3M 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

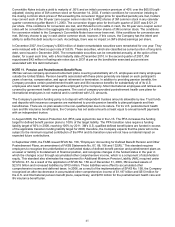

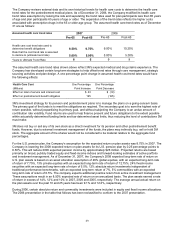

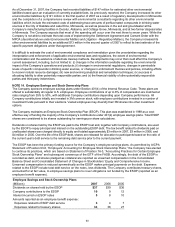

The following estimated benefit payments are payable from the plans to participants:

Qualified and Non-qualified Postretirement Medicare Subsidy

Pension Benefits Benefits Receipts

(Millions) United States International

2008 Benefit Payments $ 574 $ 188 $117 $ 13

2009 Benefit Payments 588 192 124 15

2010 Benefit Payments 607 197 130 17

2011 Benefit Payments 628 209 138 18

2012 Benefit Payments 665 222 143 20

Following five years 3,626 1,259 799 128

NOTE 12. Derivatives and Other Financial Instruments

The Company uses interest rate swaps, currency swaps, and forward and option contracts to manage risks generally

associated with foreign exchange rate, interest rate and commodity price fluctuations. The information that follows

explains the various types of derivatives and financial instruments, and includes a table that recaps cash flow hedging

amounts.

Cash Flow Hedging - Foreign Currency Forward and Option Contracts: The Company enters into foreign exchange

forward contracts, options and swaps to hedge against the effect of exchange rate fluctuations on cash flows

denominated in foreign currencies and certain intercompany financing transactions. These transactions are designated as

cash flow hedges. At December 31, 2007, the Company had various open foreign exchange forward and option

contracts, the majority of which had maturities of one year or less. The settlement or extension of these derivatives will

result in reclassifications to earnings in the period during which the hedged transactions affect earnings (from other

comprehensive income). The maximum length of time over which 3M is hedging its exposure to the variability in future

cash flows for a majority of the forecasted transactions is 12 months. Hedge ineffectiveness was not material for the years

2007, 2006 and 2005.

Cash Flow Hedging - Commodity Price Management: The Company manages commodity price risks through negotiated

supply contracts, price protection agreements and forward physical contracts. The Company uses commodity price

swaps as cash flow hedges of forecasted transactions to manage price volatility. The related mark-to-market gain or loss

on qualifying hedges is included in other comprehensive income to the extent effective, and reclassified into cost of sales

in the period during which the hedged transaction affects earnings. 3M has hedged its exposure to the variability of future

cash flows for certain forecasted transactions through 2008. No significant commodity cash flow hedges were

discontinued and hedge ineffectiveness was not material during the years 2007, 2006 and 2005.

Cash Flow Hedging - Forecasted Debt Issuance: In June 2007, the Company executed a pre-issuance cash flow

hedge by entering into a floating-to-fixed interest rate swap on a notional amount of 350 million Euros related to the

anticipated July 2007 Eurobond issuance of 750 million Euros. Upon debt issuance in July 2007, 3M terminated the

floating-to-fixed swap. The termination of the swap resulted in an immaterial gain, which is being amortized over the

seven year life of the Eurobond.

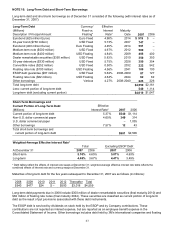

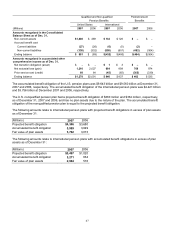

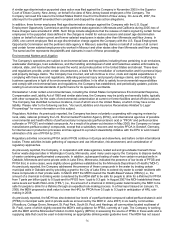

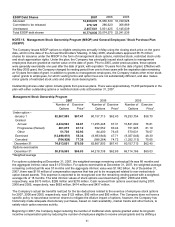

Amounts recorded in accumulated other comprehensive income (loss) related to cash flow hedging instruments follow.

Cash Flow Hedging Instruments Twelve months ended

Net of Tax December 31

(Millions) 2007 2006 2005

Beginning balance $(18) $ 38 $(42)

Changes in fair value of derivatives (17) (53) 70

Reclassifications to earnings from equity 7 (3) 10

Total activity (10) (56) 80

Ending balance $(28) $(18) $ 38