3M 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

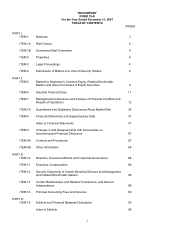

9

Item 1B. Unresolved Staff Comments.

None.

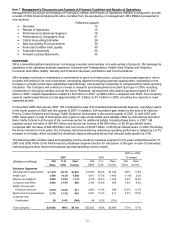

Item 2. Properties.

3M’s general offices, corporate research laboratories, and certain division laboratories are located in St. Paul, Minnesota.

In the United States, 3M has nine sales offices in eight states and operates 74 manufacturing facilities in 27 states.

Internationally, 3M has 148 sales offices. The Company operates 93 manufacturing and converting facilities in 32

countries outside the United States.

3M owns substantially all of its physical properties. 3M’s physical facilities are highly suitable for the purposes for

which they were designed. Because 3M is a global enterprise characterized by substantial intersegment cooperation,

properties are often used by multiple business segments.

Item 3. Legal Proceedings.

Discussion of legal matters is incorporated by reference from Part II, Item 8, Note 13, “Commitments and

Contingencies,” of this document, and should be considered an integral part of Part I, Item 3, “Legal Proceedings.”

Item 4. Submission of Matters to a Vote of Security Holders.

None in the quarter ended December 31, 2007.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

Equity compensation plans’ information is incorporated by reference from Part III, Item 12, “Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters,” of this document, and should be considered an

integral part of Item 5. At January 31, 2008, there were approximately 121,302 shareholders of record. 3M’s stock is listed

on the New York Stock Exchange, Inc. (NYSE), the Chicago Stock Exchange, Inc., and the SWX Swiss Exchange. Cash

dividends declared and paid totaled $.48 per share for each quarter of 2007, and $.46 per share for each quarter of 2006.

Stock price comparisons follow:

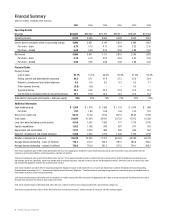

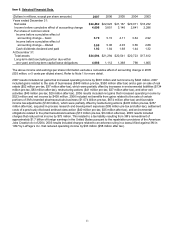

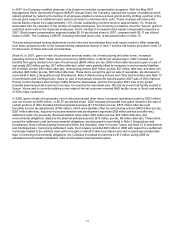

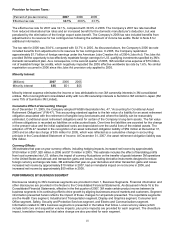

Stock price comparisons (NYSE composite transactions)

(Per share amounts)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Year

2007 High $79.88 $89.03 $93.98 $97.00 $97.00

2007 Low 72.90 75.91 83.21 78.98 72.90

2006 High $79.83 $88.35 $81.60 $81.95 $88.35

2006 Low 70.30 75.76 67.05 73.00 67.05

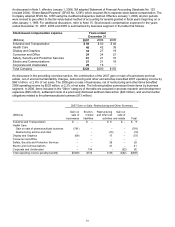

Issuer Purchases of Equity Securities

Repurchases of common stock are made to support the Company’s stock-based employee compensation plans and for

other corporate purposes. On February 13, 2006, the Board of Directors authorized the purchase of $2.0 billion of the

Company’s common stock between February 13, 2006 and February 28, 2007. In August 2006, 3M’s Board of Directors

authorized the repurchase of an additional $1.0 billion in share repurchases, raising the total authorization to $3.0 billion for

the period from February 13, 2006 to February 28, 2007. In February 2007, 3M’s Board of Directors authorized a two-

year share repurchase of up to $7.0 billion for the period from February 12, 2007 to February 28, 2009.