optical systems, driven by lower optical film

volumes for LCD TVs. In addition, organic local-currency sales declined in the renewable energy and telecommunications

markets business. Organic local-currency sales increased in 3M’s touch systems, infrastructure protection, and electrical

markets businesses.

On a geographic basis, organic local-currency sales increased 14 percent in Latin America/Canada and 3 percent in the

United States. Organic local-currency sales declined 6 percent in EMEA and 7 percent in Asia Pacific.