3M 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

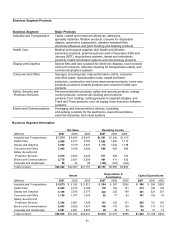

portion of the annual grant away from traditional stock options primarily to restricted stock units. These changes will

reduce the annual dilution impact from 1.5% of total outstanding common stock to about 1%. However, associated with

the reduction in the number of eligible employees, the Company provided a one-time “buyout” grant to the impacted

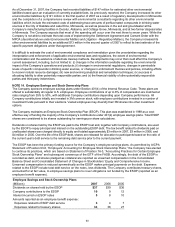

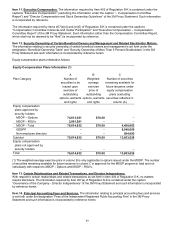

employees, which resulted in increased stock-based compensation expense in 2007. The following table summarizes

MSOP restricted stock and restricted stock unit activity during the twelve months ended December 31, 2007:

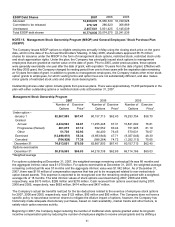

Restricted Stock and

Restricted Stock Units

Number of

Awards

Grant Date

Fair Value*

Nonvested balance –

As of January 1, 2007 411,562 $78.11

Granted

Annual 1,695,592 77.88

Other 22,465 50.88

Vested (90,913) 77.38

Forfeited (37,125) 79.04

As of December 31, 2007 2,001,581 $77.63

*Weighted average

As of December 31, 2007, there was $97 million of compensation expense that has yet to be recognized related to

non-vested restricted stock and restricted stock units. This expense is expected to be recognized over the remaining

vesting period with a weighted-average life of 39 months. The total fair value of restricted stock and restricted stock

units that vested during the twelve-month periods ended December 31, 2007 and 2006 was $6 million and $5 million,

respectively.

In addition, the Company issues cash settled Restricted Stock Units and Stock Appreciation Rights in certain

countries. These grants do not result in the issuance of Common Stock and are considered immaterial by the

Company.

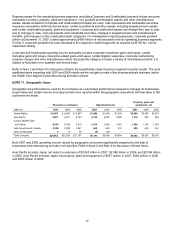

The remaining total MSOP shares available for grant under the 2005 MSOP Program are 4,408,083, 13,074,202 and

24,937,892, respectively, as of December 31, 2007, 2006 and 2005. Restricted stock and restricted stock units, per the

2005 MSOP Program, shall be counted against the total shares available as 2.45 shares for every one share issued in

connection with that award.

Effective with the May 2005 grant, the Company no longer issues options eligible for additional progressive (reload)

options; however, when a progressive option is issued upon the exercise of a pre-May 2005 non-qualified stock

option, the option is revalued and additional stock compensation expense is incurred.

For annual and progressive (reload) options, the weighted average fair value at the date of grant was calculated using the

Black-Scholes option-pricing model and the assumptions that follow.

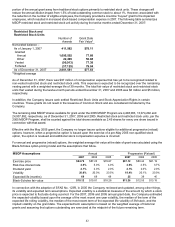

MSOP Assumptions Annual Progressive (Reload)

2007 2006 2005 2007 2006 2005

Exercise price $84.79 $87.23 $76.87 $87.12 $80.44 $81.19

Risk-free interest rate 4.6% 5.0% 4.0% 4.6% 4.5% 3.7%

Dividend yield 2.1% 2.0% 2.0% 2.1% 2.0% 2.0%

Volatility 20.0% 20.0% 23.5% 18.4% 20.1% 20.9%

Expected life (months) 69 69 69 25 39 40

Black-Scholes fair value $18.12 $19.81 $18.28 $13.26 $12.53 $13.18

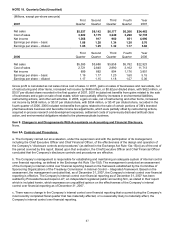

In connection with the adoption of SFAS No. 123R, in 2005 the Company reviewed and updated, among other things,

its volatility and expected term assumptions. Expected volatility is a statistical measure of the amount by which a stock

price is expected to fluctuate during a period. For the 2007, 2006 and 2005 annual grant date, the Company estimated

the expected volatility based upon the average of the most recent one year volatility, the median of the term of the

expected life rolling volatility, the median of the most recent term of the expected life volatility of 3M stock, and the

implied volatility on the grant date. The expected term assumption is based on the weighted average of historical

grants and assuming that options outstanding are exercised at the midpoint of the future remaining term.